A Superlative Example | Sycamore Portfolio Update [October 2024]

Portfolio changes and returns, introducing Sycamore Wire, still defensive?, big month at S...again, AXP earnings/updates, and "UBER: A Superlative Example"

“A light bulb turned on when I realized the investors I admire the most (and this admiration comes only in part from the amazing success they've achieved) tend to share one characteristic: They are concentrated…investors.”

Allen C. Benello, Author of Concentrated Investing

Monthly Returns

Sycamore Capital Portfolio // +2.94%

S&P 500 // -0.99%

Differential // +3.93%

Year-to-date Returns

Sycamore Capital Portfolio // +60.32%

S&P 500 // +19.62

Differential // +40.70%

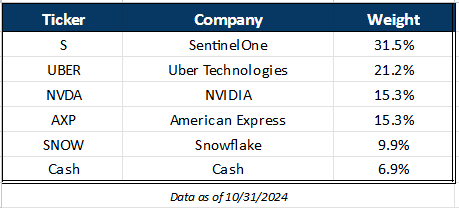

Current Holdings

Transactions in October

Decreased AXP 0.00%↑ by 19.8% @ $270 /sh

Decreased SNOW 0.00%↑ by 32.6% @ $115 /sh

Initiated UBER 0.00%↑ with 21.2% position @ $74 /sh

First Thoughts

Publication Growth

The Sycamore community grew significantly in October, with a 450.8% m/m increase (following 148.2% growth in September!). Welcome to all new subscribers!

Sycamore is not formal investment advice, but I hope my research and strategy offer value for your own investing approach.

Outperformance in October

Outperformance for the Sycamore portfolio in October of +3.93% was driven by SentinelOne +7.82% and NVIDIA +9.32%. American Express and Snowflake outperformed the index in October but were -0.41% and -0.03%, respectively.

I trimmed American Express (too soon) in October on valuation and Snowflake (too soon) to raise additional cash.

Launch of Sycamore Wire

In October I launched a new series for subscribers called Sycamore Wire. The purpose is to share the top PR, news stories, blogs, interviews, analyst insights, and more on Sycamore’s portfolio companies.

If you’re going to be a concentrated investor you have to know what you own. This simple bi-monthly series allows me to share with you everything going on with Sycamore’s portfolio companies.

In the first month, Sycamore Wire has generated great traction!

If you missed them, you can find them here:

“Getting More Defensive…”

I was and still am feeling defensive as we head into year-end (although the market is loving a Trump White House as I write at 6am on November 11). If you remember from last month I mentioned a number of reasons why. You can read about that here:

Of the five reasons I cited, the most important is that I didn’t find anything in the market compelling enough to warrant a large position.

While the S&P 500 ended its five-month winning streak in October, it was a relatively calm pre-election month. Still, a key watchlist stock fell by as much as 13% in a single day, prompting me to deploy the majority of Sycamore’s cash reserves.

For me, being defensive means having cash ready for compelling opportunities. Heading into Q4, this meant building a 20% cash position while staying 80% net long across just four names, with no hedges in place. As a result, I outperformed the index by nearly 4% and was able to take advantage of what I see as an excellent buying opportunity in shares of Uber. More on Uber below.

Big Month at SentinelOne…Again

SentinelOne, S 0.00%↑ was awarded the CyberScoop 50 Innovation of the Year award for the innovation and efficacy of Purple AI (source).

“Purple AI translates natural language security questions into structured queries, summarizes event logs and indicators, guides analysts of all levels through complex investigations and scales collaboration with shared investigation notebooks.” - SentinelOne Press Release

You’ll remember that on their recent earnings call, management noted that Purple AI has already achieved double digit attach rates within the first few months of its general availability. Very strong when you think about it.

Additionally, in October, SentinelOne held their annual partner and customer conference in Las Vegas. They shared information on the following partnership expansions and innovations:

AWS Partnership Expansion - to enhance AI-driven cybersecurity solutions by integrating its Purple AI with Amazon Bedrock and increasing investments in its Singularity Platform on AWS Marketplace.

Introduced Singularity Hyperautomation - a no-code platform with over 100 integrations to streamline security workflows and automate responses.

Launch of Singularity AI SIEM - a cloud-native, AI-driven SIEM that processes real-time data to accelerate security response times and broaden visibility across systems.

Enhancements to Purple AI - including Auto-Alert Triage and Auto-Investigations, unveiled to reduce alert fatigue and speed up response.

Introduced Ultraviolet Family of Security Models - family of large language and multimodal models to enhance cybersecurity detection and reasoning capabilities.

In case you missed it, the company also held an analyst session at the conference. I did a deep dive into those presentations and that can be found here. Lots of good stuff in here on a company executing extremely well and very well-positioned for further growth.

