No Rest for the Weary | Sycamore Portfolio Update [August 2024]

Walter arrives, quick looks at MTN & ABNB, S & NVDA earnings, and parting ways with ASO

"The way to maximize outcome is to concentrate. And that’s true not only in investing, it’s true in all facets of life." - Lou Simpson (former Chief Investment Officer for Geico)

Walter made his grand arrival on August 14th and was well received by his many brothers. He and mom are happy and healthy.

Monthly Returns

Sycamore Capital Portfolio // -0.74%

S&P 500 // +3.90%

Differential // -4.64%

Year-to-date Returns

Sycamore Capital Portfolio // +51.43%

S&P 500 // +18.42%

Differential // +33.01%

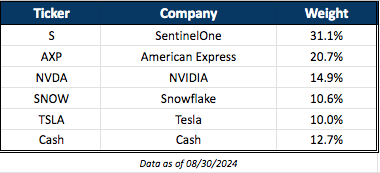

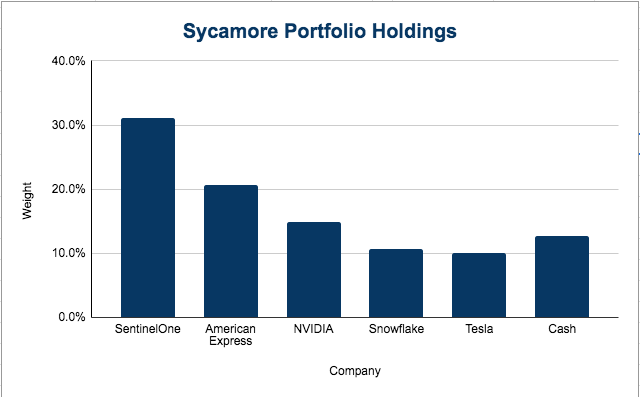

Current Holdings

Transactions in August

Increased AXP 0.00%↑ by 16.5% at ~$229 /sh

Increased S 0.00%↑ by 16.6% at $20.50 /sh

Decreased TSLA 0.00%↑ by 27% @ $220 /sh

Initiated SNOW 0.00%↑ with 10.6% position @ $114 /sh

Sold out ASO 0.00%↑ @ ~$46 /sh

First Thoughts

Subscribers to Sycamore Capital increased over 20% in August, the single largest monthly increase yet. Shout out to

