Welcome to Sycamore Capital

Welcome to Sycamore Capital, a publication dedicated to sharing my journey in the world of investing. Here, I believe that investing is not just about buying stocks—it's about owning a piece of a business. This fundamental idea of ownership drives every decision I make.

Purpose of Sycamore Capital

The purpose of this blog is to provide myself a platform to publish my ideas and hold myself accountable for my investment decisions. There are two main themes you will find here:

Qualitative Equity Research: In-depth analysis and insights into the businesses I choose to invest in.

Concentrated Portfolio Management: Strategies and decisions behind managing a focused portfolio aimed at maximizing returns.

Please note that this is not investment advice, nor is it intended for personal finance or investing education. It’s a personal journal of my investment strategy.

The Importance of Ownership

Ownership in a business is a cornerstone of my investment philosophy. In today's market, the art of truly owning a business has become lost amidst the widespread adoption of indexing. While index funds offer diversification and lower costs, they often disconnect investors from the underlying businesses they hold. True ownership involves understanding and believing in the long-term potential of the companies in which you invest.

Investing with an ownership mindset means:

Conducting thorough qualitative equity research to understand the business, its management, and its competitive advantages.

Engaging with a concentrated portfolio to maintain a strong connection to each investment.

Thinking like an owner, not a trader, which fosters patience and a focus on long-term value creation.

Why Concentrated Investing?

I manage a concentrated portfolio because I believe it’s the best way to potentially outperform the market over time. History has shown that the greatest investors of all time were and are concentrated investors. Here are a few quotes from renowned investors that reflect this philosophy:

Warren Buffett: “Diversification is a protection against ignorance. It makes little sense if you know what you are doing.”

Stanley Druckenmiller: "I think diversification and all the stuff they're teaching at business school today is probably the most misguided concept everywhere." // “If you really see it, put all your eggs in one basket and then watch the basket very carefully.”

Bruce Berkowitz: "You only need a few good ideas in a lifetime to make it big in this business."

Bill Ackman: "If you have an investment you think is a very high probability of being successful, why would you want to dilute it by diversifying into a lot of other mediocre investments?"

Lou Simpson: "The way to maximize outcome is to concentrate. And that’s true not only in investing, it’s true in all facets of life."

This philosophy is at the core of Sycamore Capital.

About the Sycamore Portfolio

The Sycamore Portfolio is composed entirely of my own money. I do not manage client assets, ensuring that every decision I make is solely for my personal financial growth and learning.

Historical Returns

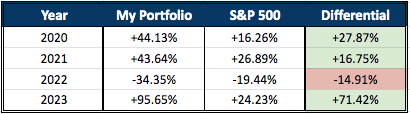

Here is a summary of my historical returns since I began formal tracking in 2020.

Cumulative total return since 2020 of +149.07%, outperforming the S&P 500 by 101.13%.

Subscribe and Follow Along

If you're interested in following my journey, subscribe to Sycamore Capital. I post once per month about everything I have been working on for that month, which may include: portfolio results, transactions, ongoing analysis of holdings, individual stock deep dives, unique business KPI updates, and more.

Join me as I navigate the complexities of the market, make investment decisions, and learn from both successes and mistakes.

Thank you for visiting Sycamore Capital. Let's embark on this journey together.

Sycamore Capital is not investment advice nor a recommendation to buy, sell, or hold securities. Sycamore Capital is not an investment advisor and does not manage client assets. Opinions are my own.