American Express Earnings, Growth, and Gold Refresh

In its third-quarter earnings report released on October 18, 2024, American Express reported:

Earnings Per Share (EPS): $3.49, a 6% increase from $3.30 in the same quarter last year, surpassing analysts' expectations of $3.27.

Revenue: $16.64 billion, marking an 8% year-over-year rise, though slightly below the anticipated $16.67 billion.

Net Income: $2.51 billion, up from $2.45 billion in the previous year.

Card Member Spending: Increased by 6% to $387.3 billion, indicating robust consumer activity.

Card Fee Revenue: Grew by 18%, reflecting strong demand for premium card products.

Highlights from the call with management included:

Customer Acquisition and Engagement: The company continues to attract new customers, especially Millennials and Gen-Z, with 3.3 million total new cards acquired in Q3 alone. American Express sees strong engagement among these new users, with transactions per customer up about 30% from five years ago.

Gold Card Refresh:

"Gold is a very popular product with total US Consumer Gold acquisitions currently running at about 30% higher than Platinum. And it's our number one premium product for Millennial and Gen-Z consumers, with 80% of US Gold Cards we acquire coming from this cohort. … In designing the refresh Gold Card, which we launched in the third quarter, we know that Millennials and Gen-Zs are especially interested in dining. In fact, these younger card members transact almost two times more on dining and make up a higher percentage of users on our Resy restaurant booking platform than other generations in our card member base." - Steve Squeri, CEO

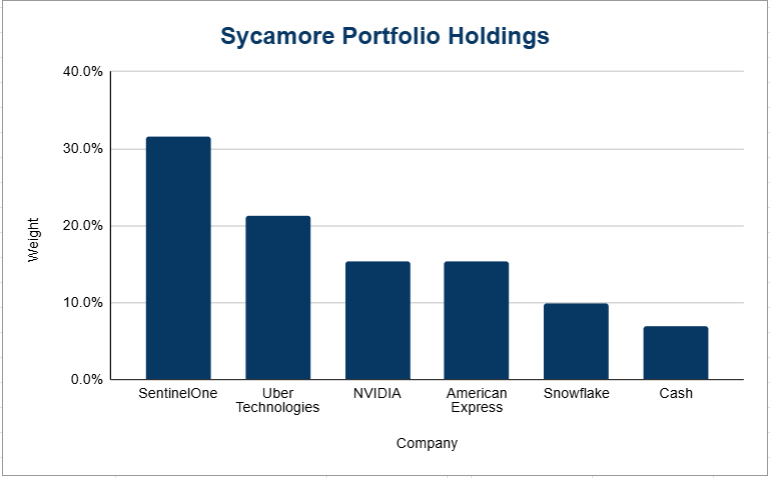

Lastly, as part of each quarterly earnings I update my favorite KPIs for the business. These are primarily KPIs that exemplify Amex’s:

growth strategy towards Millennial and Gen Z customers

card fee revenue, which serves as Amex’s version of ARR

expense controls on cardholder rewards and the potential impact of growing merchant funded rewards

See the data → AXP KPIs

“UBER: A Superlative Example”| Uber Technologies Thesis

Uber: 1. A Superlative Example of its Kind (Merriam-Webster)

UBER 0.00%↑ is a business that needs no explanation. Grammatically, it’s a prefix; in the business world, a noun; and in everyday life, a verb.

I’ve been fascinated with this business since I first learned about it years ago. I took a serious look when it IPO’d and have followed it closely ever since. At first, I wasn’t sure if the company would reach the scale needed to generate cash flow and earnings. Once they achieved that, concerns about disruption from autonomous vehicle (AV) technologies, like those from Waymo and Tesla, kept me on the sidelines further.

Unfortunately, I missed some great buying opportunities. But as they say, better late than never.

I’d like to share my thesis on this extraordinary business in a way that addresses my two long-standing concerns. To do so, we’ll look at the following:

Network effects

Global scale

Competition

Profitability

Autonomous rideshare and competition

Notable mentions

Valuation

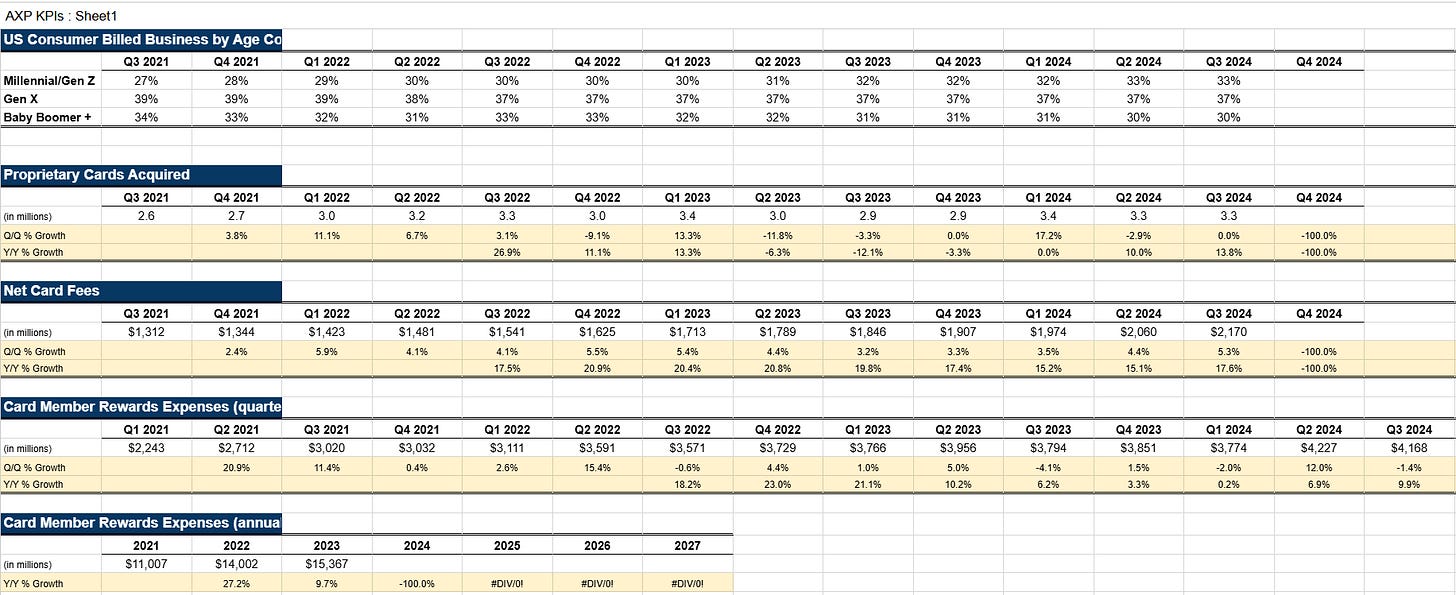

Network Effects

Network effects occur when a product or service gains additional value as more people use it. Network effects are often seen in technology platforms where the platform's value grows with its user base.

For Uber, network effects play out as follows:

Rider Growth Increases Driver Value: As more riders use Uber, it creates a greater demand for rides, which attracts more drivers to the platform. For drivers, a larger pool of riders means more potential earnings and less time waiting for a ride request.

Driver Growth Increases Rider Value: As more drivers join, riders benefit because they experience shorter wait times, more reliable service, and better pricing due to increased competition among drivers.

Geographic Expansion: Uber’s network effects grow stronger in each local area as both driver and rider bases grow, making Uber’s service more reliable and available in more locations.

Competitive Advantage: With strong network effects, it becomes harder for new competitors to disrupt Uber’s market, as they would need to match the large, established base of drivers and riders to offer comparable service quality.

In Uber's case, these network effects create a reinforcing cycle, where growth in one side of the market (riders or drivers) naturally attracts growth on the other, increasing Uber's platform value over time. Not to mention the ability to expand services into other areas like delivery, etc.

Global Scale

Uber is executing to near perfection on a massive global scale. When I took another look at this business recently I was blown away to find that Uber completes 31 million trips per day. There are a number of other important metrics that speak to their global scale, such as:

Countries & Cities: Uber operates in approximately 70 countries and is available in over 10,000 cities worldwide.

Monthly Active Platform Consumers (MAPCs): Uber reported 161 million MAPCs in Q3 2024. In addition, customers are utilizing Uber’s services more frequently as noted on their recent earnings call: “Monthly trips per MAPC remained at an all-time high and grew 4% YoY to 5.9.”

Uber One Members: Uber now has over 25 million Uber One Members and the loyalty program grew at 70% y/y in Q3.

Earners: The company has 7.8 million monthly active drivers and couriers globally.

Quarterly Trips: In the third quarter of 2024, Uber completed approximately 2.9 billion trips, an increase of 17% y/y.

Gross Bookings: In the third quarter of 2024, Uber's gross bookings reached $40.97 billion. And annualized run-rate GB of $164B.

It probably can’t be overstated, this is serious scale.