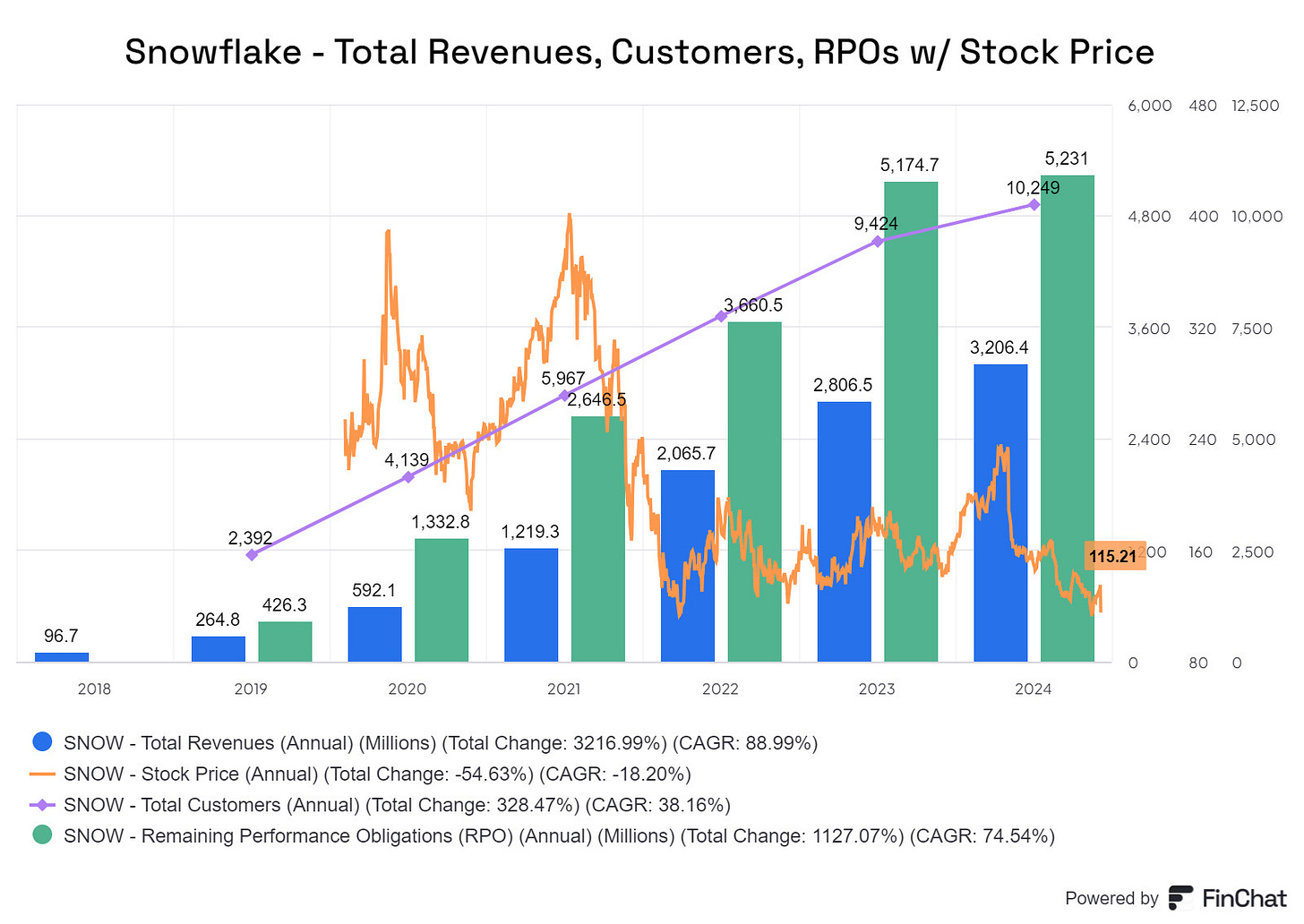

for featuring our SentinelOne Deep Dive in one of his August publications. Check out his page for great insight and tons of links to more stock deep dives.I added a position in Snowflake this month. The stock is either nearing a bottom and I’m smart or I am subconsciously preparing myself for another Minnesota winter. Yet to be seen.

I am working on a longer post for my Snowflake thesis.

When it comes to AI, Jensen Huang of Nvidia says this about Snowflake: “You are sitting on a goldmine of natural resource.”

During the month I took a close look at two additional ideas:

