Concentrated Investing

I am a concentrated investor. I have been investing this way since I opened and funded my first brokerage account at the age of 18.

Concentrated investing refers to a strategy where an investor holds a relatively small number of carefully selected investments in their portfolio. Instead of diversifying across a wide range of assets, a concentrated investor focuses on a handful of high-conviction investments. The rationale behind concentrated investing is that by thoroughly researching and understanding a few select opportunities, an investor can potentially achieve higher returns.

I’ve learned some hard lessons investing this way. One example, I put >90% of my portfolio into US Concrete in mid-April 2010. I thought I was getting a great deal because the stock was trading for around 45 cents.

The problem was that about one week later (April 29, 2010 to be exact - I still remember) US Concrete filed for Chapter 11 bankruptcy and the stock went from 45 cents to pennies. A costly but important lesson: check to see if the company is solvent before buying the stock.

Despite my error, I got back up and kept trying and crafting a strategy that made sense to me. In time, I have gotten to a place where I still much prefer to own a highly concentrated portfolio of high conviction investments. Only now I look at the balance sheet before investing, among other things…

Investing this way intuitively makes sense to me. When I invest I view it as an ownership stake in a business. I want to be a substantial owner of a few great businesses. Why would I put money into my 20th best idea when I could own more of ideas one through three?

Despite modern portfolio theory and the push for diversification, some of the all-time great investors embrace concentration:

Warren Buffett - “I would say for anyone working with normal capital who really knows the businesses they have gone into, six [stocks] is plenty.”

Charlie Munger - “I'm way more comfortable owning two or three stocks, which I think I know something about and where I think I have an advantage.”

Bill Ruane - “I try to learn as much as I can about 7-8 good ideas.”

John Maynard Keynes - “It is a mistake to think that one limits one’s risk by spreading too much between enterprises about which one knows little and has no reason for special confidence.”

Lou Simpson - “You can only know so many companies. If you’re managing 50 or 100 positions, the chances that you can add value are much, much lower.”

Bill Ackman - “I’ve always had the view that why not own the best ten or eleven investments as opposed to ideas twelve through...one hundred. The ability to concentrate is an enormously valuable asset of a strategy.”

Brad Gerstner - “At any given moment in time in the public markets, we might have 75% of our portfolio in our top 4 or 5 ideas.”

Obviously, a mistake when investing this way can be a huge set-back. And a strategy like this isn’t for you unless you’re willing to put in a significant amount of time into research and maintenance.

My Portfolio

I have made the decision to begin sharing details about my portfolio holdings and the underlying rationale behind my investment theses. It's important to note that this sharing does not constitute investment advice; rather, it serves as a personal commitment to rigorously evaluate each investment decision I make. Furthermore, it provides me with a documented track record that I can reflect upon over time.

Having worked in the investment field professionally for five years (even though I no longer do), I've gleaned the significance of maintaining an open feedback loop as a means of continual improvement. This practice allows me to consistently refine my approach and strive for better outcomes.

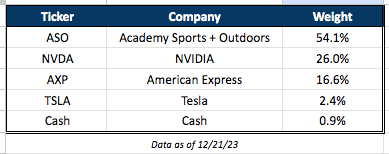

Here you go:

Academy Sports + Outdoors

Highly profitable and fast growing sporting goods and outdoors retailer, which operates in the fastest growing markets in the USA

NVIDIA

Full-stack artificial intelligence behemoth

American Express

Premium payments and banking services with strong growth amongst Millennial/Gen Z customers

Tesla

Electric cars, full self-driving, energy storage, solar, robotics, super computing, what else...?

I am committed to delivering monthly updates on portfolio adjustments, accompanied by a detailed explanation of my strategic decisions. Additionally, each post will feature a comprehensive overview of returns.

Hey Joshua, thanks for your note!

I don’t really understand Tesla either ha. I bought it in January 2023 on a simple basis: it was delivering vehicles at 40-50% growth clip while all other major vehicle manufacturers were flat to negative. It’s margins were 3x better than it’s peers and it’s forward p/e was exactly 3x it’s peers (21x). I felt like I was paying a fair price for the car business and getting the energy business, robotics business, supercomputing, full self driving, etc for free. So in a moment in time it was a favorable risk/reward. At 70x it doesn’t make much sense anymore.

What about Nvidia do you not like?

Bad investor. Very sad!