Competition

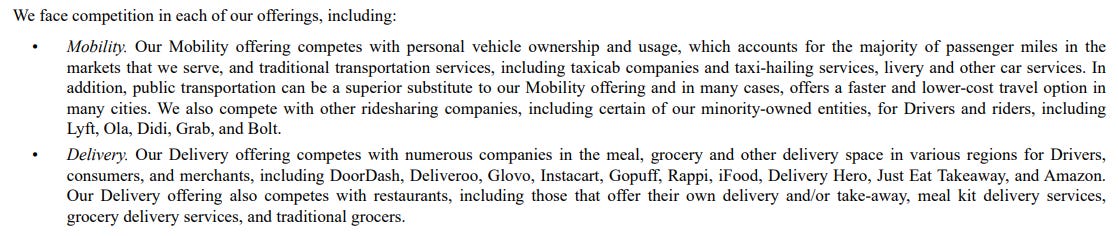

Uber identifies a myriad of competition in their 10Q. See here:

Uber has made direct and indirect (via acquisitions) investments in several of their key competitors like Didi, Grab, Moove, Lime, and Delivery Hero.

Nonetheless, I want to focus on Lyft, which is Uber’s most formidable competitor here in the United States when it comes to rideshare. Lyft boasts 24.4 million monthly active riders, 85% less than that of Uber at 161 million.