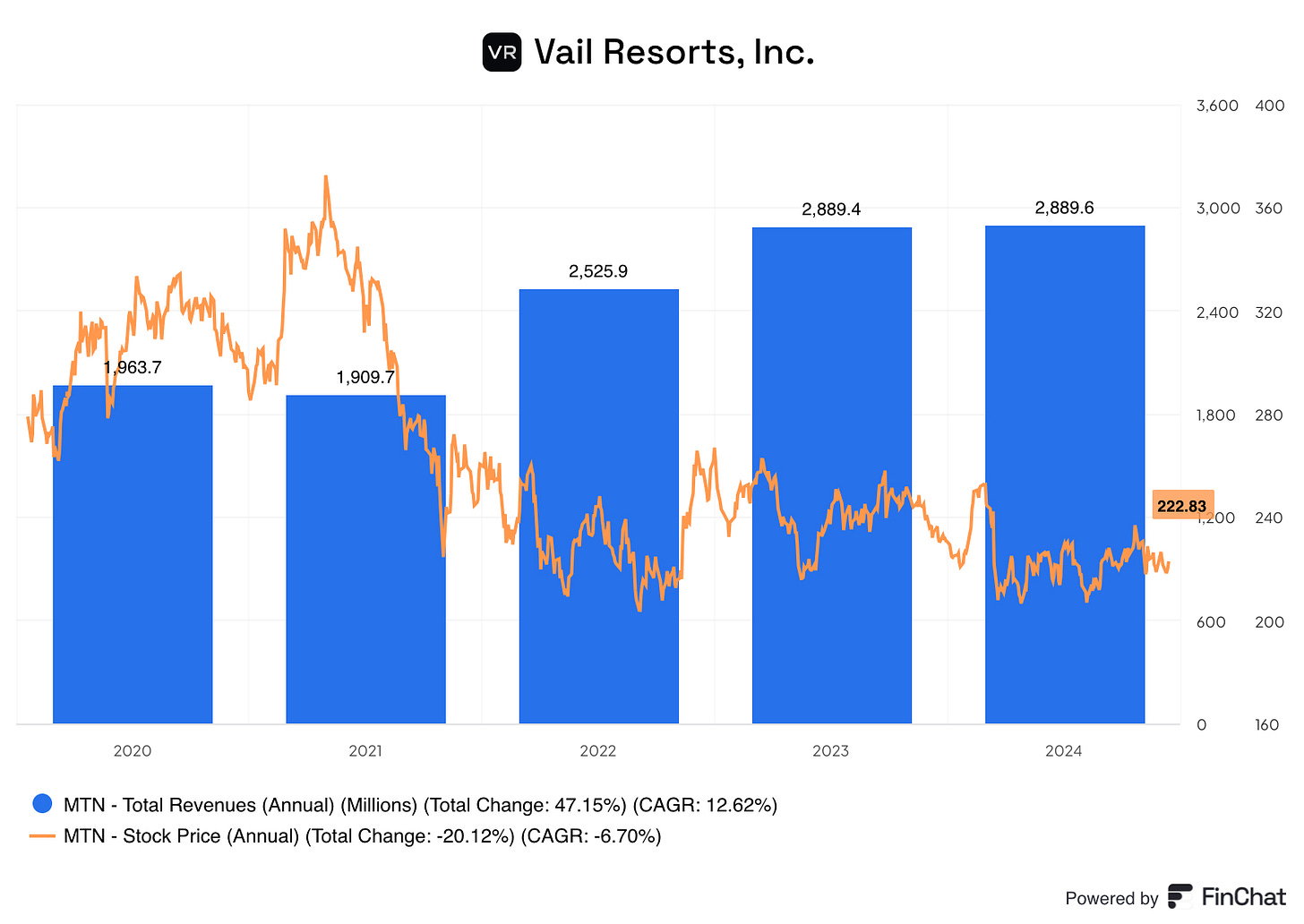

Vail Resorts MTN 0.00%↑

Owner/operator of ski resorts in USA, Europe, and Australia. Owns some of the best assets in this space including Vail, Beaver Creak, Park City, Keystone, Whistler, Heavenly, Stowe, and many more.

This is an incredibly unique asset. You can’t recreate Heavenly in Lake Tahoe, for example. There are fewer ski resorts today than there were 40 years ago (source). You can buy this asset and leave it for 20 years and when you return, people will still be skiing and snowboarding Beaver Creek in Colorado.

I passed for now because management hasn't proven they can create value. Since the new CEO took over in 2021, the stock has lost ~50% of its value, despite record-high revenues over the last 12 months. Additionally, she has just a 59% approval rating on Glassdoor.

I believe management is mismanaging capital. They're trying to invest in portfolio properties, acquire new resorts, pay down debt, repurchase stock, and maintain a ~5% dividend with a 111% payout ratio—spreading themselves too thin. They should cut the dividend, focus on aggressively reducing debt to gain flexibility for acquisitions, reinvest in existing properties, and then return capital to shareholders through buybacks.

Airbnb ABNB 0.00%↑

We all know what this company does, so I’ll skip the generic description. This is a business you can buy and hold for 20 years, and when you return, millennials and Gen Z will be older, wealthier, and still paying $300+ a night to sleep in a treehouse.

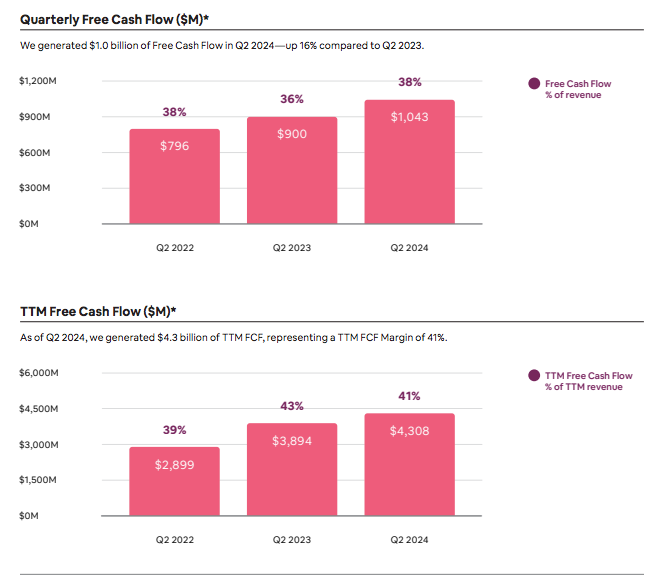

I love that this company is massively profitable and free cash flow generative. They have an immaculate balance sheet, which will give them significant room to invest in the business and try new things.

