Key Takeaways from Year-End Brokerage Conferences | Uber, SentinelOne, Amex

Mobility gross bookings growth at Uber, shifting the Crowdstrike narrative at SentinelOne, and more wallet share at Amex

The Sycamore strategy is highly concentrated, and as a result, I place a significant amount of emphasis on first-party data. These intra-quarter brokerage conferences are very valuable to my qualitative research focus.

I have provided more extensive summaries of these discussions in the past, but recently, three Sycamore portfolio companies participated in conferences. Being squeezed for time with Christmas, instead of longer posts for each company, I wanted to share my #1 takeaway from each conference.

Uber Technologies | Barclay’s 22nd Annual Global Technology Conference 2024 | December 11, 2024

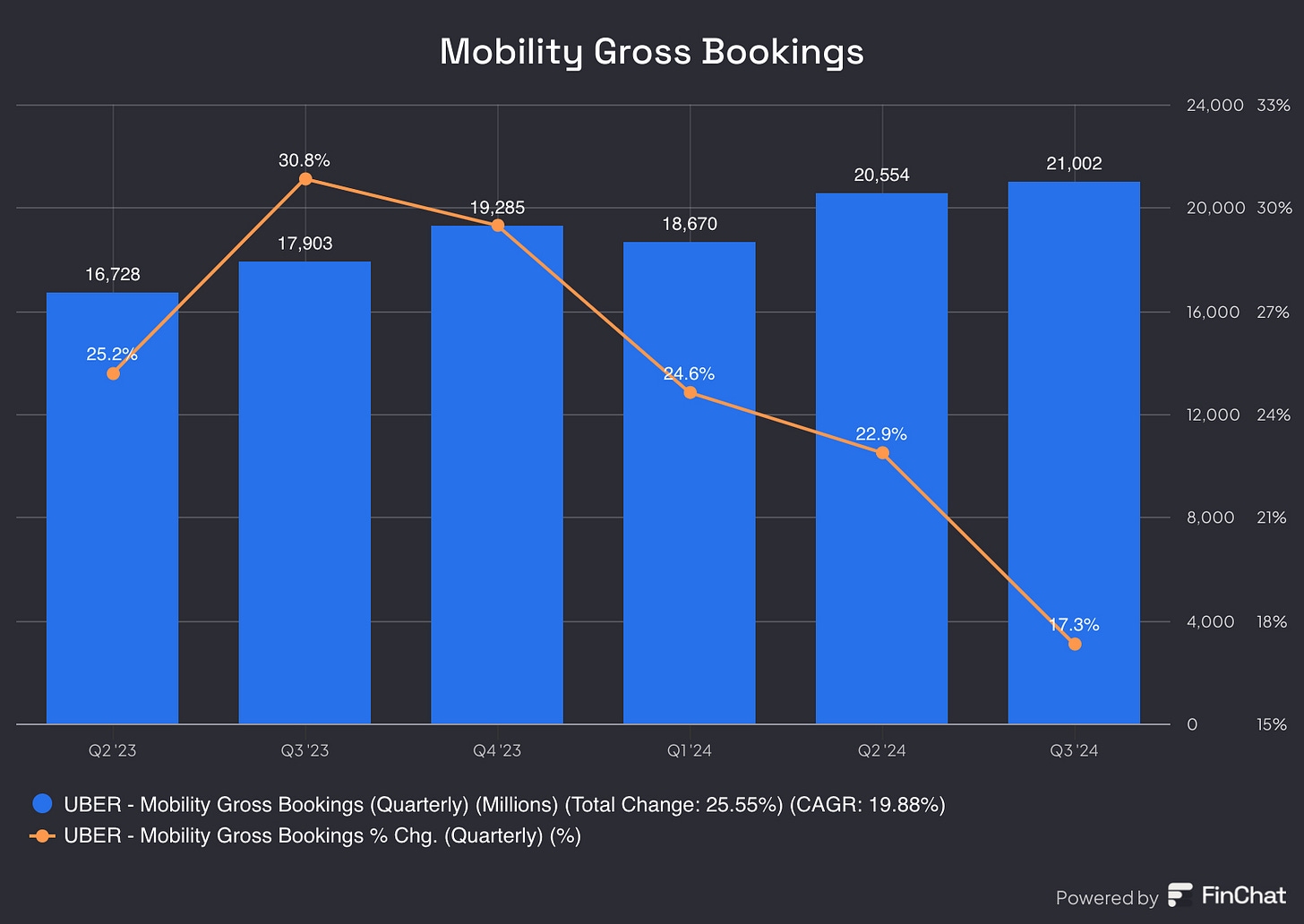

Mobility Gross Bookings (GB) Growth

Mobility makes up 51% of Uber’s total gross bookings and 57% of Uber’s total revenues. Mobility is obviously the most important KPI that investors are looking at each quarter.

In Q3 2024, Uber posted 17% gross bookings growth for mobility, and 24% on a constant currency basis.

At the Barclay’s conference, Uber CFO, Prashanth Mahendra-Rajah, said that the company’s Q4 guide assumes low 20% mobility GB growth. He then notes, without offering official guidance, that mobility GB growth is likely to range from the high teens to low twenties into 2025.

“In Q3 of this year, we had gross bookings growth for mobility…around 24%, which was a slight decel from what we saw in the first half. And then we guided for Q4 that gross bookings growth would sort of be in that similar low 20s range. Part of the reason for that decel sort of versus what you saw in the first half is second half of last year was a pretty tough comp. We had growth in the second half of 2023 in the high 20s, low 30 percent.

As we introduced a number of products, we had expansion of the 2 wheeler product, we had expansion in some regions with more hailables coming on. So we had a substantial uptick in the second half of last year, which makes comps a little tough year over year. And the other item to probably highlight is that in select markets in the U. S. where we passed through some more insurance costs, particularly where we had some tighter insurance markets, I think New Jersey, parts of Florida, Southern California, that also impacted a little bit.