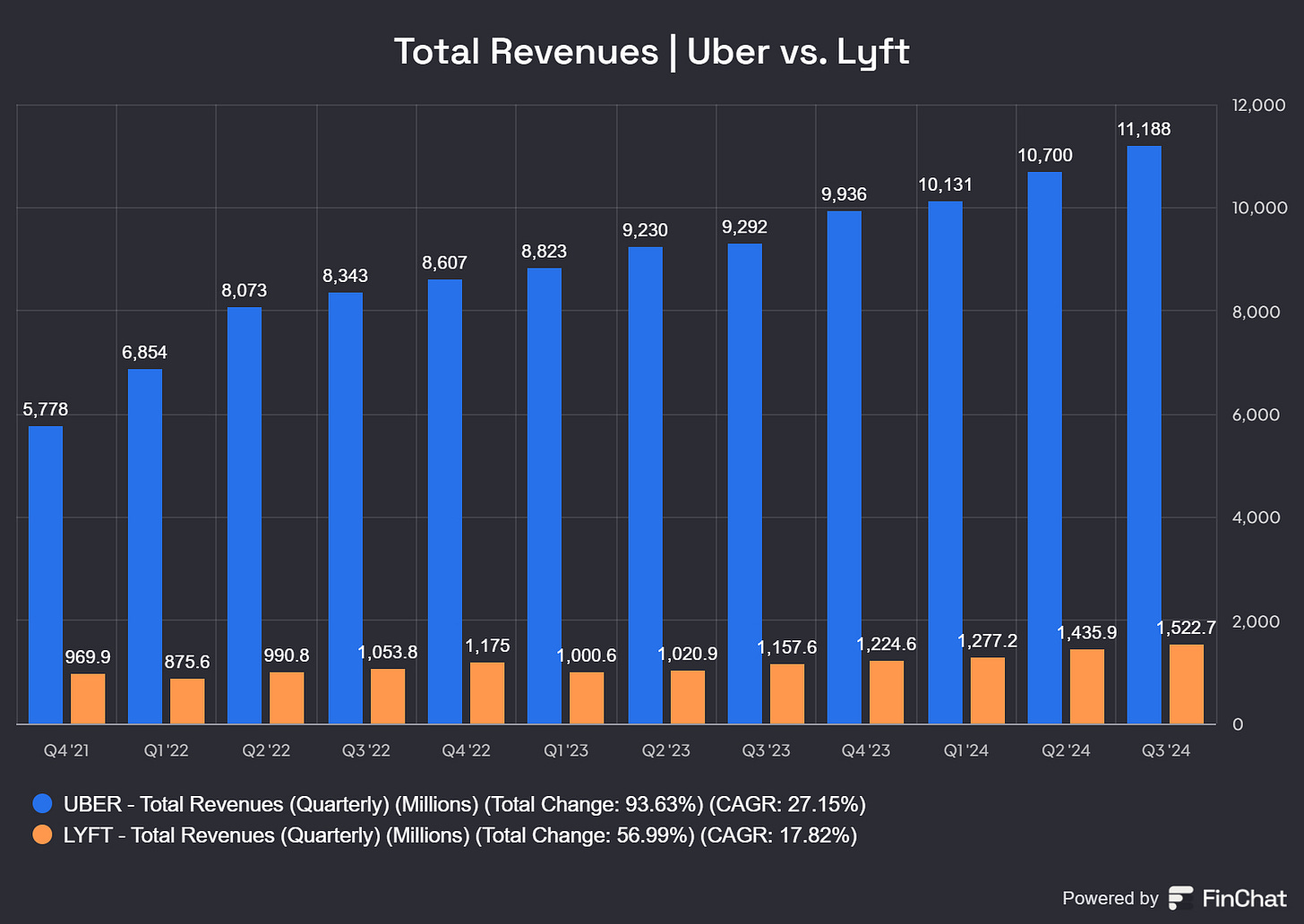

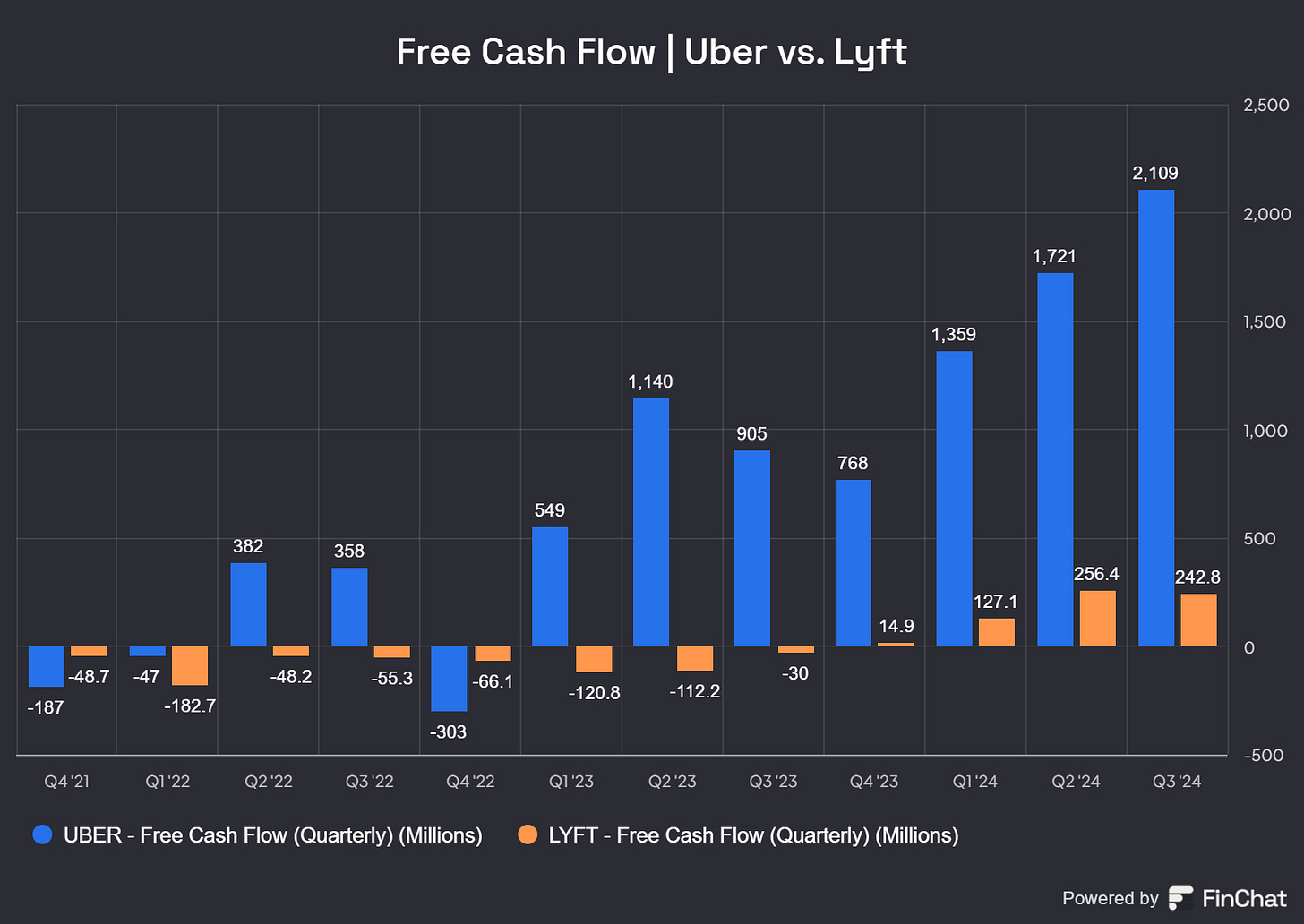

When it comes to revenue and free cash flow, Uber’s scale (moat) really shines:

You may say, well Lyft doesn’t have the same global scale and delivery business. And you’re right but that’s also the point. The network effect and cross-sale power of the Uber platform is too much for Lyft to compete with. Barring a total blow-up, I don’t see how Lyft ever catches up in a meaningful way.

Profitability

Profitability has always been a huge challenge with Uber as the company has continued to scale its operations globally. It is famous for burning through $25 billion of cash over 13 years before ever generating a single dollar of free cash flow in 2022 (source). This always kept me on the sideline, but how things have changed.

