Sycamore Portfolio Update [April 2024]

AXP rips higher again after earnings beat and Tesla FSD v12 arrives

Monthly Returns

Sycamore Capital Portfolio // -4.73%

S&P 500 // -4.16%

Differential // -0.57%

Year-to-date Returns

Sycamore Capital Portfolio // +20.15%

S&P 500 // +5.57%

Differential // +14.58%

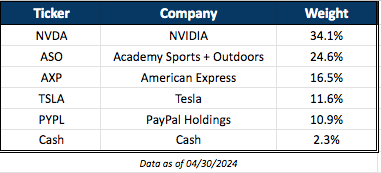

Current Holdings

Moves in April

Initiated 11.6% position in TSLA

Added to PYPL

Trimmed ASO

Trimmed NVDA

Sold out of BKNG

AmEx Rips Higher

American Express reported earnings on April 19 and the stock is trading at all-time highs following another blowout quarter for Q1.

A couple of highlights from the quarter include SME (small and medium size enterprises) spend being the company’s slowest growing LOB. But if you double click, AXP continues to win market share in this segment and is seeing continued growth in new cards acquired. Spending is roughly flat y/y but as BofA Securities put it, this segment is a “coiled spring” and AXP stands to experience outsize benefits when spending recovers.

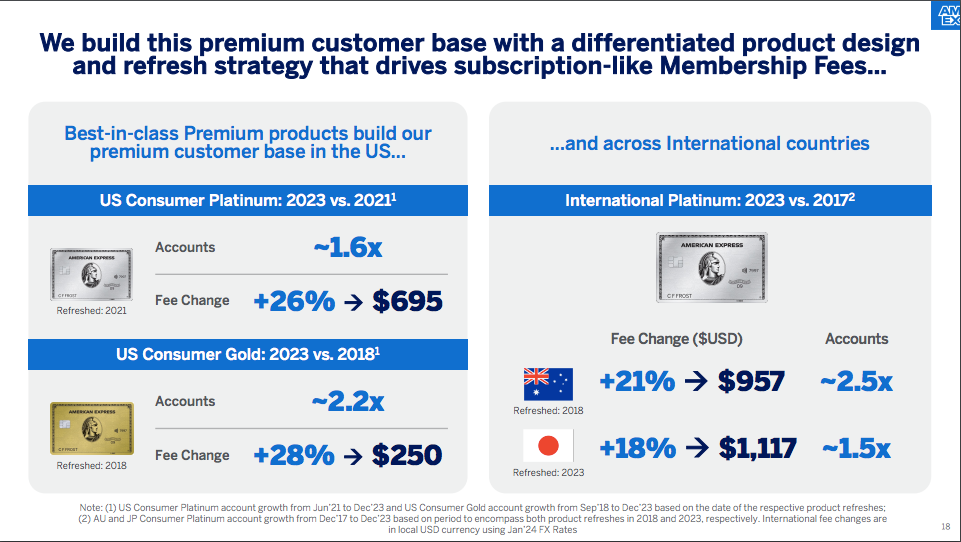

Most importantly to me as a 30+ year time horizon investor is the huge success AXP is experiencing with Millennial and Gen Z consumers. It was on the growth of this segment of customers that I began acquiring a core position in this business nearly two years ago. The data and commentary around this cohort only gets more intriguing as we go along. Here are some highlights:

>60% of all new card acquisitions from Millennial/Gen Z

75% of all new Gold and Platinum cards acquired by Millennial/Gen Z

2x faster spend growth versus Gen X/Boomer customer

~2x higher expected lifetime value versus acquiring Gen X/Boomer customer

Millennials and Gen Z are and will continue to be motivated by travel and experiences and no credit card company can speak this language better than AXP. As this cohort’s earnings increase over time so does their value for AXP. Not to mention the $50-$75 trillion of generational wealth being passed down to them over the next 30 years.

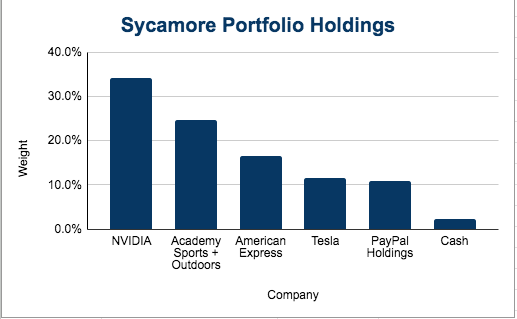

American Express continues to issue a robust number of new cards, majority of which are fee based and thus continues to see very healthy card fee growth. AXP published this slide in their Investor Day from April 30, 2024.

