Monthly Returns

Sycamore Capital Portfolio // +1.35%

S&P 500 // +3.10%

Differential // -1.75%

Year-to-date Returns

Sycamore Capital Portfolio // +24.32%

S&P 500 // +10.16%

Differential // +14.16%

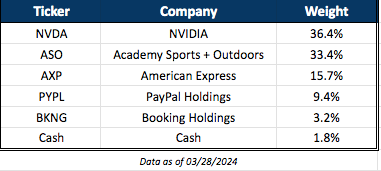

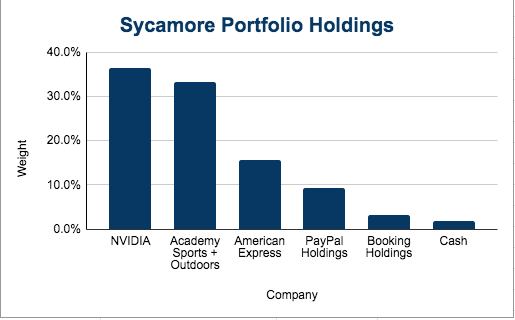

Current Holdings

Moves in February

Trimmed ASO

Sold out of position in CMG

Doubled position in BKNG

Initiated a 9.4% position in PYPL

Academy Earnings On-Target but Guidance Disappoints

ASO reported in-line results for the quarter but disappointing guidance for the year. My biggest concern with the company is that new stores are not ramping as projected. The company confirmed this on their earnings call. As a result, the company will now need to open more stores to reach their 5-year financial goals of $10B in annual revenue and $1B in annual profit. More details below:

Financial Metrics for the Latest Quarter:

Revenue: $1,794.83 million, showing a growth of 2.77%.

EPS (Earnings Per Share): $2.27, with an increase of 11.61%.

Net Income: $168.17 million, up by 6.67%.

Guidance for Fiscal Year 2024:

Net Sales: Expected to be between $6.07 billion and $6.35 billion, representing a 2% growth at the midpoint compared to fiscal 2023 (excluding the 53rd week).

Comparable Sales: Projected to range from -4% to +1%.

Gross Margin Rate: Anticipated to be between 34.3% and 34.7%.

GAAP Net Income: Forecasted to be between $455 million and $530 million.

GAAP Diluted EPS: Expected to range from $5.90 to $6.90.

Free Cash Flow: Anticipated to be between $290 million and $375 million, with capital expenditures projected between $225 million and $275 million.

This guidance reflects a conservative outlook due to the challenging economic environment and consumer pressures anticipated for the year.

Highlights in the Quarter:

Voluntary Debt Paydown: Academy has made a substantial effort to reduce its debt, voluntarily paying down $100 million of its term loan during the quarter. This action reduced the outstanding balance to $91.8 million. Following this paydown, the company reported having $348 million in cash and a total debt of $484.6 million, with no outstanding borrowings on its $1 billion credit facility. This marks a decrease in total debt from $1,696.69 million at the end of the fiscal year 2024, reflecting a year-over-year reduction of 4.07%.

The company also increased their annual dividend by 22%, in-line with historical annual increases.

Increased Store Expansion Plans: The company is accelerating its growth strategy by revising its store expansion forecast. Initially planning to open 120 to 140 new stores over the next five years, Academy now aims to open between 160 and 180 stores. For the year 2024 alone, they plan to inaugurate 15 to 17 new stores, focusing on a mix of existing and new or adjacent markets. This strategy includes targeting smaller and mid-sized markets, which have demonstrated strong results and a favorable expense structure. The company's approach to entering new markets involves opening multiple stores simultaneously to achieve greater operational efficiencies and marketing synergies.

While it appears they are accelerating their expansion plans to reach their 5-year financial targets, I do like the strategy shift to smaller size markets. Bottom line, the company, while not necessarily thriving, is still able to self-fund these endeavours and return capital to shareholders through a 22% dividend increase, buybacks, and debt reduction.

PayPal Looks Attractive

I have began adding a position in PayPal as I believe the stock is attractive at only 12x forward earnings. The company processes approximately one quarter of global e-commerce transactions but growth has stalled due to lack of innovation within the company. PayPal recently hired a new CEO, Alex Chriss, who I actually like (not consensus on the Street - more on that below).

