Uber Q1 2025 Earnings Recap | Engagement and Frequency

Financial highlights, margin profile and cash flow, delivery segment spotlight, AV update, capital allocation and balance sheet strength, and charts/extras

UBER 0.00%↑ delivered a strong first quarter, typically its slowest of the year. The performance was all the more notable given ongoing macro uncertainty. Shares have climbed to all-time highs above $90 as of my writing on May 13. Uber remains a core holding in the Sycamore portfolio.

“Our retention rates are at or near all-time highs globally, once again showcasing the strength of the Uber consumer and just how essential our products have become to people's everyday lives.”

Dara Khosrowshahi, CEO

Financial Highlights & Operating Metrics

Uber entered 2025 with strong momentum, delivering another quarter of profitable growth at scale. CEO Dara Khosrowshahi emphasized the company’s improving user retention and platform efficiency, as trip volume rose 18% year-over-year (Y/Y) to 3.0 billion. Gross Bookings reached $42.8 billion, up 14% Y/Y (18% in constant currency), while revenue increased 14% to $11.5 billion.

Most notably, Uber posted a GAAP net income of $1.8 billion — a sharp turnaround from the $0.65 billion loss in Q1 2024. Adjusted EBITDA rose 35% Y/Y to $1.9 billion, with EBITDA margin expanding to 4.4% of Gross Bookings, up from 3.7% a year earlier. Operating income grew to $1.2 billion, reflecting a $1.1 billion year-over-year improvement. Monthly Active Platform Consumers also rose to 170 million, up 14% Y/Y.

Quick Summary:

Trips: 3.0 billion, +18% Y/Y

Gross Bookings: $42.8 billion, +14% Y/Y (18% in constant currency)

Revenue: $11.5 billion, +14% Y/Y

GAAP Net Income: $1.8 billion (vs. $0.65 billion loss in Q1 2024)

Adjusted EBITDA: $1.9 billion, +35% Y/Y

EBITDA Margin: 4.4% of Gross Bookings (up from 3.7%)

Operating Income: $1.2 billion (+$1.1 billion Y/Y)

Monthly Active Platform Consumers: 170 million, +14% Y/Y

Uber One Members: 30 million (members spend 3x more than non-members)

“Our audience grew 14% to 170 million monthly active consumers. Engagement strength continued with trips up 18% and with retention rates hitting all-time highs globally, and gross bookings grew in-line with trips, fueled by strength across both mobility and delivery. We see this as robust, healthy growth. Growth that’s coming from engagement and frequency, not just price.”

