Getting More Defensive Heading into Q4 | Sycamore Portfolio Update [September 2024]

First thoughts, quick look at WYNN, a second look at MTN, getting more defensive, big month at S, selling TSLA again, and initial thoughts on SNOW

“If you have an investment you think is a very high probability of being successful, why would you want to dilute it by diversifying into a lot of other mediocre investments?”

Bill Ackman, Pershing Square Holdings

Monthly Returns

Sycamore Capital Portfolio // +2.99%

S&P 500 // +2.02%

Differential // +0.97%

Year-to-date Returns

Sycamore Capital Portfolio // +55.62%

S&P 500 // +20.81%

Differential // +34.81%

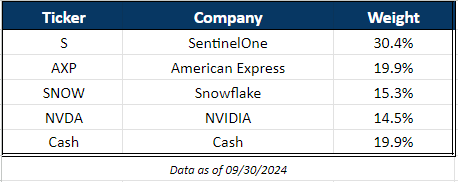

Current Holdings

Transactions in September

Increased SNOW 0.00%↑ by 50.2% @ $109 /sh

Decreased AXP 0.00%↑ by 4.7% @ $272 /sh

Sold out TSLA 0.00%↑ @ ~$220 /sh

First Thoughts

Publication Growth

Throughout the month, Sycamore’s subscriber base grew by 148.2%. Whoo! If you’re new over the past month, thanks for being here. Hopefully you find something I am doing valuable to your own research and investing.

Quick Update on AXP 0.00%↑

In case you missed it, here are my notes and key takeaways from American Express’ presentation at the Scotiabank Financials Summit:

I am working on a longer post for AXP that I plan to publish in October following their Q3 earnings report.

I trimmed my American Express position in September. I had added to the position in August when the stock fell into the $220s to bring the weighting up to 20%. It has run hot since to all-time highs in the low $270s. Here are the three reasons why I trimmed it at $272 /sh.

The weighting drifted above my 20% target weighting.

The economy is edging towards a possible contraction, so what are the chances AXP comes out with a beat and raise next quarter? Not likely at all in my calculus.

The stock is trading at a forward P/E of about 20.5x, while its 10-year historical average is more in the ballpark of 15-16x (excluding Covid disruption). I think it’s fully valued here at this price and given the set-up.

Watchlist

Wynn Resorts - WYNN 0.00%↑

With the rush of capital into Chinese equities, which I have always avoided, I started looking into a name I know well that has significant exposure to the region. Wynn Resorts.

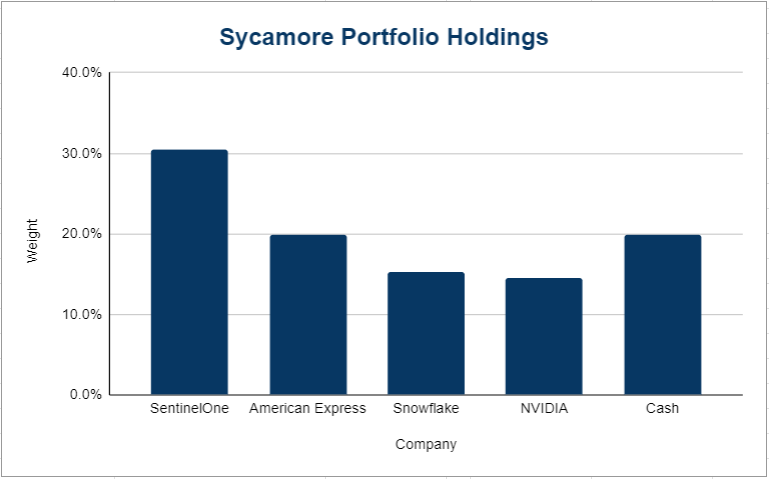

Wynn’s Macau business accounts for approx. 50% of total resort revenue in 2023. However, in the chart below you can see just how volatile that region is.

It's an interesting idea given the scale of China's latest stimulus package, the largest since 2008. However, the business has faced boom-and-bust cycles largely due to its Macau properties, and I don’t have a clear understanding of the Chinese market or economy.

