The Trade Desk Q1 2025 Earnings Recap | Winning in an Unfair Market

+54% over past month, overview of Q1, objectivity superpower, business highlights, valuation, charts and extras

“As we've said before, if we can win share in an unfair market against the biggest tech players in the world, as we have over the last 15 years, imagine what we can do in a fair market.”

Jeff Green, CEO

TTD 0.00%↑ has quickly become the largest position in the Sycamore portfolio as of this writing on May 20. One, due to the heavy concentration I put on while the stock was extremely out-of-favor. And two, because of the stocks significant outperformance over the past month (+54% since April 17).

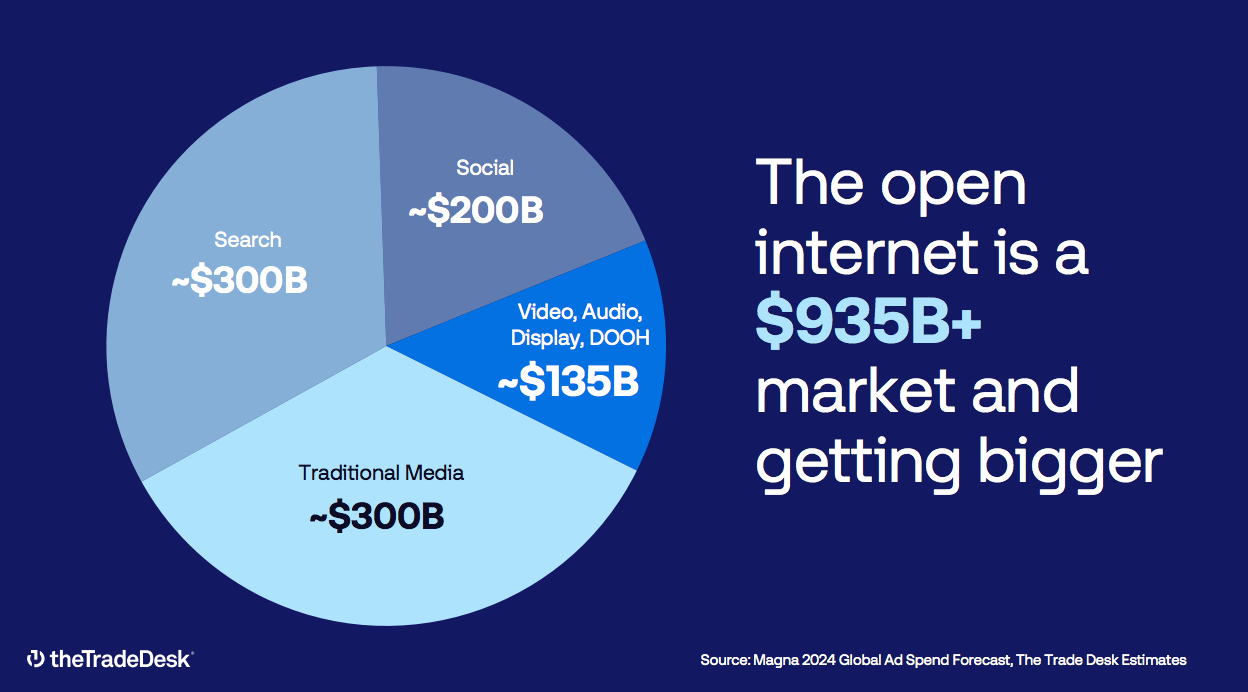

As I’ve mentioned, this is a great business that is run by a visionary founder and operating in a gigantic market with significant opportunity for further upside down the road.

Overview of Q1 2025 Performance

The Trade Desk reported strong first-quarter results, marking a solid rebound after a softer Q4. Revenue grew 25% Y/Y to $616 million, exceeding both company guidance and analyst expectations. Net income also rose sharply, up 59% to $51 million, as the company expanded margins and drove higher profitability.

According to CEO Jeff Green, the outperformance was driven in part by strategic platform upgrades launched in late 2024, most notably continued adoption of Kokai. Despite a cautious advertising environment earlier in the year, management noted that major marketers are increasingly shifting budgets to the open internet, a trend that plays directly to The Trade Desk’s strength in objective, data-driven media buying.

Objectivity is our Superpower

During The Trade Desk’s Q1 2025 earnings call, CEO Jeff Green underscored objectivity as the company’s defining advantage in the digital advertising ecosystem. He drew a sharp contrast between The Trade Desk’s transparent, open internet model and the “walled gardens” of competitors like Google and Amazon, which often act as both player and referee.

“We have been winning in an unfair market. We're even more confident we can win in a fair market.”

Jeff Green, CEO

Green pointed to recent regulatory scrutiny, particularly antitrust rulings against Google, as a major turning point that is creating new opportunities for neutral platforms like The Trade Desk.

“Google has been declared an illegal monopoly in two separate instances in 2025 by the US courts... The net effect of these changes is a healthier ecosystem and a thriving open internet.”