Dara Khosrowshahi, CEO

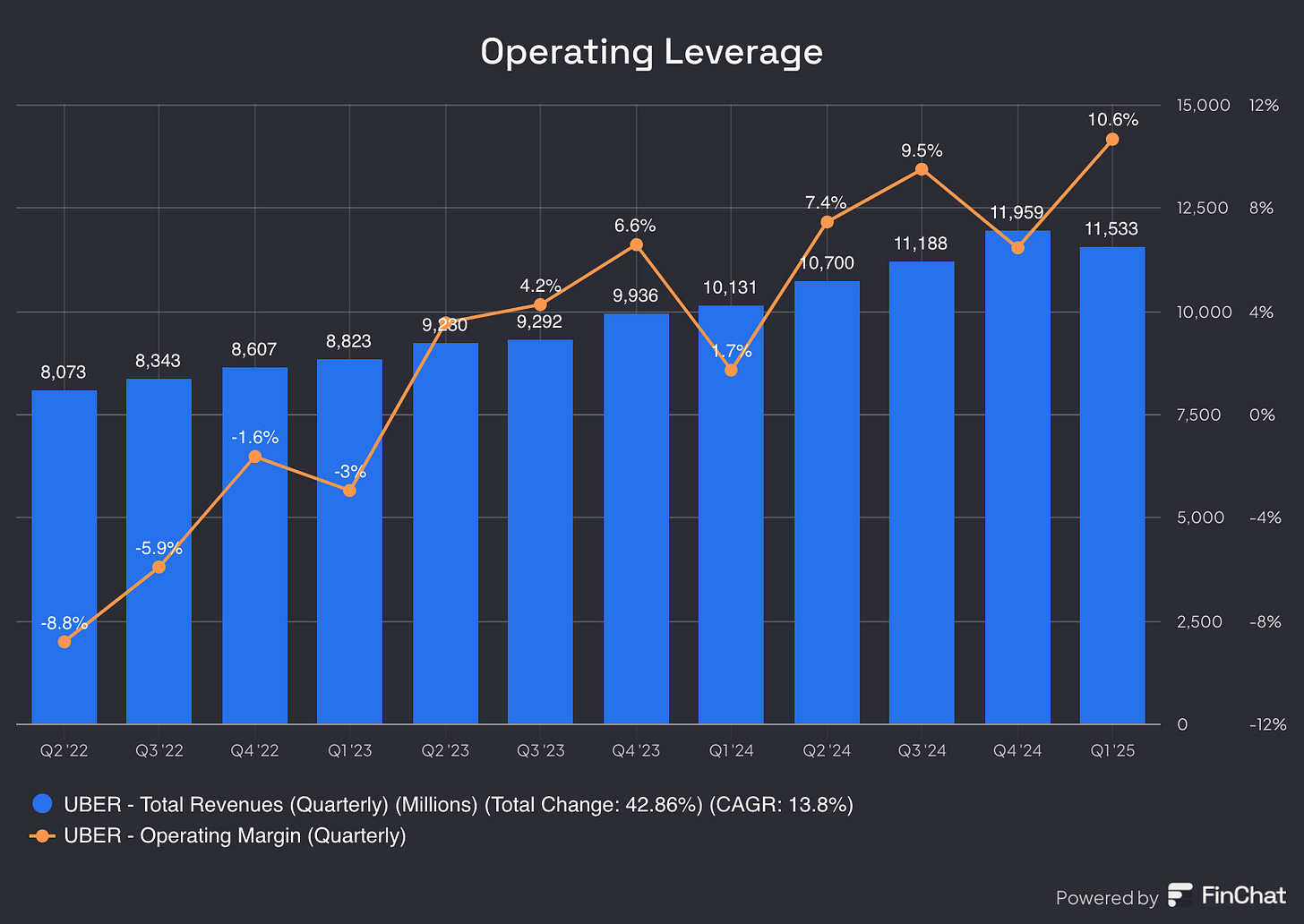

Margin Profile and Cash Flow

Uber's Q1 2025 results highlight significant improvements across core profitability metrics, reflecting disciplined execution and operational efficiency.

Operating Margin: Operating income reached $1.2 billion, resulting in an operating margin of about 10.6% based on revenue. This marks a substantial improvement from the prior year.

Net Profit Margin: With net income of $1.8 billion, Uber achieved a net profit margin of approximately 15.4%, a sharp turnaround from its Q1 2024 net loss.

Adjusted EBITDA Margin: Adjusted EBITDA rose 35% Y/Y to $1.9 billion, representing 4.4% of Gross Bookings, up from 3.7% in Q1 2024.

