Re-Underwriting my Portfolio after a +96% Year

Portfolio update, historical returns, getting NVDA right, and current market pricing

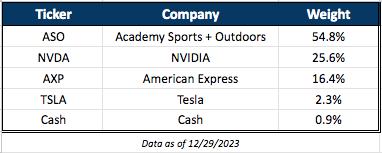

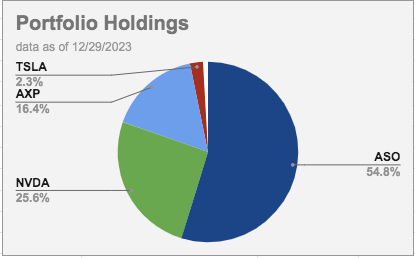

Portfolio Update

As of year-end, my portfolio remains unchanged, with no transactions executed throughout December.

The portfolio returned +96% this year, outperforming the S&P 500 by 71%.

2023 individual stock performance summary:

Nvidia (NVDA) +238.87%

Tesla (TSLA) +101.72%

American Express (AXP) +26.80%

Academy Sports + Outdoors (ASO) +25.62%

S&P 500 +24.23%

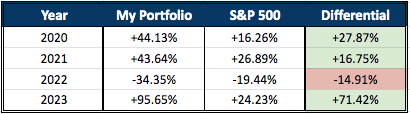

Historical Returns

Here is a summary of my historical returns since I began formal tracking in 2020.

Cumulative total return since 2020 of +149.07%, outperforming the S&P 500 by 101.13%.

Getting Nvidia Right

I began acquiring a sizable position in the stock throughout the summer and fall of 2022. At that point in time, no one had anything good to say about this company. The decision to concentrate here (among other decisions) meant underperforming the S&P 500 by 15% in 2022. Every time I bought the stock, it went down more. It was my largest position at the start of 2023.

My qualitative analysis was that this company was perhaps one of, if not the most, important companies in the US for a handful of reasons:

AI: It owned the artificial intelligence market in every way. Chips. Systems. Software.

Technology Stack: The way they can combine their chips, systems, and software solutions in tandem is a really powerful competitive advantage and means very sticky customers long into the future.

Omniverse: This was the buzz word of 2022. Meta talked about the omniverse but nobody knew what it was. Nvidia was actually building the omniverse for enterprise customers via “digital twins,” which is really cool.

National Security: You need powerful semiconductors to maintain a competitive advantage as a country in a technological world. America needs Nvidia’s technology more than they need technology from any other American company.

Pace of Innovation: I read countless hours of Glassdoor reviews from Nvidia engineers. What I learned was that they are expected to move quicker and innovate faster than anyone else in the market. I was confident they would grow out of their downturn.

I believed this was a generational company, and throughout 2022, the stock traded down 66% off its all-time high to the bottom of its historical forward P/E range for very short sighted reasons. Despite falling out of favor with Wall Street, the extent of the downturn was, in my assessment, considerably exaggerated.

The timing was fortuitous. I completed my final transaction of the stock in mid-October and ChatGPT launched 6-weeks later, which marked the official beginning of the age of AI.

Being positioned ahead of and on the right side of the most significant trade on Wall Street for 2023 is indeed gratifying.

While it’s tempting to attribute my timing to good luck, the truth is that a substantial amount of hard work paved the way for this year's return. As emphasized by a close friend and highly successful fund manager, it's crucial not to credit big wins to good luck, because no one will let you attribute losses to bad luck.

