Portfolio Update [February 2024]

The Nvidia rocket continues, Academy site visits, two new buys, and more!

Recent Subscriber Reviews

“I can’t believe I don’t have to pay for this!” - Anthony H.

“It’s a shame this isn’t investment advice, because I could be doing really well for myself if it was…” - Will H.

Don’t miss an update by subscribing for FREE! Wow, what a value!

Monthly Returns

Sycamore Capital Portfolio // +19.12%

S&P 500 // +5.17%

Differential // +13.95%

Year-to-date Returns

Sycamore Capital Portfolio // +23.06%

S&P 500 // +6.84%

Differential // +16.22%

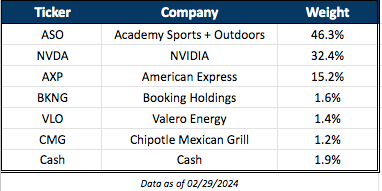

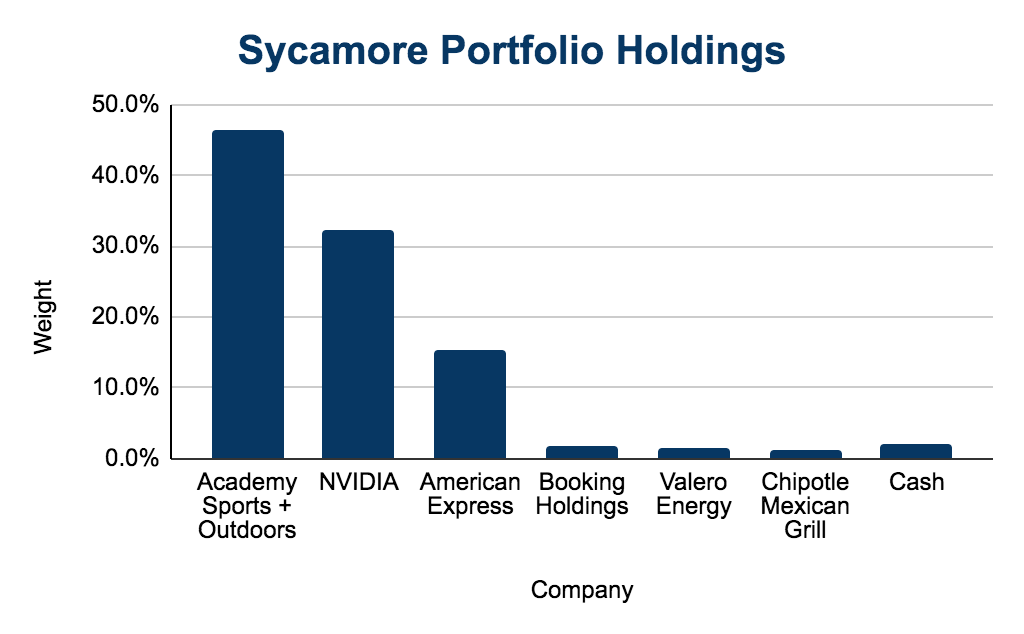

Current Holdings

Moves in February

Trimmed ASO by 3.9%

Initiated 1.2% position in CMG

Initiated 1.6% position in BKNG

Nvidia Rocket Continues

Nvidia blew the doors off of earnings again. According to Jensen Huang, the company is positioned at the core of a comprehensive upgrade of the $1 trillion data center infrastructure, transitioning from CPUs to GPUs, specifically accelerated computing. Huang identifies this as a multi-hundred billion dollar annual opportunity. Given the absence of substantial competition, Nvidia's primary challenge lies in maintaining supply to meet the soaring demand. Consequently, the pricing for their H100 GPUs remains robust, contributing to extraordinary profit margins.

In the realm of competition, although many companies are swiftly attempting to enter the fray against Nvidia, the complexity of the H100 GPU presents a formidable barrier. Described by Jensen Huang during a recent earnings call as not merely a chip but a 70-pound supercomputer comprised of 35,000 components, replicating or competing with such sophistication proves to be no simple feat.

Providing a glimpse into Nvidia's strategic foresight, management asserts visibility through 2024 and into 2025, emphasizing that demand continues to significantly outpace supply. Moreover, the production of their next-generation chips is already underway.