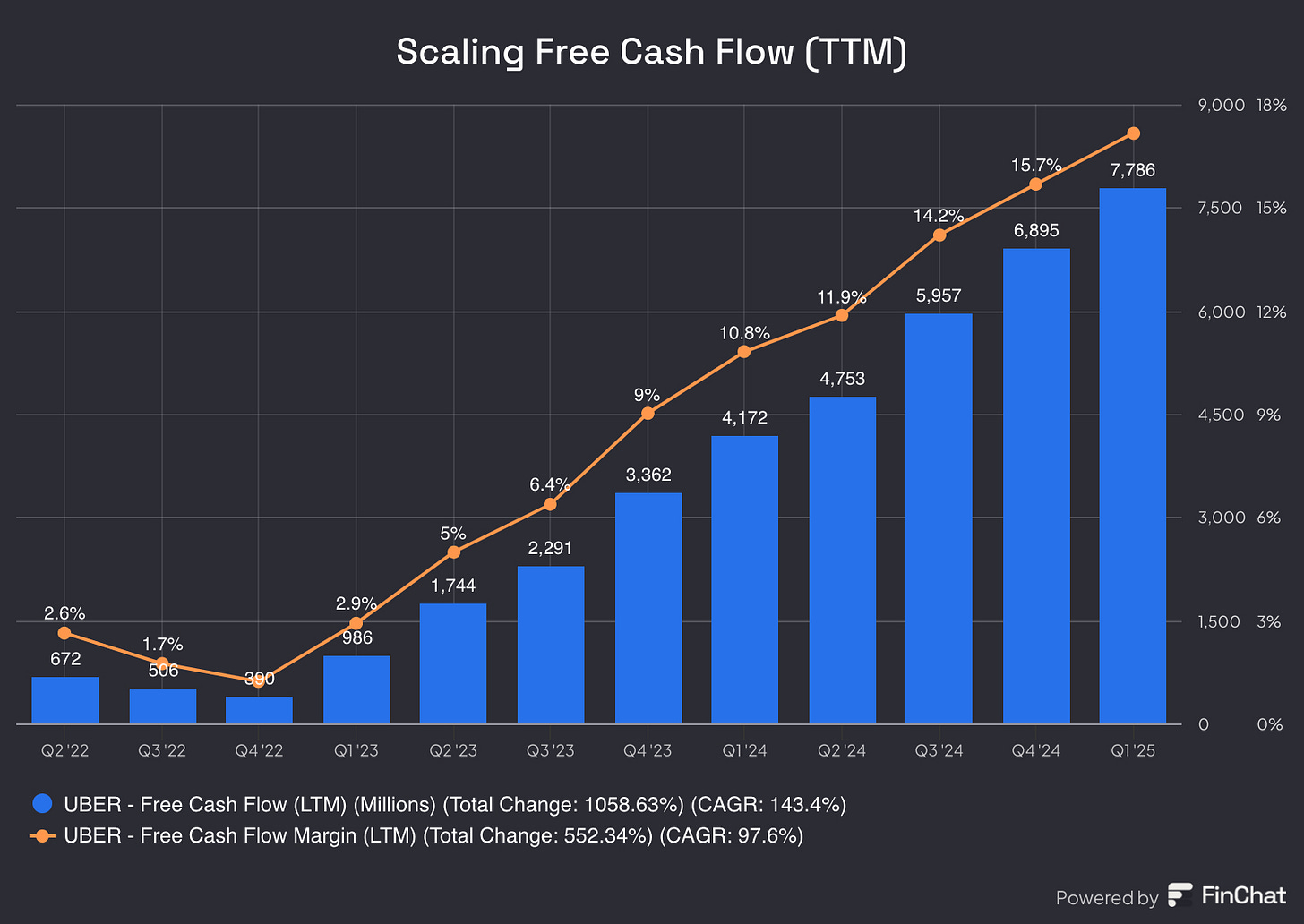

Free Cash Flow (FCF) Margin: Uber generated $2.3 billion in free cash flow during the quarter, equating to a free cash flow margin of 19.5%.

CFO Prashanth Mahendra-Rajah called this “industry-leading cash flow growth,” noting multiple levers to sustain high conversion rates. Looking ahead, Uber expects Gross Bookings of $45.75 to $47.25 billion and Adjusted EBITDA of $2.02 to $2.12 billion in Q2 2025, implying further margin expansion and a continuation of profitable growth at scale.