But from what we see today, the trajectory of Q4 and sort of looking forward into 2025, feel very comfortable that our mobility business is going to continue to be sort of a high teens, low 20s grower for at least the 1st few quarters of 2025. I'm reluctant to give a full year guide, so I wouldn't take this as guidance, but that's sort of where our view is on how mobility is going to run out in 2025.”

Although he’s not entirely clear about Q4 specifically, his comments seem to imply a continued deceleration in mobility GB’s into the high teens or stabilizing in the low twenties as we work through 2025.

SentinelOne | Barclay’s 22nd Annual Global Technology Conference 2024 | December 12, 2024

Shifting the Crowdstrike Narrative

Since the Crowdstrike IT outage in July, the narrative from SentinelOne management has been about just how disastrous the outage was. And that new business, from Crowdstrike, was going to be coming their way. During that time, the market bid SentinelOne stock up about 40%, from ~$20 /share to ~$28 /share, as a result.

However, six months later, Crowdstrike has retained >97% of customers, including Delta Air Lines, despite CEO Ed Bastian’s public outrage and massive lawsuit.

During the Barclay’s conference, SentinelOne CEO, Tomer Weingarten, began shifting the narrative away from Crowdstrike’s mishap:

“I think what's really important to understand is that, that company that suffered the outage, they're still a pretty good execution company. And to displace the customer of theirs is something that takes typically more energy, more time. I can do 10 incumbent displacements at the time that I do 1 company displacement. So at the end of the day, I mean, you also want to kind of pick and choose if you're going after these opportunities. The ACV, given their discounting, is sometimes not as lucrative.

So it's really much more what do you want to take out of that versus am I going to just spend all of my sellers' time in all these customers looking to leave and looking for a great price point, but at the same time, they're fighting tooth and nail to try and keep them. So we kind of prioritize what we want to get from that long list of people that contact us. But, we have to balance it with the inertia that we have in the business elsewhere, because time is time. So, to me, I just want to focus on what I can, the most I can do with my time. That's not always that displacement opportunity.”