Millennials and Gen Z customers are not shy with paying annual card fees, are hungry for travel/experiences/dining out, and inheriting trillions, this tailwind has an extremely long runway. I am tracking these trends here: AXP Consumer Billed Business by Age Cohort/Proprietary Cards & Card Fees

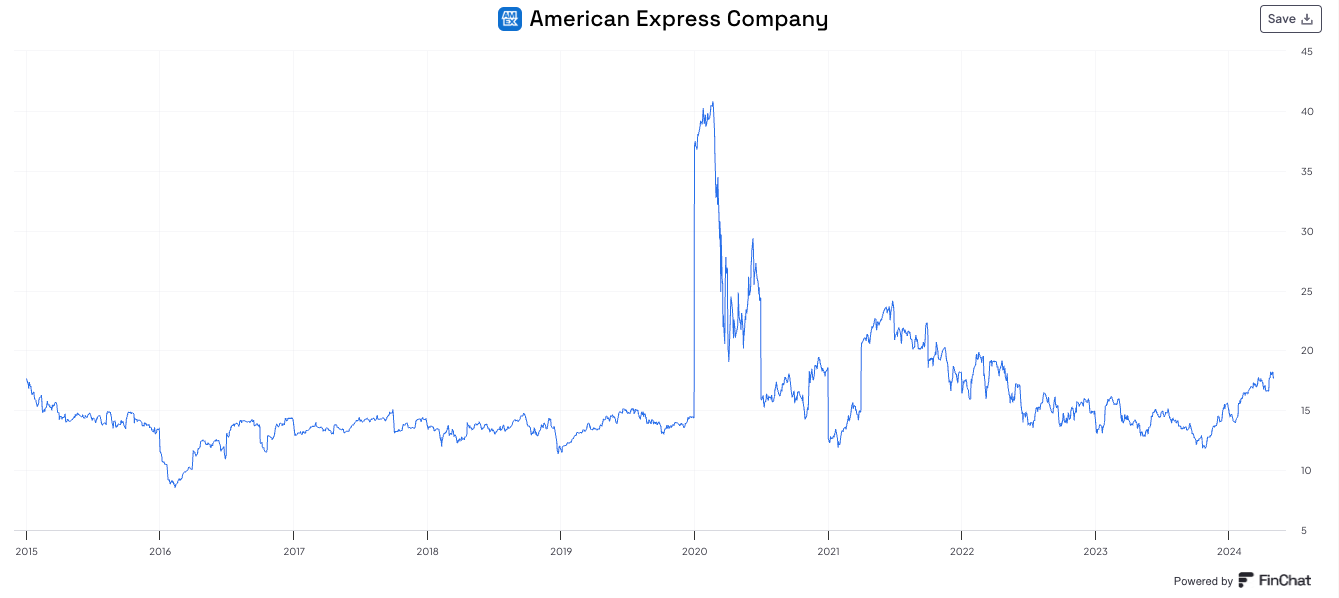

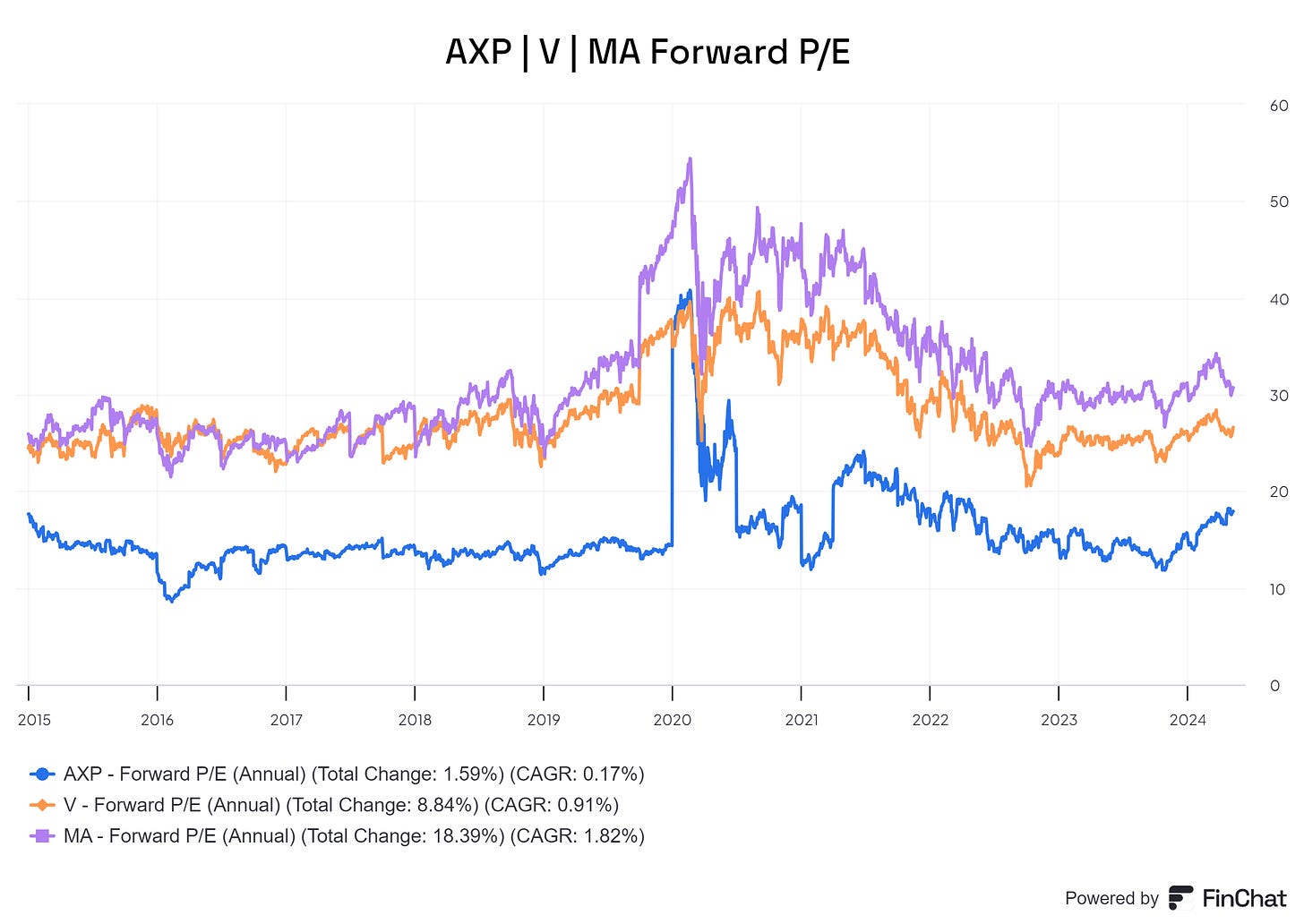

I would like to get AXP to a 20% position in the portfolio but may wait to see if we get a pullback. At close to 18x forward earnings, the price is about 10-15% higher than its 10-year historical average (ex-covid disruption). As a result, I’d prefer to see the stock back in the $200-$210 range to add to the position. However, the market is likely giving the stock a premium due to the following:

more premium customer/stronger credit quality than pre-pandemic

consistent 10% revenue and mid-teens EPS growth (just as management said they would accomplish)

younger cohort of customers

So, I’ll keep my eye on things and try to opportunistically add to my position.

This analysis really begs the following question: why am I rolling the dice on a hopeful turnaround at PayPal while AmEx and its management team is firing on all cylinders? Should I just be buying more of a top conviction pick that plays in similar markets…?

AXP Forward P/E Chart

Tesla: The Technology Company

“I mean we’re putting the actual auto in automobile.” - Elon

I bought Tesla in 2022/2023 after Musk bought Twitter and the stock sold off. The valuation was right (~21x) but I sold it after the stock doubled and it didn’t make sense anymore from a valuation perspective (~70x). I stand by that decision. It was also good timing because I sold at $240 /share and the stock has fallen as low as $140 since.

Nonetheless, I’ve bought it back and am hoping to build a core position.

But why now? What changed in my thinking?