At ~$115/share and 26x NTM earnings, I’m not convinced we've hit bottom yet. The company is signaling a slowdown in its customer base, which I expect to continue for a few more quarters. I’d rather not try to fight against a weakening U.S. consumer right now.

SentinelOne Earnings

“The continuation of high-profile breaches and the recent global outage once again reinforced that cybersecurity is not a winner-take-all market. The systemic risks of single-vendor concentration are abundantly clear. After recent events, customer interest in our platform and AI-based security have distinctly risen.” - Tomer Weingarten, CEO

This earnings report felt exceptionally pivotal. It was our first report being owners of SentinelOne. S 0.00%↑ quickly became a VERY significant piece to the Sycamore equation with a 32% weighting going into the print. In addition to this, the stock has already appreciated by ~10% off my cost basis in less than two months.

Despite the stock falling ~5% initially (and even more since), I thought the report was very strong. The company beat revenue and earnings estimates, as well as raised revenue guidance for the year. Margin expansion continued.

Financial Highlights:

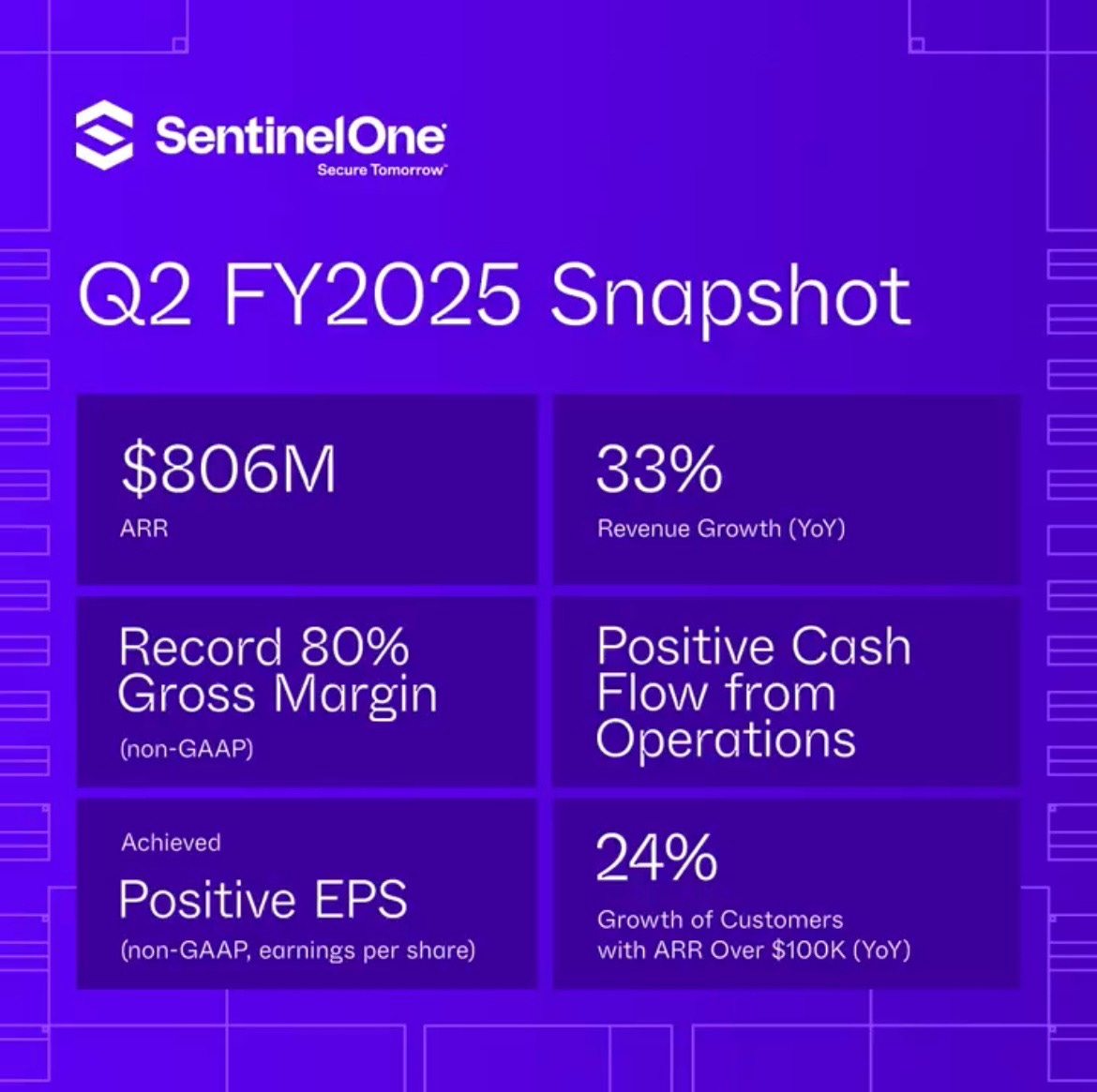

Revenue: SentinelOne reported a revenue of $199 million for Q2 FY2025, representing a 33% year-over-year growth

Annualized Recurring Revenue (ARR): The total ARR grew 32% year-over-year to $806 million. The company added $44 million in net new ARR, exceeding expectations by a double-digit percentage

Gross Margin: The gross margin reached a record high of 80%, up 3 percentage points year-over-year

Net Income and EPS: SentinelOne achieved its first-ever quarter of positive net income and earnings per share (non-GAAP)

Operating Margin: The operating margin improved by 19 percentage points year-over-year to negative 3%, outperforming guidance

Cash Flow: The company generated a positive operating cash flow margin and a positive 2% net income margin

Remaining Purchase Obligations: RPO’s grew 40% y/y on larger and longer-term contracts

A few highlights:

Organic growth

The key takeaway from the call is that S1 continues to grow despite a tough macro environment. Newer products like Purple AI, Data, and Cloud outpaced overall top-line growth. The company raised its revenue guidance and expects ARR to accelerate in 2H, driven by new product adoption and higher win rates. This leads to my next point…