I have a strong affinity for Nvidia's "I Am AI" videos. Here's one for your enjoyment:

Current Market Pricing

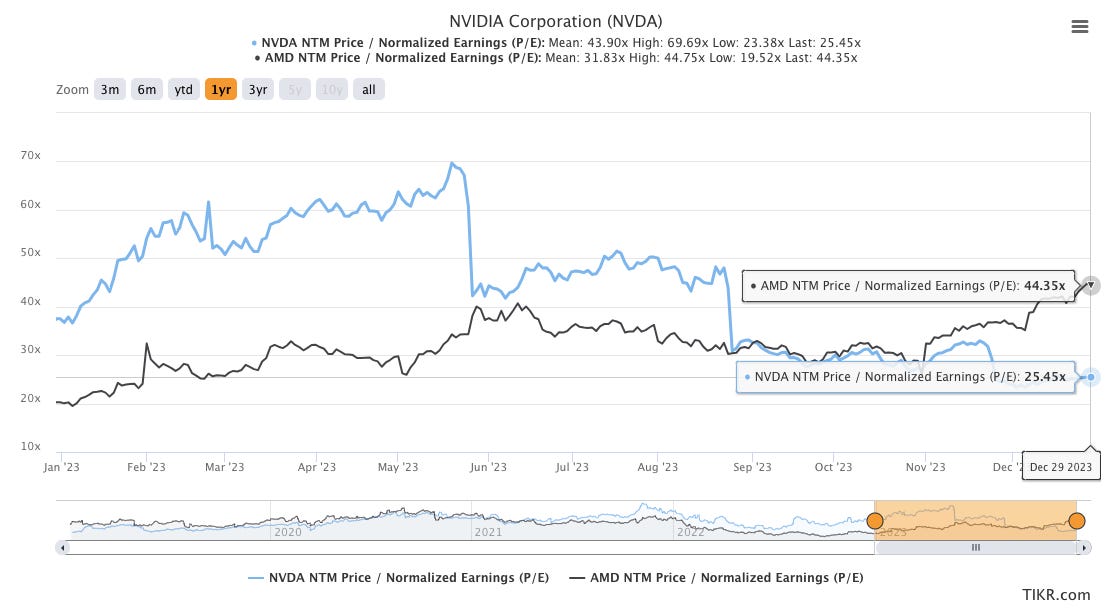

Despite appreciating 96% in 2023 - on a stock-by-stock basis - prices in my portfolio are not excessive (TSLA being the only exception). On a forward looking basis, Nvidia is actually 31% cheaper going into 2024 than it was going into 2023 (even after appreciating 239% - truly mind blowing!).