Consensus on Wall Street is that the company will generate $6.3 billion in free cash flow for full-year 2024 and $7.7 billion in 2025. Uber’s free cash flow margin has expanded consistently and significantly over the years.

Management is committed to continue optimizing the business and expanding margins as top-line continues to grow at 20%+ y/y.

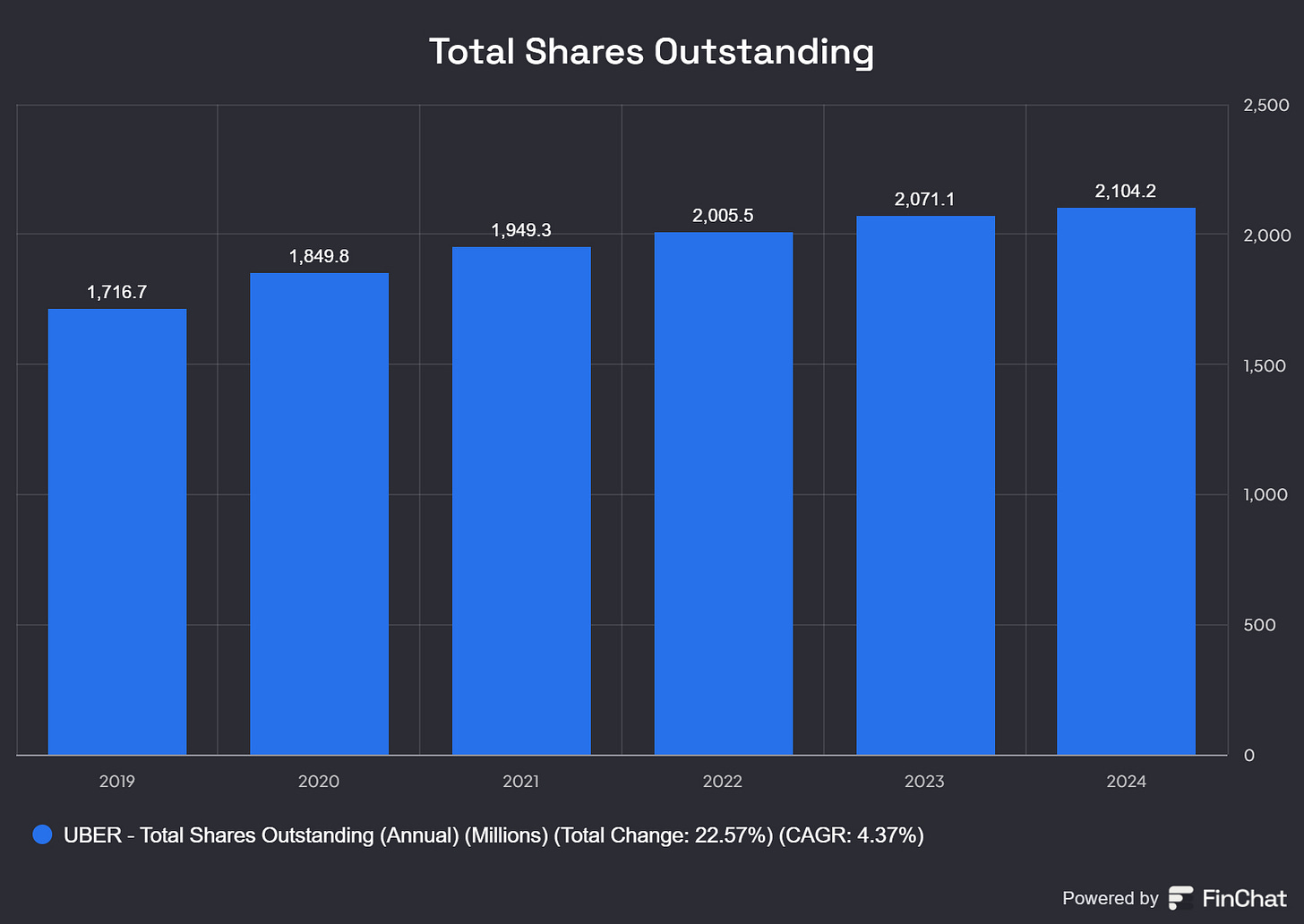

The company announced on their latest earnings call that they will voluntarily retire $2 billion of debt in Q4. In addition, management noted that they will utilize free cash flow to begin buying back shares in earnest and expect shares outstanding to decline throughout calendar 2025 and beyond. This is in stark contrast to Uber’s entire history as a public company.

This is an extremely important inflection point for shareholders as share count deflation will be a great benefit going forward.

Autonomous Rideshare and Competition

Beyond profitability concerns, the second theme that kept me on the sideline for so long was the overhang of autonomous rideshare platforms coming to market and competing directly with Uber, namely Waymo and Tesla.