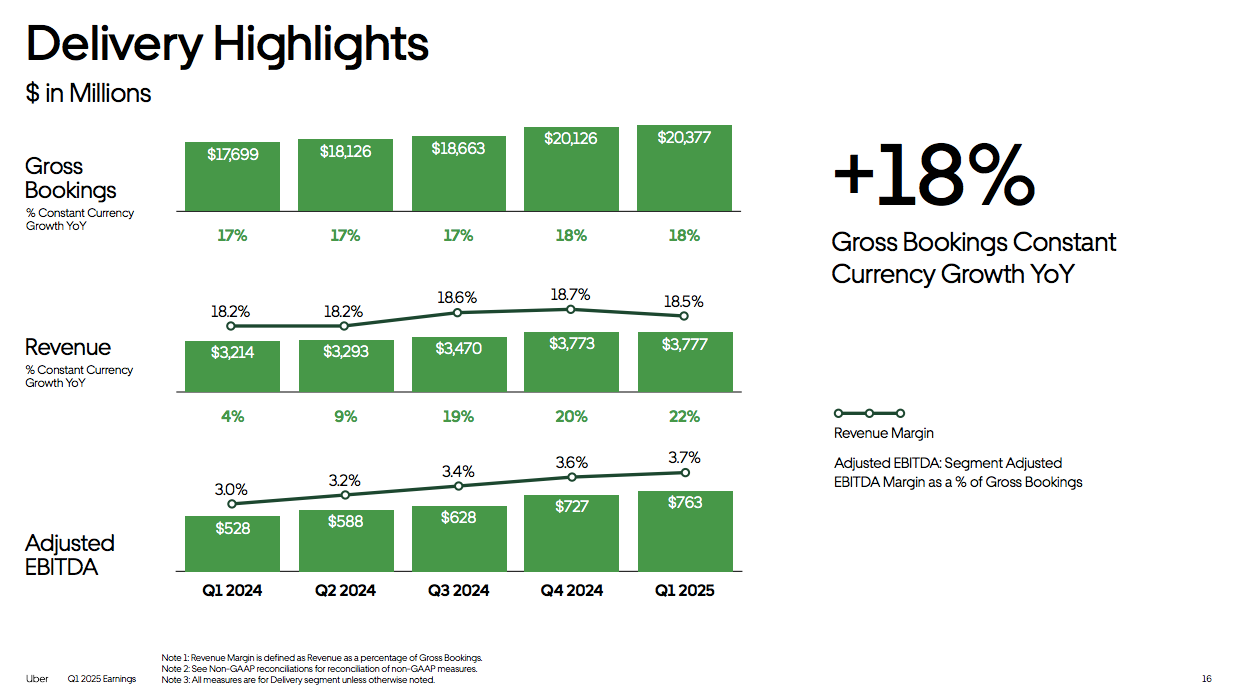

Delivery Segment: Profitable and Expanding

Once a heavily subsidized business, Uber’s Delivery segment has become a key profit engine. In Q1:

Gross Bookings: $20.4 billion, +15% Y/Y

Revenue: $3.78 billion, +18% Y/Y

Adjusted EBITDA: $763 million, +45% Y/Y

EBITDA margin: ~3.7% of Delivery Gross Bookings

Management described the segment as “under-appreciated,” noting its profit margins are now only modestly lower than UberX. Organic growth was driven by increased order volume (+15% Y/Y), subscriber growth, and expansion beyond restaurant delivery.

“I will call out one item that may not be notable to everyone is incremental margins for delivery in Q1 were 9%. So with that very strong top-line growth, it’s a reflection of what the earnings power of this business can be with continuing to see that opportunity to drive margin expansion.”

Prashanth Mahendra-Rajah, CFO

Key growth drivers:

Uber One: Membership continues to “turbocharge” loyalty, now accounting for ~60% of Delivery Gross Bookings in top markets. It’s Uber’s highest ROI lever for retention and spend. Monthly trips per active Uber One member increased by 3% Y/Y to 6.0.

Cross-platform synergy: Nearly one-third of new Eats customers came from the Uber Rides app.