Las Vegas has shown resilience and could continue to do so. According to Morgan Stanley, Wynn has been investing more heavily in its Vegas properties than its peers, allocating 24% of Vegas EBITDAR to capex over the last five years, compared to MGM’s 17% and Caesars' 10%. This investment could drive significant outperformance, especially since Wynn is the premium destination in the region.

Wynn is also investing hundreds of millions in the construction of a luxury island resort in Dubai, UAE, which could have a significant impact on the business. However, while Wynn Al Marjan Island looks incredible (see here), the company has yet to secure a gambling license. They’re betting that if they build it, the license will come. Currently though, gambling is prohibited under Islamic law, and there are no casinos in the UAE.

The last piece is that casino operators love debt. And Sycamore Capital does not love debt. Wynn is no exclusion to this as they are currently running about 4.5 turns of leverage.

Even though the stock is trading at an approximate 25-30% discount to its pre-Covid EV/EBITDA average, considering all the uncertainties and the fact that the stock has already rallied 35% in a month, you really have to believe a lot about this story to be buying here.

Second Look at Vail Resorts - MTN 0.00%↑

Management announced a $100 million cost-saving initiative as part of its multi-year "Resource Efficiency Transformation Plan," aiming to achieve these savings by the end of fiscal year 2026.

Key elements of the plan include:

Job Cuts: Vail Resorts will reduce its corporate workforce by 14% and its total workforce by less than 2%, which includes both corporate and operational staff.

Operational Scaling: The company will leverage a global shared services model and expanded workforce management to improve efficiencies across its locations.

Targeted Savings: Vail expects to realize $27 million in savings during fiscal year 2025 and an additional $67 million by fiscal 2026, though these will be partially offset by one-time operating costs.

In my opinion, this is table stakes and not enough to win over investors. The market agrees with my viewpoint here as the stock has traded down following earnings by ~5%. I still believe this is a unique asset but with a poor capital allocation policy (i.e. poor management!)

As I’ve said before, management is spreading themselves too thin. They are:

Acquiring new properties for growth

Trying to pay down debt (currently running three turns of leverage)

Investing in portfolio properties/resorts

Paying $8.88 /yr in dividends (~120% payout ratio)

Buying back stock (announced an additional 1.1 million shares on top of existing 0.6 million share allowance in recent earnings call)

This is a growth business and they should invest accordingly:

Suspend the dividend and buybacks for now

Aggressively pay down debt and strengthen the balance sheet

Invest in the existing portfolio and acquire new resorts

Considering all this, the stock is too expensive at 24x next year’s earnings.

Getting More Defensive

I have been getting more defensive heading into the fourth quarter. This has meant clearing my position in Tesla, trimming AXP, and increasing my cash holding to 20% of the portfolio. Here are a few reasons why I have been making this move:

Great Returns YTD

The portfolio is up 55.6% YTD, and I’m comfortable taking a more conservative stance heading into Q4, while remaining 80% invested. Although I occasionally use put options to hedge a particular position around earnings or similar events, I don't have any such positions on right now And just to be clear, I never short stocks.

Escalating Geopolitical Tensions

While this is always a risk, there are significant concerning developments or scenarios on three fronts: Israel/Iran, Russia/Ukraine, China/Taiwan.

While I would argue that a World War III type scenario is a very low probability event, the fact that it even has a weighting in the probability skew is concerning. Escalatory events within these conflicts could lead to rapid and severe consequences depending on how they unfold.

Bottom line, we are absolutely in a heightened geopolitical environment right now and it does concern me.

Election Volatility

October is the most volatile month of the year during election years (source). I don’t anticipate any significant drawdowns due to the election, but I do expect a tumultuous election and the potential for a volatile market.

Overwhelmingly throughout history, politics makes no difference to financial markets in the long-term. Markets are driven by fundamentals, not politics. However, short-term volatility can be great opportunities if cash is ready.

21.5x Forward P/E on the S&P 500 & A Possible Recession

The historical average of the S&P 500 forward P/E is in the range of 16-18x. It’s currently trading at a ~25% premium to the average.

At the same time, there is plenty of conversation about a possible recession sometime in 2024/2025. Estimates vary, but consensus is somewhere in the 30-40% probability range.