In 2020 Uber sold off their autonomous driving (hardware) unit and opted for the partnership approach, leaning into their strength as a leader in marketplace, not hardware.

“There are very few companies that can do hardware and software well, Apple, Tesla, are arguably [some] of the few in the world. And we decided to make a bet on the platform” (source). - Dara Khosrowshahi, CEO

Since then Uber has partnered with 14 AV (autonomous vehicle) companies globally. Notably here in the US, they are already providing driverless Uber rides in multiple cities with Waymo.

Waymo has its own rideshare app for their AV product. However, their partnership with Uber has been so successful that in 2025, Waymo will launch AV rideshare in Austin and Atlanta exclusively through Uber, without offering it through their own app in these locations. That’s the power of Uber’s scale and marketplace.

“Well, I think for us the good news is that we’re in discussions with multiple AV partners about bringing their content onto our platform, as long as that content is safe, etc. What we bring is that we’re already operating in all these markets, so we understand the pickup points, the drop-off points, when to operate, etc. We’ve built out all that infrastructure, so an AV player can come in and essentially monetize instantly, with demand already spoken for” (source). - Dara Khosrowshahi, CEO

Now, onto Tesla. I’ve always believed Tesla is approaching AV the right way by integrating it directly into the cars themselves (using a vision-only inference model rather than LIDAR, etc.). But at the end of the day, the Waymo example shows us that being great at hardware and software doesn’t necessarily make you great at building a marketplace.

Here are a series of takes on Tesla partnering with Uber:

“People say history may not repeat, but it rhymes. Daimler, BMW—they tried to set up their own networks as well. But it's a really, really different business. It’s what I was talking about with hardware: to build a $20,000 or $50,000 piece of hardware from driving over 30 million transactions every day, and then on a revenue basis, you make $2 off of it. It’s just a very, very different business. Everything you have to build in terms of the matching stack, the pricing stack, all the things that can go wrong… In a lot of markets, people want to pay cash, accidents happen in a car, people get sick, people lose items. All of those considerations—we’ve had to learn how to build out a system that’s able to make everything work for both the rider and the driver with economics that work. It’s taken us 15 years, it’s taken us tens of billions of dollars in capital, and we can provide that instantly to a partner. And, you know, hopefully Tesla will be one of those partners—you never know” (source). - Dara Khosrowshahi, CEO

“There is a world in which 1P (first party relationships) and 3P (third party relationships) work together. If you look at food, for example, you’ve got McDonald’s, Starbucks, Domino’s—every single major player out there has a direct channel to consumers. But as they try to maximize the utilization of their restaurants, etc., they have come to the conclusion that they should work with marketplaces. I think the same is going to be true of cars. If you want to drive utilization of that asset, you’re going to want to engage 3P, and if you want to develop your own 1P channel as well, that can also be true; it doesn’t have to be either/or.” (source). - Dara Khosrowshahi, CEO

“If [Tesla] develops their own AV and decides to go direct only through the Tesla app, they would be a competitor. And if they decide to work with us, then we would be a partner as well. To some extent, both can be true. So, I don’t think it’s going to be an either/or. I think Elon’s vision is pretty compelling, especially since you might have these ‘cyber shepherds’ or owners of fleets, etc. Those owners, if they want to maximize earnings on those fleets, will want to put them on Uber” (source). - Dara Khosrowshahi, CEO

Lastly, I have been reading a lot this past week about the Trump election and why Tesla is surging higher. According to several analysts, notably Dan Ives from Wedbush, he believes easing regulations could pull forward Tesla’s Cybercab concept by several years (source). While Tesla stock is +40% in the past week, Uber is flat to down. Why?

I believe this benefits Uber even more, as an accelerated launch timeline means even less time for Tesla to build its own marketplace and potential loyalty program. Just as Waymo has shown it needs Uber, Tesla will need to partner with Uber even more to gain access to its demand network of 161 million monthly active users. I don’t think the market understands this right now. And I don’t see a scenario where Dara misses this opportunity, which is why I’m placing my bet here. And it’s a big bet—so I hope this thesis ages well.

Notable Mentions

There is a lot to this business and plenty I have not covered here. Some of those are:

Advertising: Uber has a large, rapidly growing, and highly profitable advertising business within its platform ecosystem. In Q3, it grew 80% year-over-year and is currently on a revenue run rate exceeding $1 billion annually. Management expects this to multiply significantly in the coming years. Think about it—they know who you are and where you’re going, or who you are and what and when you like to order. It’s a slam-dunk ad business if done the right way.

Labor Platform: At its core, Uber is a labor platform with 7.8 million monthly earners. In Q3 alone, Uber earners generated $18.1 billion in income—on their own terms. That’s powerful. Uber is also expanding into new earning opportunities, like AI data labeling and mapping.