On March 29, 2024 Tesla released FSD v12 to customers. FSD v12, in my opinion, exemplifies that Tesla is clearly a technology company (something I have always thought). FSD v12 is an Nvidia-powered AI model trained on over a billion miles of real-world video driving data and connected to an end-to-end neural network. The end result is that the car no longer self-drives like a computer, instead, the car self-drives like a human.

This framework for FSD is fundamentally different than the likes of Waymo and Cruz, who are using sensors and LIDAR to try and solve autonomy.

Highly recommend watching the Tesla FSD 12 segment from this BG2 podcast.

“If somebody doesn't believe Tesla is going to solve autonomy, I think they should not be an investor in the company.” - Elon, Q1 2024 earnings call

If you haven’t seen it yet, here is a random video I pulled from YouTube (there are tons of these all over the internet).

I believe the downstream effects of solving the autonomous question permeates everything that Tesla does and will drive the valuation of this business higher long into the future. The company will use this technology and scale it across a number of business opportunities, including:

Be the primary catalyst for increased demand for its cars (especially in new and cheaper “Model 2”, which should roll out in 2025)

Enable a fleet of Tesla Robotaxis to compete directly with Uber

Enable humanoid robots for commercial and retail utility

“He’s back to piloting the plane,” says Dan Ives from Wedbush speaking of Musk after the recent Q1 earnings call. Here are some Elon highlights from that call:

FSD

“Since the launch of full self-driving, supervised full self-driving, it's become very clear that the vision-based approach with end to end neural networks is the right solution for scalable autonomy. It's really how humans drive. Our entire road network is designed for biological neural nets and eyes. So naturally cameras and digital neural nets are the solution to our current road system.”

“The way to think of Tesla is almost entirely in terms of solving autonomy and being able to turn on that autonomy for a gigantic fleet. And I think it might be the biggest asset value appreciation in history when that day happens when you can do unsupervised full self-driving.”

“If you've not tried the FSD 12.3 … Then you really don't understand what's going on. It's not possible.”

“We’re in conversations with one major automaker regarding licensing FSD.”

“We do have some insight into how good the things will be in like, let's say, three or four months because we have advanced models that are far more capable than what is in the car, but have some issues with them that we need to fix. So…there'll be a step change improvement in the capabilities of the car, but it will have some quirks that are – that need to be addressed in order to release it. As Ashok was saying, we have to be very careful in what we release the fleet or to customers in general. So like – if we look at say 12.4 and 12.5, which are really could arguably even be Version 13, Version 14 because it's pretty close to a total retrain of the neural nets in each case are substantially different. So we have good insight into where the model is, how well the car will perform, in, say, three or four months.”

