Monthly Returns

Sycamore Capital Portfolio // +4.57%

S&P 500 // +2.91%

Differential // +1.66%

Year-to-date Returns

Sycamore Capital Portfolio // +40.62%

S&P 500 // +14.48%

Differential // +26.14%

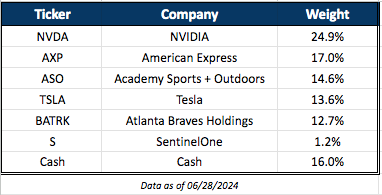

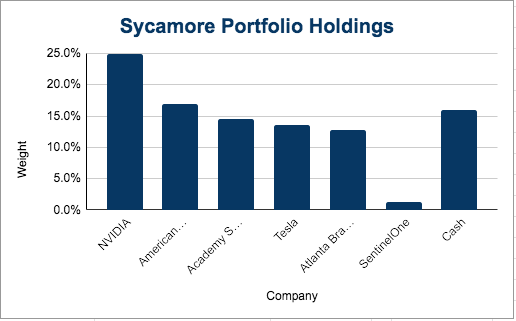

Current Holdings

Transactions in June

Increased AXP by 5.8% @ ~$224 /sh

Increased BATRK by 1,600% @ ~$38 /sh

Decreased NVDA by 37.5% @ ~$125 /sh

Decreased ASO by 20.6% @ ~$52 /sh

Decreased TSLA by 24.1% @ ~$175 /sh

Initiated S with 1.2% position @ ~$20 /sh

Equal-Weight Nvidia

*Note - When I wrote this section, Nvidia stock was trading around $130 per share. As I go to publish, it is trading at $117.

During the month, I began cutting my Nvidia position more significantly. Here are a few of my thoughts (not in any order) on why I am doing this now:

Valuation is getting ahead of its average during this run-up (30-35x). It’s closer to 50x right now (when I actually wrote this - has come down some).

High multiple, with sky high expectations, leaves very little room for error. If there is any sort of miss with revenue and earnings this will get punished.

Historically, when companies begin forecasting decelerating earnings growth, it is very hard for the stock to continue to outperform. While Nvidia should continue to grow very nicely, growth falling to 30-40% over the next several years is significant deceleration from >450%.

How much demand has Nvidia pulled forward? Impossible to answer now but without a doubt some.

How much stock appreciation has been pulled forward? None? One year? Ten years? While I love the business, I could see a scenario where the business continues to perform very well, and the stock goes nowhere for a long time. The stock could very well need an extended consolidation.

This has been a 9x return for me in less than two years. It’s a $3T+ company, it can’t just keep going straight up forever.

The critical voices are getting louder and sentiment is starting to shift to more realism… what do we get for these hundreds of billions of dollars of AI investment? A chat bot? Anything else?

These are my streamlined thoughts - not very polished. But it’s what is swirling around in my head. In the end, I have been cutting my significant overweight position to a more equal-weight position (~15%). This adjustment will be fully realized in the next monthly update.

Perhaps I’m too soon, but I am extremely pleased with my return: I went overweight the stock when everyone hated it in 2022, returned 239% in 2023, and stayed overweight to realize another 175% gain in 2024.