I love this narrative shift away from Crowdstrike’s failures because of the strength of SentinelOne’s fundamentals:

“So I can share, I think last I've looked at it, the average deal size in our pipeline is up 40% y/y. That's significant. And that’s partially outage, some of it is outage. I wouldn't say the dominant stuff we have in our pipeline is outage displacement.

I think there's quite a bit there. But at the same time, again, we’ve got multiple capabilities, multiple avenues to market, some parts of the market where that competitor is almost not present despite their attempts. So again, the diversification of our kind of revenue funnel, I would say, makes it that not one thing is going to control the entire pipeline. But as a whole, it's the biggest pipeline we've had. It's record pipelines as we go into next year.

We just experienced net new ARR acceleration. All the fundamentals are intact. We're getting more efficient. We just crossed last 12 months free cash flow positivity. So, I'm fairly confident that we can keep on accelerating net new ARR.”

The company previously noted a ~30% increase in deal volume, but this is the first mention of a 40% increase in deal size, which is very strong.

The market has hammered SentinelOne's stock since their December 4th earnings report, driving it back near pre-outage levels. Why? SentinelOne isn’t displacing CrowdStrike or poaching its customers en masse, and the market is having to re-adjust.

Nonetheless, I believe Weingarten is making the right move by reframing the narrative, as SentinelOne's merits are plenty strong enough to stand on their own.

Business is accelerating, and the narrative has shifted.

American Express | Goldman Sachs 2024 U.S. Financial Services Conference | December 10, 2024

More Wallet Share

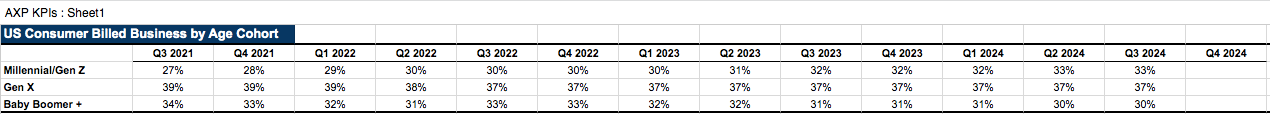

Anytime American Express management speaks about their Millennial and Gen Z cohort of customers, I listen intently. American Express is not just a brand for Baby Boomers, but increasingly a lifestyle brand that is resonating extremely well with younger generations with a long runway for growth, according to CEO, Steve Squeri.

“So if you think about our business, we have about 5% of the cards in the United States. And if you think about the fee paying cards, we have about 25% of those cards. That says to me there's still huge opportunity. When you think about Millennial and Gen Z, we're not taking every Millennial and Gen Z. When you look at the credit profile of the Millennial and Gen Z’s that we have, it is at the top. We are taking the cream off the top.

And so the nice part about the Gen Z population is that as we go on, more and more come into the workforce. And as we've talked about, we are targeting these card members with either a gold card or a platinum card. Years ago, we used to target them with a fee free product. And it did not get the engagement level that we needed. And so they get engaged with the benefits.

And what happens with Millennials and Gen Z is that they spend more…we get a higher share of their wallet, right. And one of the reasons we get a higher share of their wallet, they're not used to having the card not accepted. When you were growing up and I was growing up, you asked, do you accept American Express? You don't ask that question anymore, especially in the United States, where the card is as accepted as Visa and Mastercard. So that's a big deal and that gets us a higher share of their wallet.

They don't spend as much right now as a Gen X’er or a Boomer, and they don't borrow as much. But we believe they'll have 20 more years of relationships with us. And so we think the lifetime value is really 2x. The other interesting thing about this cohort is as they go along, we're still an aspirational brand for them. And so while we may not take them as they come out of college or they come into the workforce in a trade or something like that, as they establish their credit, they're still available to us.”

The Millennial/Gen Z tailwind is one of the core reasons American Express has been a core holding in the Sycamore portfolio for nearly three years. They’re willing to pay a significant annual fee and as a result, they use the card for every purchase and not just T&E (travel and entertainment) spend.

Tracking KPI’s associated with their Millennial and Gen Z cohort has been a focus of mine. Billed business share has steadily grown over the past few years and will continue to do so. Here is the latest update as of their October earnings report.