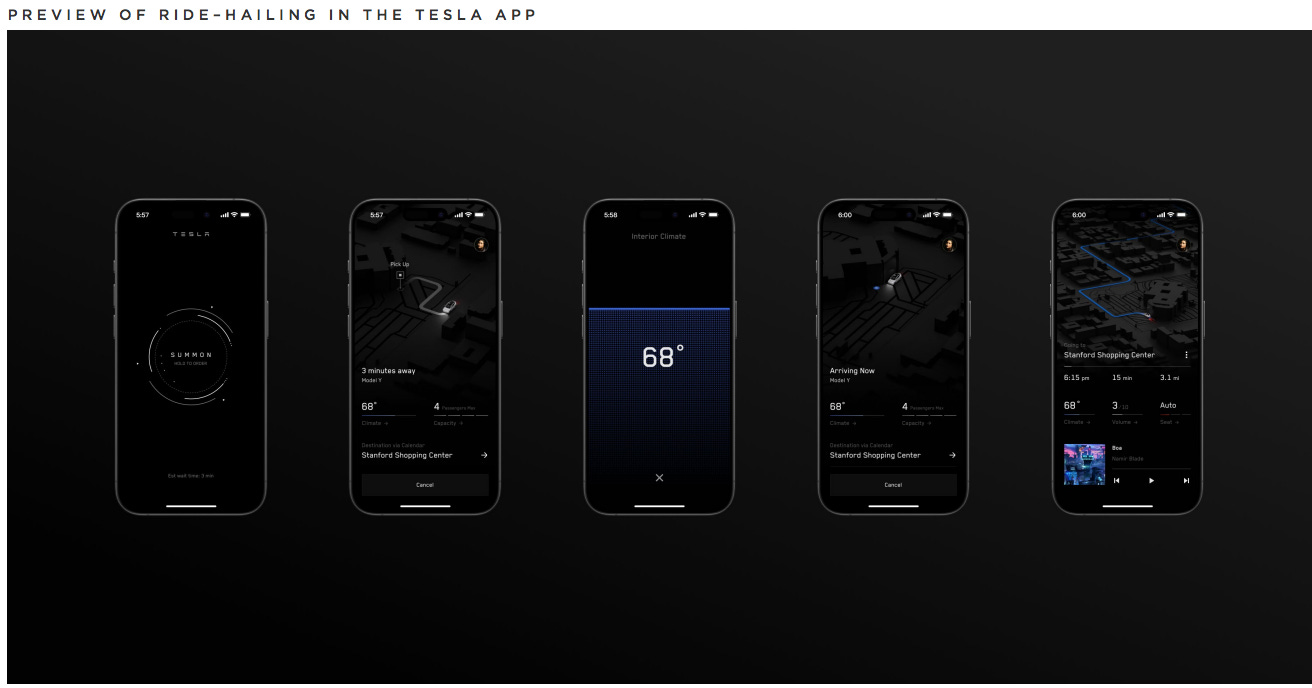

This three to four month projection coincides with Tesla’s Robotaxi/Cybercab event scheduled for August 8th. They previewed what the app will look like in the earnings slide deck here.

Robotaxi/Cybercab

“Something I should clarify is that Tesla will be operating the fleet. So you can think of like how Tesla, think of it like some combination of Airbnb and Uber, meaning that there will be some number of cars that Tesla owns itself and operates in the fleet. There will be some number of cars and then there'll be a bunch of cars where they're owned by the end user. That end user can add or subtract their car to the fleet whenever they want, and they can decide if they want to only let the car be used by friends and family or only by 5-star users or by anyone at any time they could have the car come back to them and be exclusively theirs, like an Airbnb. You could rent out your guest room or not, any time you want. So as our fleet grows, we have 7 million cars going to – 9 million cars going to, eventually tens of millions of cars worldwide.”

Optimus

“If you've got a sentient humanoid robot that is able to navigate reality and do tasks at request, there is no meaningful limit to the size of the economy. So that's what is going to happen. And I think Tesla is best positioned of any humanoid robot maker to be able to reach volume production with efficient inference on the robot itself. I mean this perhaps is a point that is worth emphasizing, Tesla's AI inference efficiency is vastly better than any other company. There is no company even close to the inference efficiency of Tesla. We've had to do that because we were constrained by the inference hardware in the car, we didn't have a choice. But that will pay dividends in many ways.”

Here is a really good and in depth take on Tesla with emphasis on humanoid robots:

Shoutout to my #1, Nvidia <3

“But anyway roughly 35,000 H100s are active, and we expect that to be probably 85,000 or thereabouts by the end of this year.”

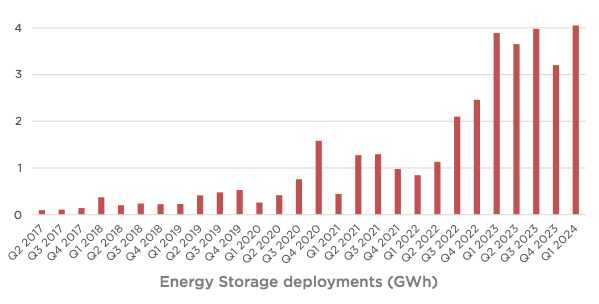

Energy Generation and Storage

By the way, almost no one is talking about Tesla’s energy generation and storage business. This business is growing very well, is the company’s most profitable business, and can continue to grow for a very very long time.