Jeff Green, CEO

He emphasized that while Amazon’s DSP largely serves its own ecosystem (such as Prime Video), The Trade Desk is purpose-built to optimize across the entire open internet. “Objectivity is our superpower,” he said, arguing that advertisers increasingly value independence and transparency in their media buying platforms.

“I believe it's imperative that Google relinquished some of the roles that they currently play in the marketplace. Doing so will significantly improve competition, transparency and fairness in the ad market for all participants. I continue to believe that Google will stop trying to monetize the open internet and instead focus more on their destinations. I expect that Amazon will continue on the same path. DV360 is primarily technology to buy YouTube. Amazon's DSP is primarily a product built to buy Amazon's Prime Video.”

Jeff Green, CEO

With major marketers shifting more spend away from closed platforms and toward data-driven, omnichannel solutions, Green expressed optimism about The Trade Desk’s competitive positioning. He framed the company not just as a technology leader but as a principled alternative in an industry often dominated by self-interested incumbents.

“I want to share something that we put in The Trade Desk business plan 16 years ago before we'd written even a single line of code. We argued to potential investors then that at end state, there will be 10 or less scaled DSPs. We think most of them will be conflicted. We thought then that most DSPs would compromise their objectivity with buyers in order to promote their own content. Walled gardens biased their own content at the expense of media buyers who look to seek value and performance across the entire ecosystem. The walled garden business models are inherently flawed because over the long term, their fiduciary duty to grow for shareholders is at odds with what is in the best interest of the agencies and advertisers which is to objectively buy media from all over a competitive, massively scaled digital media landscape where no single company can possibly own all of the good media. The Trade Desk is pointed at the entire open Internet, and nearly all of global advertising will be transacted programmatically at end state. We are convinced that based on the current landscape and current competitive set, we are the best positioned to win the lion's share of market share at end state.”

Jeff Green, CEO

Business & Segment Highlights

The Trade Desk’s growth in Q1 2025 was led by continued momentum in Connected TV (CTV), which remains the company’s largest and fastest-growing channel. The platform now reaches over 90 million CTV households and more than 120 million devices. CTV accounted for a substantial share of ad spend in Q1 and was a key driver of the 25% Y/Y revenue increase.

Mobile advertising, including in-app, video, and mobile web formats, also contributed meaningfully to performance. Growth was broad-based across formats, supported by the company’s focus on programmatic advertising.

“CTV is the kingpin of the open Internet. And the open Internet is where all of the most beloved content of the Internet exists. The open Internet monetizes movies, television, journalism, music and sports.”

Jeff Green, CEO

Geographically, North America remains the largest region for The Trade Desk, but management emphasized growing international opportunity. Currently, only 12% of platform ad spend comes from international markets, while approximately 60% of global ad spend occurs outside North America. Closing this gap remains a long-term strategic priority.

Customer retention stayed above 95% in Q1, a level the company has maintained for over a decade. This metric reflects the portion of last year’s client spend that remained active on the platform, underscoring strong advertiser satisfaction.

Retail Media continues to emerge as a high-potential growth segment. The Trade Desk has formed partnerships with major retailers including Walmart, Target, and Albertsons to integrate shopper data into its platform. These relationships allow advertisers to leverage first-party purchase data to improve targeting across channels like CTV and display.

"We continue to grow at a rate significantly higher than the broad digital marketing industry and gain market share."

Jeff Green, CEO

Strategic Initiatives

Unified ID 2.0 (UID2): Adoption continued to grow in Q1, with new integrations from ad tech firm Perion and publishers such as Toyo Keizai (Japan) and Piemme (Italy). UID2 is The Trade Desk’s open-source identity framework built to replace third-party cookies.

OpenPath: Direct inventory access expanded, with Warner Bros. Discovery and The Guardian joining in Q1. NY Post, an early OpenPath partner, reported an 8.6x increase in programmatic fill rate and a 97% boost in web display revenue after one year.

Kokai platform rollout: Kokai is a major platform upgrade featuring advanced AI and automation tools. Initial rollout began in late 2024, with full client migration expected in 2025. Management noted early signs of improved campaign performance tied to Kokai adoption.

Sincera acquisition: The Trade Desk completed its acquisition of Sincera, a digital advertising analytics firm. Though not contributing revenue in Q1, Sincera enhances transparency and measurement tools. The company also introduced OpenSincera, a new product to help advertisers assess inventory quality and ROI.

Valuation

The Trade Desk remains expensive on an absolute basis, but for good reason. It’s a premium asset with durable advantages, including objectivity, omnichannel reach, and deep customer relationships. Yet the stock is trading near the bottom of its historical valuation range.

With structural tailwinds in programmatic advertising, rising CTV adoption, and increasing regulatory pressure on Google’s ad tech monopoly, TTD is well-positioned to benefit from a more open and competitive market. Its strong margin profile and fortress balance sheet, along with a top-tier management team and continued product innovation reinforce its leadership. In my view, the stock deserves to trade closer to the top of its historical range, not the bottom.