Grocery & Retail (G&R): Gross Bookings from non-restaurant categories are now running at a $10 billion annualized rate. New partners include The Home Depot, Petco, FreshDirect, and 1-800-Flowers.

Ads and monetization: Uber’s in-app advertising business surpassed a $1.5 billion run-rate, growing over 60% Y/Y. Sponsored listings and brand placements are now contributing ~2% of Delivery Gross Bookings.

The segment’s efficiency improvements across logistics, matching, and scale have unlocked close to $3 billion in annualized EBITDA since breakeven. And with only ~18% of delivery users ordering G&R each month, Uber sees significant runway ahead.

Personally, I would agree with this assumption as Grocery is a much stickier and recurring use category than restaurant/dining delivery.

Autonomous Vehicle Partnership Announcements and Waymo in Austin

Uber’s AV team continues to fire on all cylinders. In just the past few weeks, it announced five new or expanded AV partnerships.

Partnership announcements include:

Volkswagen: Partnering with Uber to test all-electric, autonomous ID. Buzz vehicles in Los Angeles later this year, with commercial rollout expected in 2026 via Volkswagen’s mobility brand, MOIA.

May Mobility: Formed a multi-year partnership with Uber to deploy thousands of AVs, starting in Arlington, Texas by the end of 2025, with plans to expand to other U.S. cities in 2026.

WeRide: Expanding its partnership with Uber to deploy AVs in 15+ cities globally over the next five years, including targeted expansion across Europe.

Pony.ai: Set to launch robotaxi operations with Uber in a key Middle Eastern market in 2025, with broader international expansion planned thereafter.

Momenta: Entered into a strategic agreement with Uber to launch AVs in Europe beginning in 2026, starting with safety operators onboard before transitioning to full autonomy.

Waymo, however, remains the crown jewel of Uber’s AV ambitions. In March, Uber launched Waymo’s autonomous ride-hailing service in Austin. The rollout has exceeded expectations:

Waymo now operates ~100 robo-taxis in Austin

These vehicles complete more daily trips than 99% of human drivers on Uber’s platform in the city

Given the strong rider demand, Uber plans to expand the Waymo fleet to “hundreds” in Austin and will soon roll out service in Atlanta, where riders can already join a waitlist.

“We’re laser-focused on bringing more [AV] partners and more AVs, in more places, onto the Uber platform.”

Dara Khosrowshahi, CEO

As I have called out a number of times, a fragmented AV market plays right into Uber’s hand as the ultimate demand aggregator. The more players with real technology in this space, the better.

“There are a lot of other players that are showing incredible promise as well. We announced a partnership with May Mobility, with VW, with Momenta as well, where we expect to see an AV development deployment in Europe as well and Avride. So this is a technology that has been proven. Waymo is definitely the leader there, but there are many other players investing in the space, and we expect to see a number of successful companies in the space.”

Dara Khosrowshahi, CEO

Capital Allocation and Balance Sheet

Uber’s capital allocation remains disciplined, balancing reinvestment with shareholder returns while maintaining an investment-grade profile.

Q1 capital position:

Unrestricted cash and short-term investments: $6.0 billion

Equity stakes in public and private companies: $8.7 billion

Long-term debt: ~$8.3 billion

Free cash flow (Q1): $2.3 billion

Free cash flow (TTM): $7.8 billion

Uber completed a $1.5 billion accelerated share repurchase and bought back $1.8 billion in total during Q1, leaving $4 billion of capacity on its existing $7 billion buyback authorization. The CFO noted that Uber expects to remain “active and opportunistic” in repurchasing shares and is “on track to steadily reduce our share count.”

In addition to buybacks, Uber announced a $700 million deal to acquire a controlling stake in Trendyol Go, a leading Turkish delivery business with ~$2 billion in annual Gross Bookings. The deal accelerates Uber’s growth in a key international market.

With rising margins, strong free cash flow generation, and ample liquidity, Uber appears well positioned to compound value while selectively expanding its global footprint without sacrificing balance sheet strength.