Guidance assumes no incremental business wins from the Crowdstrike CRWD 0.00%↑ outage

S1 is cautiously managing the opportunity created by the Crowdstrike outage. On the call, they noted their typical sales cycle is 9-12 months. While the new business pipeline is strong (with analysts estimating a 30% increase based on channel checks, though S1 didn’t quantify), their guidance assumes no incremental wins from Crowdstrike.

I believe S1 is positioned for several quarters of beat-and-raise performance, driven by new products, an expanded pipeline, higher win rates, and conservative guidance.

One Vendor vs. Multiple Vendors//Closed vs. Open Ecosystem

I listened to both the SentinelOne and Crowdstrike earnings calls, and it's a tale of two approaches:

Tomer Weingarten, SentinelOne:

"Putting all eggs in the same basket is not advisable in security. Following this incident, customers and partners are looking to reduce their reliance on vendors that enforce closed garden platforms.

At SentinelOne, we take an open ecosystem approach to security to give enterprises flexibility and choice. Our goal is not to force-sell modules but to provide optionality and access to best-of-breed capabilities that minimize security risk and maximize resilience. At Black Hat a few weeks ago, we heard from enterprises that they want to diversify cybersecurity technologies and mitigate the risk of another global outage."George Kurtz, Crowdstrike:

Kurtz highlighted that customers prefer to avoid disintegration across multiple vendors and, instead, want to stick with Crowdstrike while continuing to add modules and services.

Both narratives could be true at the same time, but my bet is that redundancy with multiple vendors on an open ecosystem platform will win out, especially in such a mission-critical area.

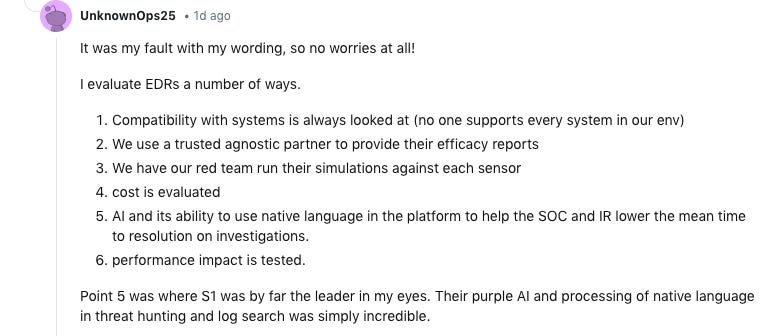

Purple AI is for real and addresses the open ecosystem theme

“Purple AI is proving to be truly transformative and we're seeing great customer traction. Within only months after general availability, Purple AI adoption has surpassed all our expectations and contributed to Q2 outperformance. For instance, we achieved double-digit attach rate for Purple AI across all eligible endpoints sold in the second quarter, indicating incredible momentum.” - Tomer Weingarten, CEO

“We're…seeing tremendous customer interest and adoption of our advanced Purple AI capabilities. Purple's generative AI capabilities are a major competitive advantage and we have a clear time-to-market lead.