At its core, investing is the process of weighing various probabilities and potential outcomes. Put these two things together (on top of everything else I’ve already mentioned) and I would argue the market is getting ahead of itself at these levels.

Note: once the Federal Reserve begins a rate cut cycle that is not followed by a recession, there is a 100% chance, equity prices are higher 3, 6, and 12 months from that date based on previous cycles. In these scenarios, the median return is +16%, according to Fundstrat. So, I could be way wrong on this one.

Nothing I Love

I’m running a hyper-concentrated strategy here. While I never go all-in on a single name, I prefer to hold positions in companies that, in extreme circumstances, I would in theory have the confidence to put all my eggs into one basket.

I just can’t find anything that seems obvious to me that I’m willing to take a big bet on.

Bottom Line

The portfolio has been compounding at a ~35% CAGR for nearly five full years, and I’d like to see this 50%+ return in 2024 hold through year-end. Given everything I have mentioned above, why not get more defensive heading into Q4?

I Sold Tesla… Again

I sold TSLA 0.00%↑ in September because, as I’ve mentioned before, it always feels like a trade to me. Its volatility and my more defensive posture makes it hard to pass up a 30%+ gain in a few months. Nonetheless, I sold too soon, as the news from China sent any stock with exposure soaring.

I'm curious to see what comes from Robotaxi Day on October 10. But what is the Robotaxi business really worth, and how much of that is already priced in? I’m not sure but the combined market caps of UBER 0.00%↑ and LYFT 0.00%↑ are around $160 billion.

In the past 30 days, Tesla's market cap has grown by $110 billion. Is the market already pricing in at least some of the Robotaxi business, even though its launch timeline is uncertain? As exciting as FSD is—and as bullish as I am on it— this will be a complete paradigm shift and will take time to penetrate the market in a meaningful way.

I will move Tesla to the watchlist and add a new position for a third time if it provides an attractive entry point.

Lenovo Deal and Industry Awards at SentinelOne

Lenovo Partnership

SentinelOne announced a significant multi-year partnership with Lenovo to integrate its AI-powered security solutions into millions of Lenovo devices globally. As part of this collaboration, Lenovo will include SentinelOne's Singularity Platform and Purple AI in new PC shipments, enhancing endpoint protection through real-time threat detection and autonomous defense capabilities (source).

This is a big deal as Lenovo ships nearly a quarter of all PCs globally. Analysts from Wells Fargo think this could provide significant earnings impact. They liken the deal to the Crowdstrike/Dell deal, which was meaningful for CRWD 0.00%↑. They see a total deal value adding ~5% ($50 million) to SentinelOne’s ARR within 12 months (source).

SC Media Awards

SentinelOne’s Singularity Platform won Best Enterprise Security Solution and Best Endpoint Security Solution at the SC Media Awards. The platform was recognized for its use of generative AI through Purple AI, which enhances threat detection and response (something we have commented on in previous posts here). These awards validate the platform's efficiency in addressing cybersecurity challenges and automating defense against advanced threats. These accolades were awarded by a panel of experts from sectors like healthcare, finance, and technology, affirming the platform's ability to address the increasing complexities of cybersecurity (source).

Meanwhile, Crowdstrike won… nothing.

Tomer at Goldman

In case you missed it, Tomer Weingarten, CEO of SentinelOne presented at the Goldman Sachs Communicopia + Technology conference in early September. You can find my summary and key takeaways from that event right here:

Initial Thoughts on Snowflake

This investment, by far, has had the most reaction from followers on Substack. All of it negative. I appear to be the only one intrigued by this idea at this price.

Here is what people don’t like:

