Portfolio Update [January 2024]

Nvidia on fire, Academy's positive comps, a new holding, and more!

Recent Subscriber Reviews

“The best value on Wall Street!” - Matt B

Don’t miss an update by subscribing for FREE! Wow, what a value!

Monthly Returns

Sycamore Capital Portfolio // +3.20%

S&P 500 // +1.59%

Differential // +1.61%

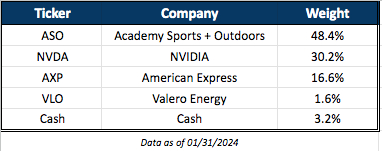

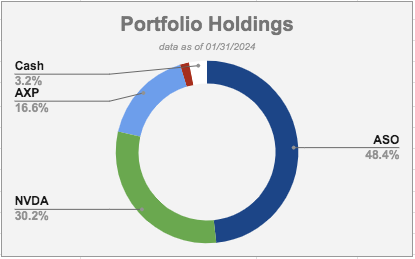

Current Holdings

Moves in January

Sold out TSLA at ~$240 /share

Trimmed ASO by 2.5% at ~$65 /share

Started 1.6% position in VLO

Nvidia is still on fire

On January 7 I posted the following note on Nvidia:

Since this post, Nvidia has been straight up and to the right. The stock is +40% YTD.

Selling Tesla

On January 4 I sold out of my relatively small position in Tesla. The timing was right as I sold for an average price of $240 and then watched the stock plummet to $180 low as January rolled on.

Here is why I bought Tesla in January 2023 to begin with:

Delivering vehicles at 40-50% growth clip while all other major vehicle manufacturers were flat to negative

Margins were 3x better than its peers and its forward p/e was exactly 3x its peers (21x)

Believed I was paying a fair price for the car business and getting the energy business, robotics business, supercomputing, full self driving, etc for free

The stock had traded down so sharply because Musk had bought Twitter and was in the middle of the Twitter Files release - everyone was calling for the end of Tesla, but the data did not support the headline narrative

I bought it thinking I would hold it for a long time and wasn’t expecting the stock to recover within 12 months. It recovered back to where I wasn’t willing to buy/own it beforehand so I sold it. It ended up being more of a trade.

Trimming Academy Sports + Outdoors but +comps have returned

With the run up from the low-mid $40’s to the mid $60’s in very short order, my position in Academy has relatively become very large. Over 50% of the portfolio. As a result, I have taken this opportunity to slowly trim the position back to a target range of 40-50%.

It’s still my highest conviction pick at 8.5x forward earnings and bottoming-to-positive same-store sales data in F4Q.

According to Bank of America debit/credit card data, Academy ended F4Q with observed sales at +2.2% y/y compared to -9.3% from the previous quarter. This implies same-store sales growth of +3.2% in the quarter, which is +8.9% ahead of current consensus estimates at -5.7%. That’s a huge outperformance following 7 straight quarters of negative same-store sales comps. Earnings report will be released sometime in mid-March.

A new metric that BofA Securities is tracking is mobile app monthly active users (MAUs). Academy launched their app in July 2021 and has seen steady growth to the current ~600K MAUs.

Holding American Express and looking for an opportunity to add more

This is an incredible company and that was highlighted once again on their recent earnings report/call. I’m pleased to see the stock over $200 /share but would welcome a pullback to add to the position.

I’m working on a post on AmEx and am focused on tracking their growth amongst Millennials and Gen Z cohorts. AmEx has become an intergenerational business and the youngest customers are experiences-hungry by nature and set to inherit over $50 trillion in the next 20-30 years. That’s AmEx’s sweet spot and an extremely strong secular tailwind.

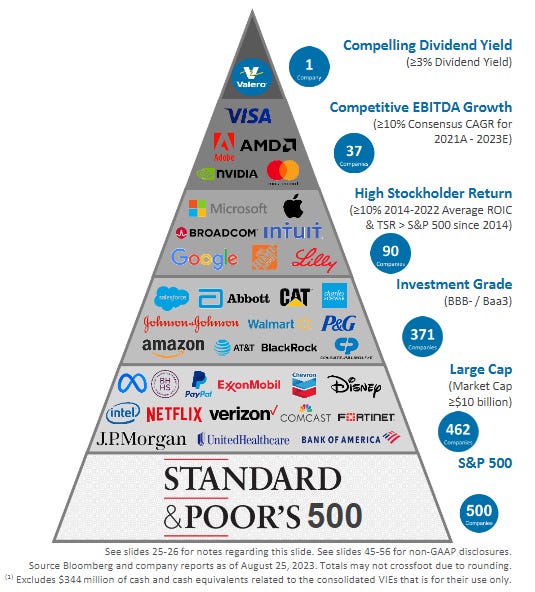

Buying Valero

I have followed the company for a long time and started a very small position and will see where we go from here. Here are a few initial thoughts as I have not had time to do a deeper dive post yet (data as of mid-January):

Valero is a best-in-class operator (lowest cost producer)

Top-tier efficiency, up-time, and safety

95% crude utilization in most recent quarter vs. 93% at PSX

2% is a big deal when you have 3.2 million barrels per day of capacity

Fortress balance sheet

Cash build from $2B to $3B in calendar year 2023. Management is targeting a $4B cash reserve cushion

Disciplined and favorable capital allocation to continued growth and for shareholders

Target 40-50% cash return to shareholders via dividends and buybacks

Distributed 60% in 2023

Raised the annual dividend by 5% and repurchased 11% of the outstanding shares in 2023

Capturing upside value in renewables

50% owner of Diamond Green Diesel that has grown incrementally for 10+ straight years (ex 2020)

Expanding into renewable jet fuels (SAF project will be complete and come online in Q1 2025)

Using refining and liquids expertise to innovate in this area

Climate change agnostic - serving both traditional and renewable energy

Extremely competent management team with long Valero-specific tenure

97 years of Valero-specific cumulative experience between CEO, CFO, and COO

Cash generative through the cycle

Trading at a cheap price (8.9x forward P/E)

10% discount to PSX

20% discount to MPC

50% discount to S&P 500

Also this graphic is fun and I’m a sucker for stupid stuff like this!

That’s all I’ve got for now. February is going well I think. ASO Google Review Update for January coming soon.

I take my investments seriously. There's only two people I follow and trust for my financial planning: Nanci Pelosi, and Matthew Blake.