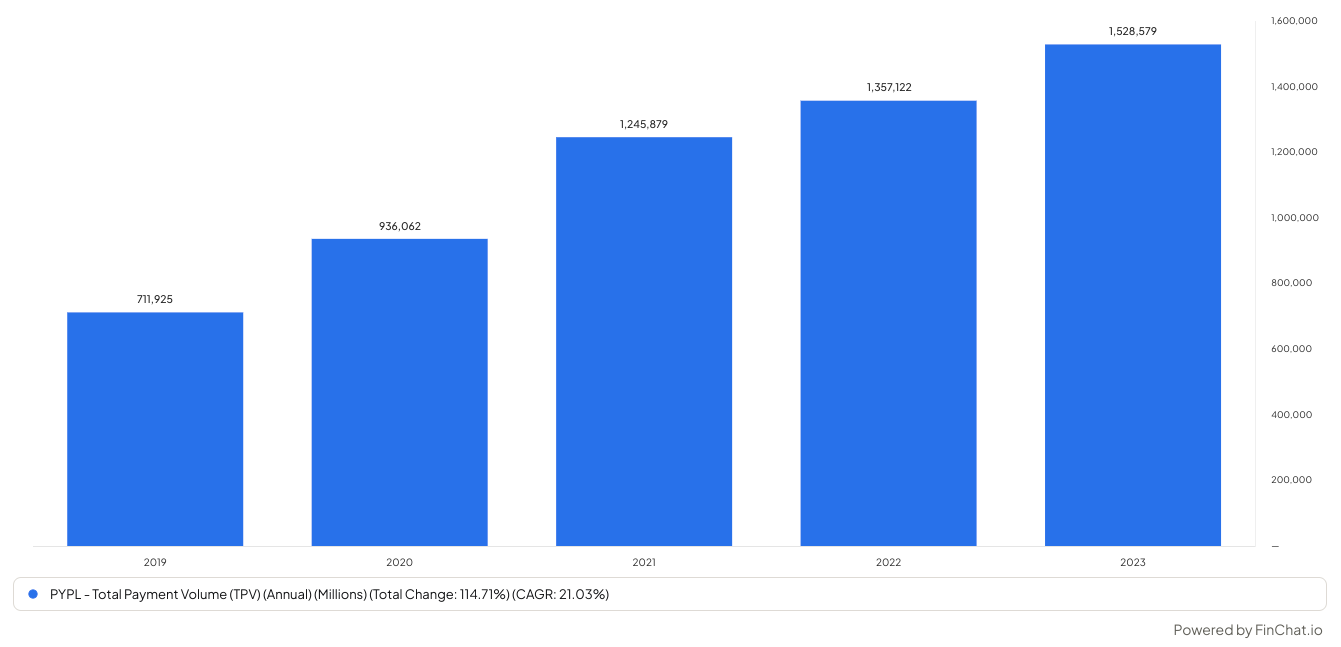

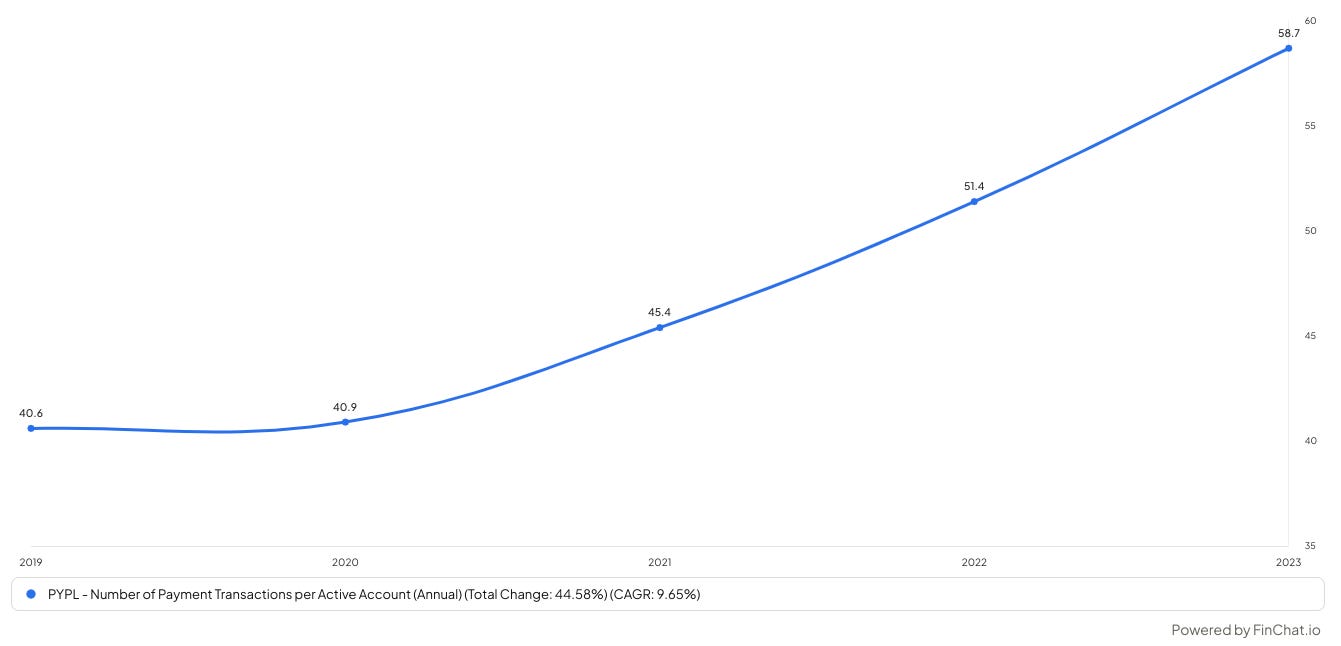

Bottom line though, while user growth has slowed and slightly declined recently, underlying metrics are still very strong with total payment volume (TPV) up 12.6% y/y. In addition, transactions per active account are at all-time highs (and compounding at nearly 10% annually), which tells me users are increasingly more engaged with the product.

The company is also committed to returning significant capital back to shareholders via buybacks, which is my preferred method of returns. The company plans to buyback over $5B this calendar year alone (7.5% of outstanding shares at current prices).

Follow that up with new management, new ideas, fresh innovations, and at 12x earnings I think the downside here is very limited and risk/reward is skewed in favor of the owners. Congrats to all owners.

Total Payment Volume:

Transactions per Active Account:

Lastly, Alex Chriss seems to have an unfavorable rating on Wall Street, primarily for his “shock the world” comment on CNBC. Many have trashed him for not “shocking the world” at their innovation day as reportedly promised. But I watched the video and I believe his comment is actually just referring to PayPal in general over the next couple of years, not the innovation day specifically. I thought the innovation day was a great start for a brand new CEO and management team. Watch the video here and decipher for yourself.