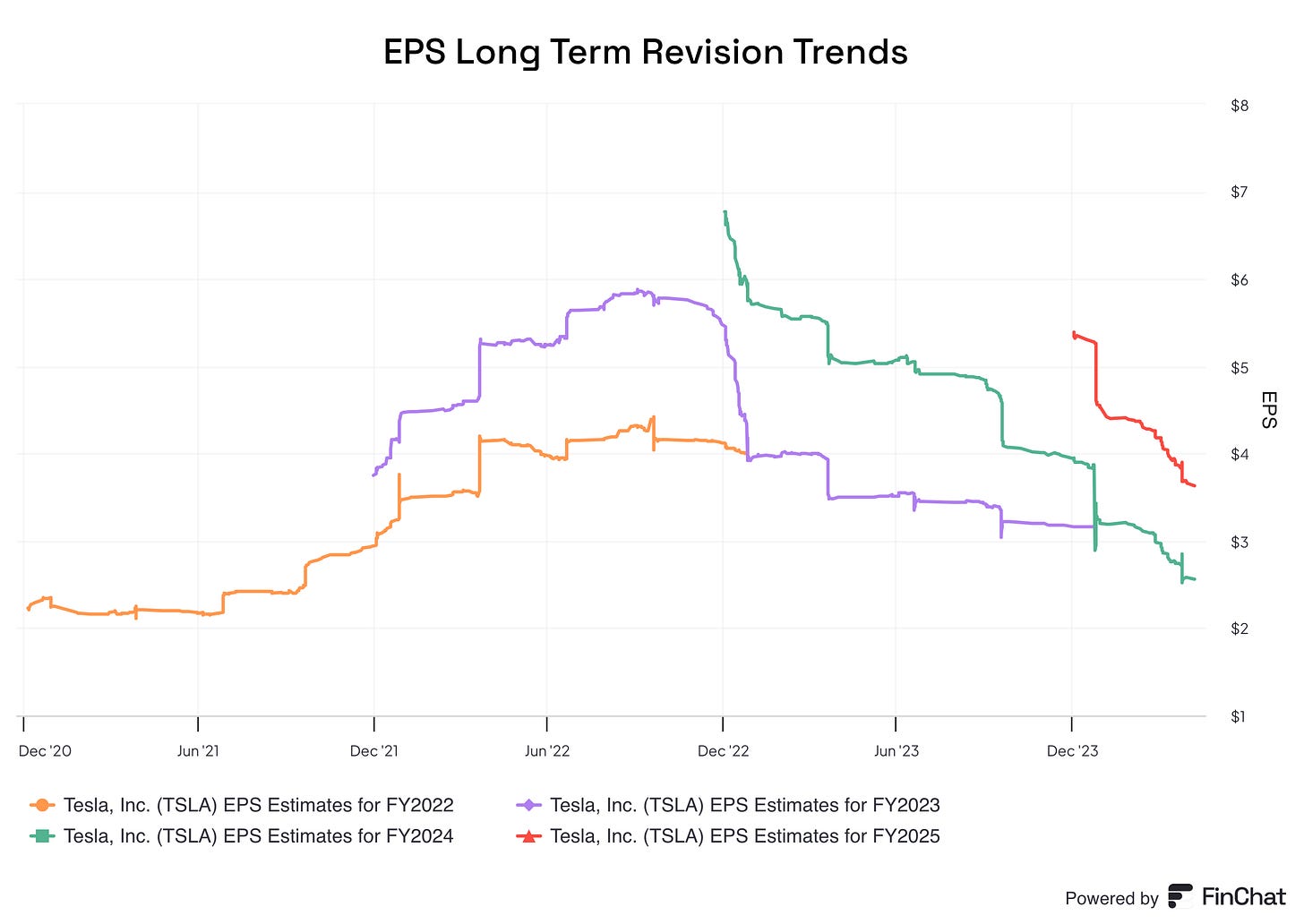

The stock is expensive (~62x) and the only way you can own it here is if you believe this is a technology company. I believe it is and I that Tesla has its hands in at least four opportunities that have asymmetric upside. The forward P/E has also been driven significantly higher as earnings estimates have come down precipitously over the past 18 months. See chart here (green line)…

Lastly, I recently went to my local Tesla showroom (the place was packed!) and demo’d a Model 3 and FSD v12. It was incredible. I tried to have an unbiased mindset, but when the car takes over you can’t help but feel like this is absolutely the future. My six-year old son, Hosea, was floored. He kept asking who was driving the car. He even made comments putting down our “stupid minivan.” When it was time for him to choose his favorite, he went with the obvious and ultra-beautiful…Cybertruck… I told him I would stick with the Model S Plaid.