Purple AI is natively integrated across our entire platform. Purple touches every aspect of managing security and has the ability to see and manage all security events, including those of competing products.” - Tomer Weingarten, CEO

Additional highlights from the earnings call:

“At one of the largest hospitals in the United States, SentinelOne and another endpoint vendor had been deployed in select geographies.

Unfortunately, every system secured by this other vendor got breached, while systems secured by SentinelOne remained protected. The difference was clear and the customer fully deployed SentinelOne with a multi-million dollar expansion.”

- Tomer Weingarten, CEO

“Customers and partners are now looking for better platform architectures and building more resilient cyber defenses. This is resulting in significant pipeline pickup for us in high levels of customer interest. This is coming from some of the largest enterprises and partners in the world that did not have a chance to appreciate Singularity platform's breadth and superiority relative to the competitive offerings, all of that isn't changing now. And they are impressed by what we can offer. For instance, several of the world's biggest companies are now engaging with SentinelOne and some of them have already made the decision to switch.” - Tomer Weingarten, CEO

“Every year, multiple vendors claim 100% detection with more than one claiming they had the best results.

This can't be true and it's not. Two important metrics everyone should look at are the number of delays and configuration changes during the MITRE evaluations. Making dozens of configuration changes during an attack evaluation simply means that the vendor had to modify its product for detection and protection, otherwise, it failed. This is, obviously, unrealistic in real-world and real-time scenarios, especially when coupled with brittle kernel-level updates.

In our Q3 shareholder letter from fiscal year '24, you can see the MITRE evaluations chart showing overuse of configuration changes and delays, the two largest endpoint vendors by market share combined had more than 50 delays and configuration changes. SentinelOne had zero. In our view, customers and partners deserve transparency from the first conversation through multi-year relationships to build trust and a secure future. This should be the industry standard.

We lead with better technology instead of aggressive marketing claims.” - Tomer Weingarten, CEO

With their forward growth adjusted EV/Sales ratio at ~0.25x, whereas the median software business multiple is 0.4x, I feel very comfortable that their is some built in downside protection here.