Trading at a forward P/E of 33x, a valuation consistent with its status 18 months ago when the stock was priced at $150, and positioned at the lower end of its historical range, I remain committed to holding my position. Until compelling reasons emerge suggesting that this remarkable trajectory may encounter headwinds, I see merit in maintaining my ownership in Nvidia.

Academy Site Visits

Like a good analyst, I conducted on-site visits to three Academy locations as part of comprehensive channel checks. These visits took place in Topeka, KS, Sugar Land, TX, and Missouri City, TX. I actually took the family to Houston, which is why I was near some stores.

The Academy stores presented a commendable image of cleanliness, organization, and well-maintained inventory. Academy's new private label brand, R.O.W. (Right of Way), is the poor mans Lululemon and it is awesome. I bought a zip-up jacket that is extremely comfortable and high quality. My two older boys found 5-foot long spears and proceeded to walk around the store with them pretending they were gladiators.

Noteworthy is the fact that Academy's private label brands contribute significantly to its sales, constituting 21% of total sales as of Q1 2023. These private labels command higher margins than major brands like Nike. Private label brands at Dick’s constitute only 14% of total sales, in comparison. In other words, people like Academy for Academy more than people like Dick’s for Dick’s.

Despite the stock at an all-time high, Academy's current valuation remains favorable, trading at 9.5x forward earnings—a 30% discount when compared to the inferior Dick's. Congrats to all owners.

Buying Chipotle (CMG)

This is a great business that is growing quickly and consistently. Recent AUV across their 3,000+ restaurants recently topped $3M for the first time. Management sees a pathway to doubling the footprint here in the US and then expanding internationally, while growing AUV to $4M and expanding margins through automation.

There is a lot to like, but it is expensive at 49x forward earnings. And it doesn’t make a lot of sense as a Sycamore business. I put it in the portfolio in February but will be exiting in the first week of March to allocate to better and more appropriately priced ideas.

Speaking of better ideas…

Buying Booking Holdings (BKNG)

I am really excited about Booking Holdings! This is a remarkable company and currently the largest entity in the travel industry globally. Notably, it boasts significant profitability and robust free cash flow generation. And consistently achieves a return on invested capital exceeding 20%.

In the recent quarter, total bookings grew 16% y/y compared to Airbnb at 15% and Expedia at 6%. Even more significantly, the company grew alternative accommodation nights booked (that’s anything other than a hotel) at 19% in the quarter and 24% for the year, while Airbnb grew at 12% and 14%, respectively. And that is Airbnb’s sole business…wow!

Under the strategic leadership of Glenn Fogel, a visionary with a long-term perspective, the company is well-positioned to capitalize on the enduring opportunities within the travel sector.

The favorable thematic tailwind for travel is just beginning, with Millennials and Gen Z expressing a strong affinity for travel, experiences, and dining out. With these generations set to inherit well over $50 trillion within the next 30 years, Booking Holdings is poised for sustained growth over an extended period.

Additionally, the company demonstrates a shareholder-friendly approach by returning substantial capital to investors through share repurchases and now dividends, with notable achievements in 2023, such as the repurchase of 9% of outstanding shares. This commitment aligns with the company's dedication to enhancing shareholder value.

It's worth noting that Booking Holdings currently trades at 20x forward earnings, which is a slight discount to the S&P 500, despite its fantastic track record to invest capital, grow their business, and return it back to shareholders.

Sycamore Portfolio Management Philosophy

Understanding my approach to portfolio management is crucial. When I find a compelling opportunity, I prefer initiating with a small position. It allows me the space to engage with the investment over time, gauging my level of enthusiasm and the impact it has on me. I assess whether the acquisition keeps me awake with excitement or stress, and I immerse myself in gathering every bit of relevant information about the business. This meticulous evaluation process is integral to my investment strategy because when I decide to commit, I aim to be truly invested, to be a true owner, often allocating a significant portion of my net worth if I love the business and the circumstances align favorably.

I begin with a small allocation to any new idea, and over time, these positions either transition out of the portfolio or evolve into substantial components. Therefore, it shouldn't be surprising if you observe such developments with holdings like VLO, CMG, or BKNG. Currently, I am in the early stages of exploring the potential of these businesses, and my approach is dynamic, adapting as the investment narrative unfolds.