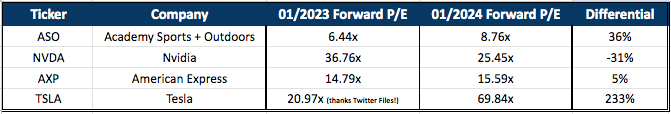

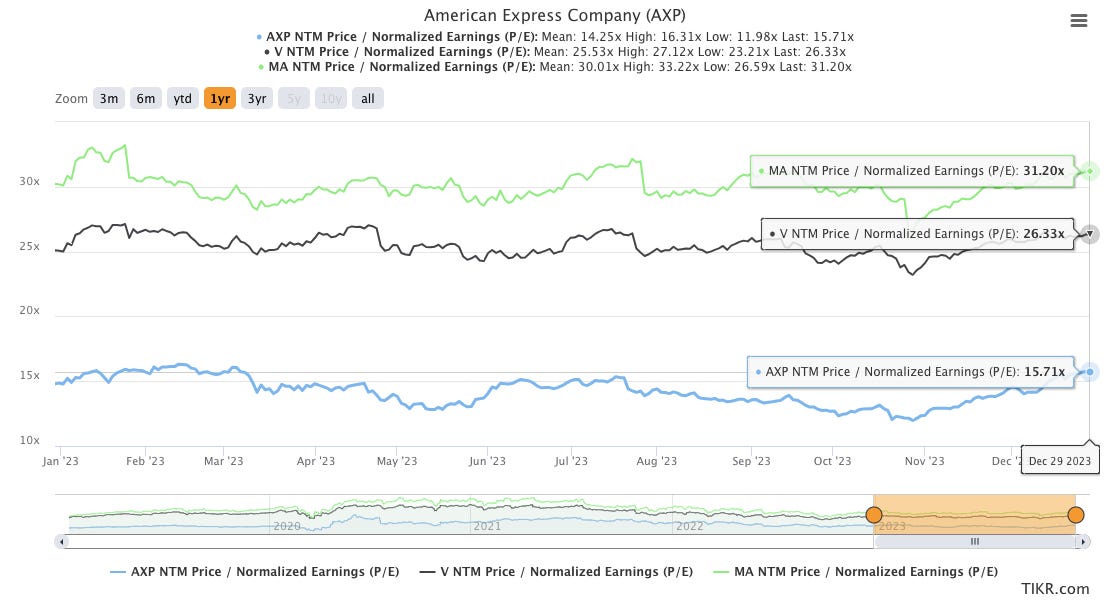

As of end-of-year, the S&P 500 forward P/E is 21.57x. As for my holdings, here’s where we began and ended the year:

Only Nvidia and Tesla trade at a premium to the market. Nvidia is forecasted to grow earnings at approximately 70% next year. So at only 25x, I think Nvidia is positioned to follow up 2023 with another strong year.

Why the 25x valuation? Possibly due to profit-taking, concerns about competition coming online in 2024, or skepticism about high earnings estimates, or a mix of these factors and others I am not accounting for.

Tesla probably doesn’t make a lot of sense at 70x earnings. It did at 20x, but probably not 70x.

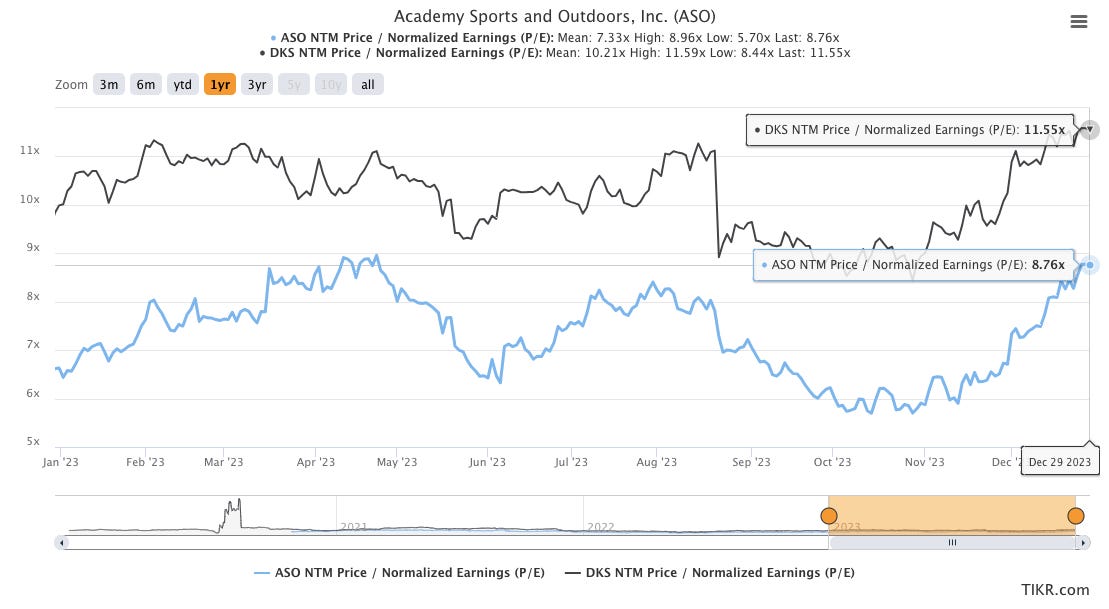

Here is how my portfolio companies’ multiples comp to their peers:

Academy Sports trades at a 31.8% discount to Dick’s Sporting Goods.

Nvidia trades at a 42.6% discount to AMD. Not a joke.

American Express trades at a 40.5% discount to Visa and 49.7% discount to Mastercard.

Tesla is expensive and I don’t know who to comp it against if I’m just accounting for P/E.

All this to say, the companies I own are not unreasonably priced (ex-TSLA). The portfolio didn’t earn 96% in 2023 and simultaneously see multiples go to the stratosphere. I own high quality, reasonably priced businesses that I believe will continue to grow earnings long into the future, buyback their own stock, and possibly see multiples expand.

That’s a set-up I like.