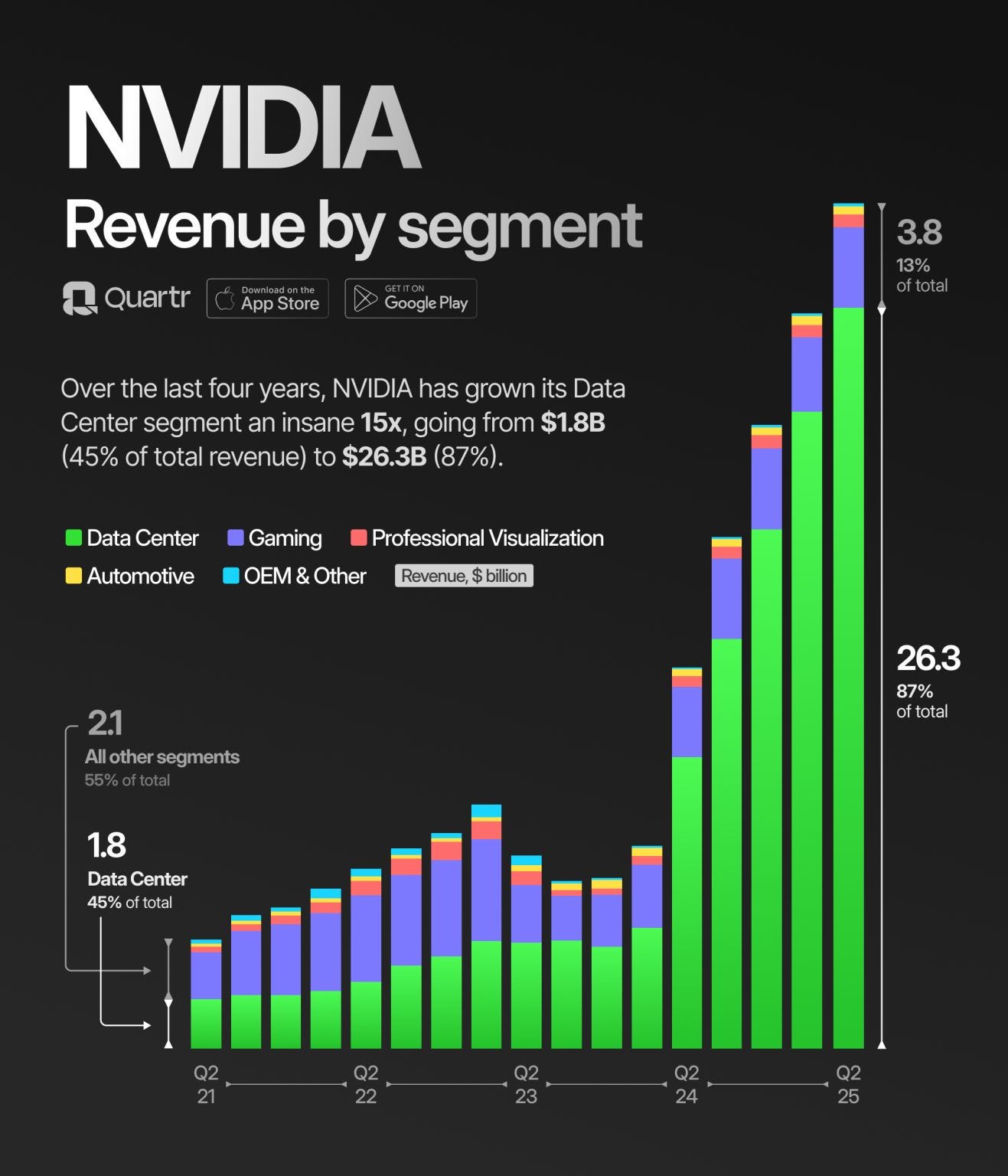

NVDA Earnings

NVIDIA’s earnings report has been well documented so I won’t spend a lot of time here. But here is a simple overview of the earnings call:

Record Revenue: NVIDIA reported record Q2 revenue of $30 billion, up 122% year-over-year, driven by strong demand for Hopper GPUs and networking platforms in the data center.

Data Center Growth: Data center revenue grew 154% year-over-year, with cloud service providers and consumer/enterprise companies driving growth. Demand is strong for generative AI, model training, and inference workloads.

Blackwell AI Platform: The Blackwell AI platform is widely sampling and expected to begin ramping production in Q4, with several billion dollars in revenue expected. Blackwell offers 3-5x more AI throughput than Hopper in power-limited data centers.

Blackwell, though delayed a few months, should make for an exciting CY2025.

Parting Ways With Academy Sports + Outdoors

My position in Academy Sports has gradually declined from ~50% at the start of 2024 to zero as of today.

I started losing conviction when CEO Ken Hicks retired in October 2023. The logical successor in my opinion, CFO Michael Mullican, wasn’t promoted and soon after left the company. Since then, I’ve had doubts about the new management team, and I mentioned my concerns in earlier updates.

As a result, I’ve been selling down the position while locking in solid gains on my mid-$40 unit cost basis:

January: reduced by 2.5% at $65

February: reduced by 3.9% at ~$70

March: reduced by ~10% at $68

April: reduced by ~30% at ~$64

June: reduced by 21% at $52

With recession fears rising in early August, I sold the remaining shares at $46, preferring cash over a small stake in Academy. In hindsight, I should have acted sooner when my thesis changed, not when I became concerned about broader market risks.

This has been a good reminder that I’m not a macro investor. My focus is on evaluating businesses from a fundamental and qualitative standpoint.

The stock has since rebounded into the mid-fifties.

Good looking family you got there. Congrats Matthew (and the Mrs off course)

even retrospectively differentiated retail is hard.

my painful lesson was a 2X in Tractor Supply rather than a 5X. why? because i already was biased that it was overvalued and looked for an excuse...which i found in a ton of negative employee reviews.

even following those with good track records is hard, because i am highly skeptical of durable consumer models in a hyper-competitive world. (even today, i am shocked at how few apple owners realize\care that several android phones are equal or better with a more flexible ecosystem.)