Academy Sports

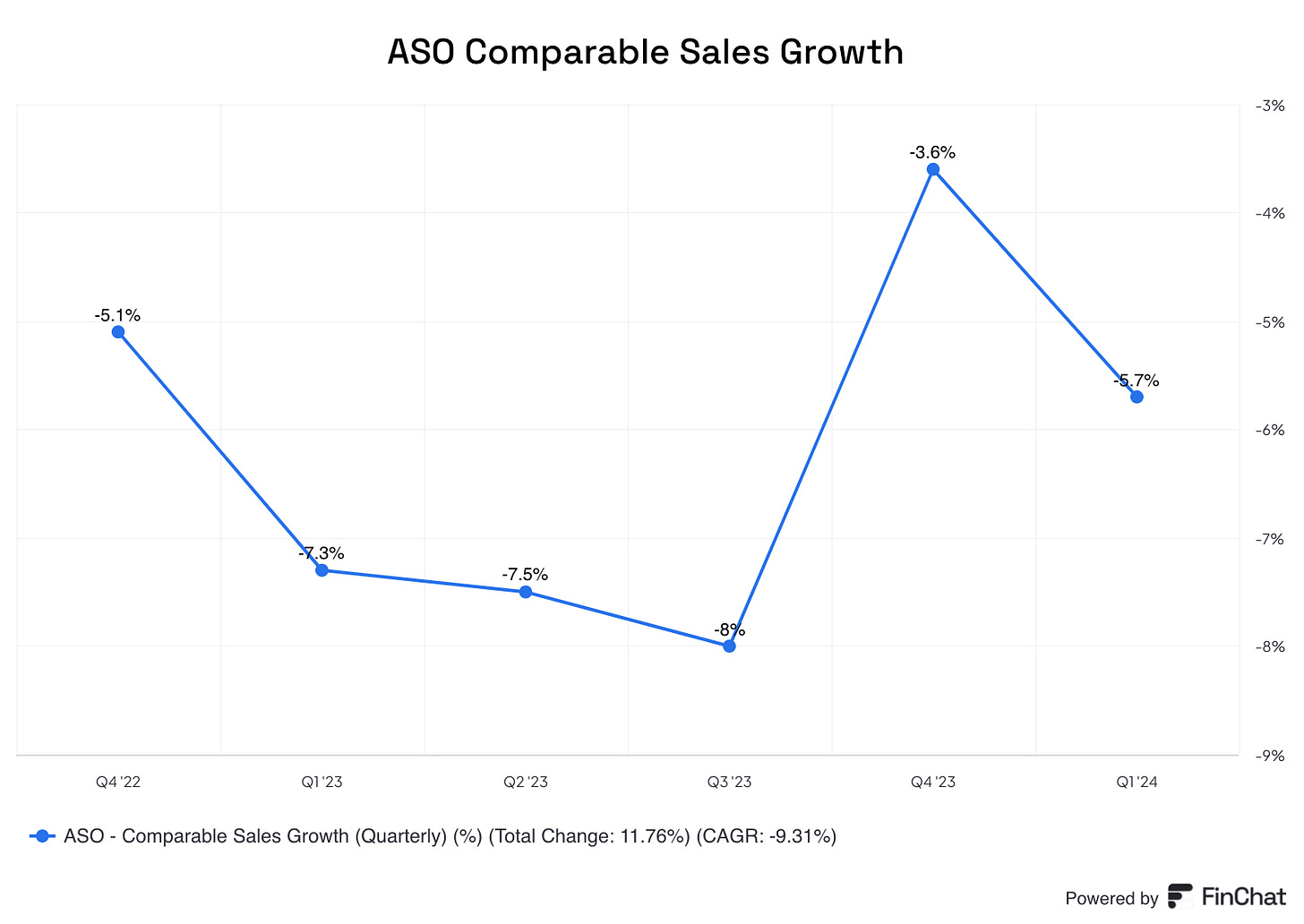

Academy reported earnings in June and was overall underwhelming. They continue to argue that the business is fine, just the consumer remains under pressure. Understandable considering inflation and higher interest rates, but I’d like to see the company do something other than get on the phone every quarter and give the same reason for why they continue to miss expectations.

I am not confident in the new management team that is in place ever since Ken Hicks stepped down as CEO in 2023 and CFO/President Mike Mullican left the company in 2023.

The one bright spot from the earnings call was the company’s mention that early same-store sales comp readings from their 2022 and 2023 vintage stores are posting positive comps. This is a big deal considering same-store sales comps have been in decline for quite some time (see below). I am now underweight ASO (<15%) but will be looking for more positive news on new store openings.

June update on the ASO & DKS Google Review Tracker:

Academy Sports + Outdoors

Total number of reviews // 158

Average rating // 4.11

Sequential improvement // -3.4%

Hard data // Academy Google Review Tracker

Dick’s Sporting Goods

Total number of reviews // 16

Average rating // 3.33

Sequential improvement // -22.1%

Hard data // Dick’s Google Review Tracker

Commentary

It only took a month but looks like we have reverted back to the mean here already with DKS drastically underperforming ASO.

Portfolio Weightings

One last thought, going forward here is what I mean with regard to portfolio weightings considering that Sycamore prefers holding 3-7 stocks at any given time:

Under-weight = <15%

Equal-weight = 15%-20%

Over-weight = >20%

Reading through your thoughts the NVDA trade was just a master stroke on your part. Bought when hated, stayed for a good portion of it being loved & you continue to ride the momentum. Far too many “value” investors get out when it reaches their “fair value” and ignore momentum as a factor giving up a LOT of upside.

I think you’ve captured an immense amount of the safe upside here & a 9 bagger in 3 years is nothing to scoff at.