Valuation

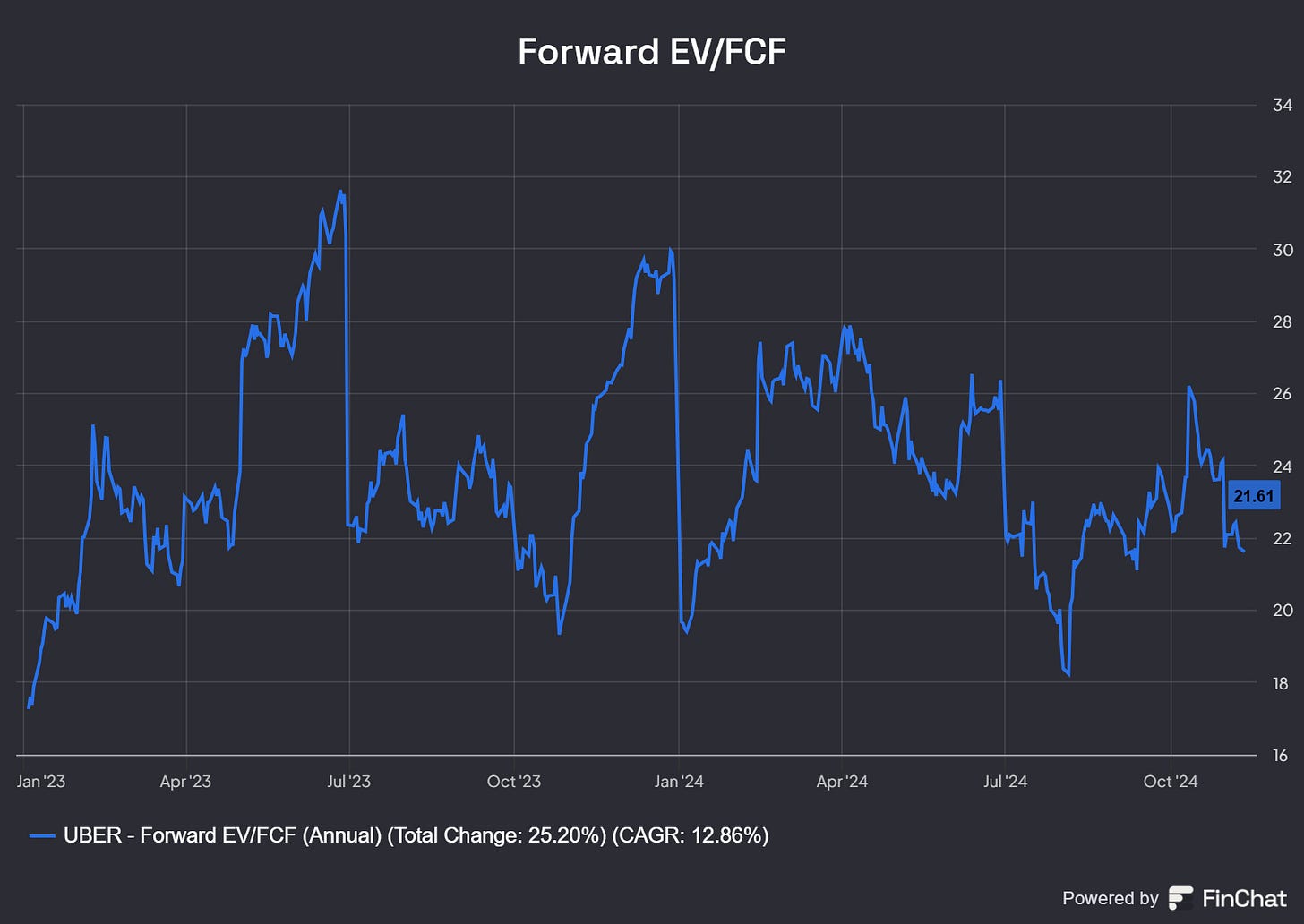

This is a free cash flow story, in my opinion. The stock is currently trading at ~21x forward EV/FCF.

The historical multiple is limited due to the company's recent shift to free cash flow positive. However, over the past 18 months, the stock has traded between 18x and 30x FCF, so the stock is trading on the lower end of its recent range.

Overall, for a business growing its top line by 20%+, expanding margins, benefiting from industry tailwinds, increasing user engagement, expanding lines of business, and with significant global scale (moat), I think 21x free cash flow is a very reasonable price to pay.

![Getting More Defensive Heading into Q4 | Sycamore Portfolio Update [September 2024]](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F1493f9e8-da54-44ff-ab78-64bc6fb1e653_840x480.jpeg)

Thanks for the mention!

Excellent write up on Uber!