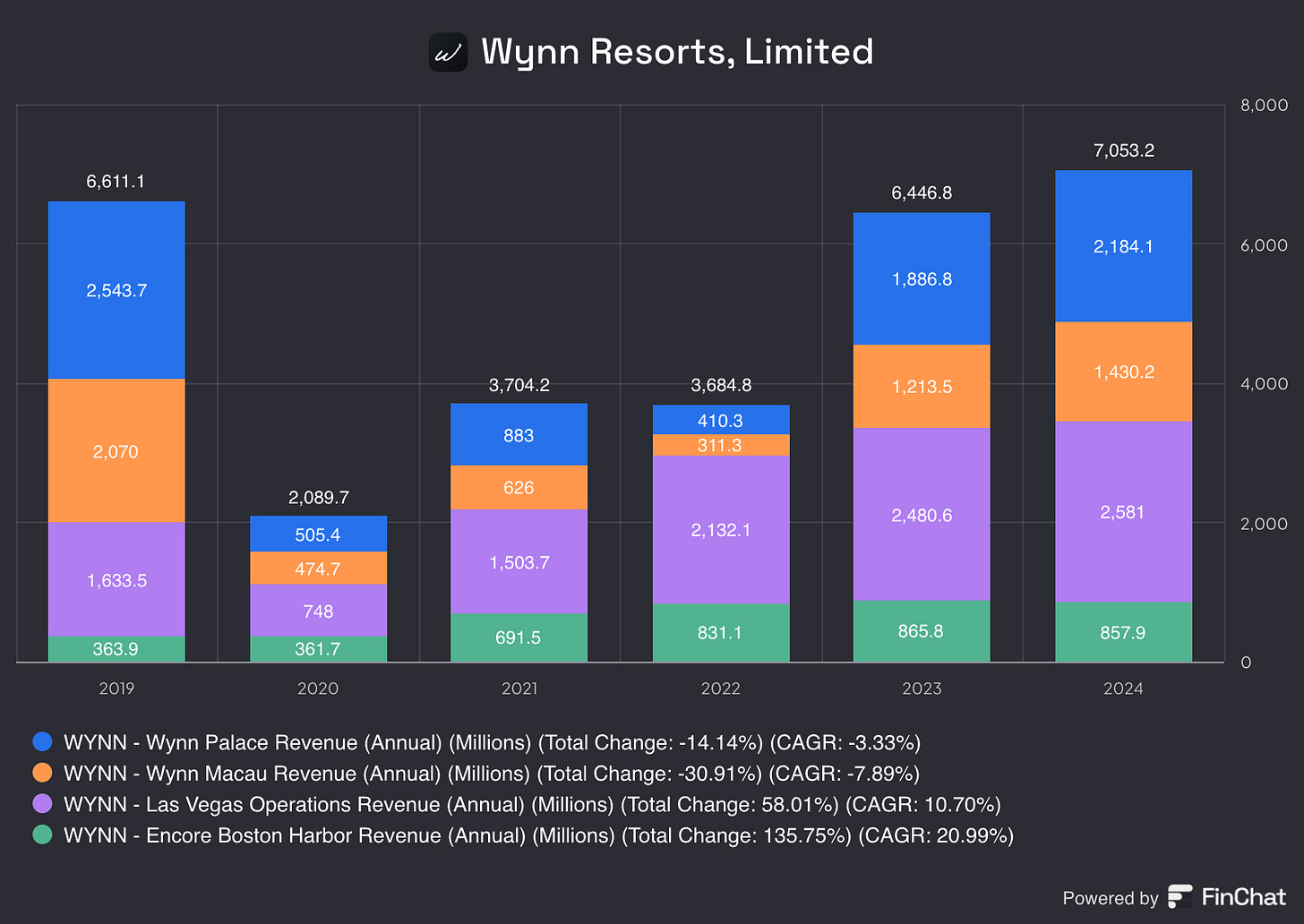

Stock based comp is excessive at 40% of revenue. Management is out of control with this excess. I agree it’s excessive and would like to see management get their hands around this sooner rather than later.

Here is what I do like:

Data for AI

Data is the essential input for both training and inference within AI models. Structured data is typically used in more traditional machine learning applications, such as financial forecasting or customer segmentation, where data is well-organized in rows and columns. In contrast, unstructured data—including text, images, and audio—drives more complex applications like ChatGPT, which relies on vast amounts of unstructured text for natural language processing.

Snowflake has traditionally dominated the market for structured and semi-structured data providing a robust platform for scalable storage and querying. However, through Snowpark, Snowflake is expanding rapidly into the unstructured data space, enabling users to process and analyze more complex data formats directly within its platform, positioning itself as a more comprehensive solution for modern AI applications.

“[Snowflake is] sitting on a goldmine of natural resource.” - Jensen Huang, CEO of Nvidia

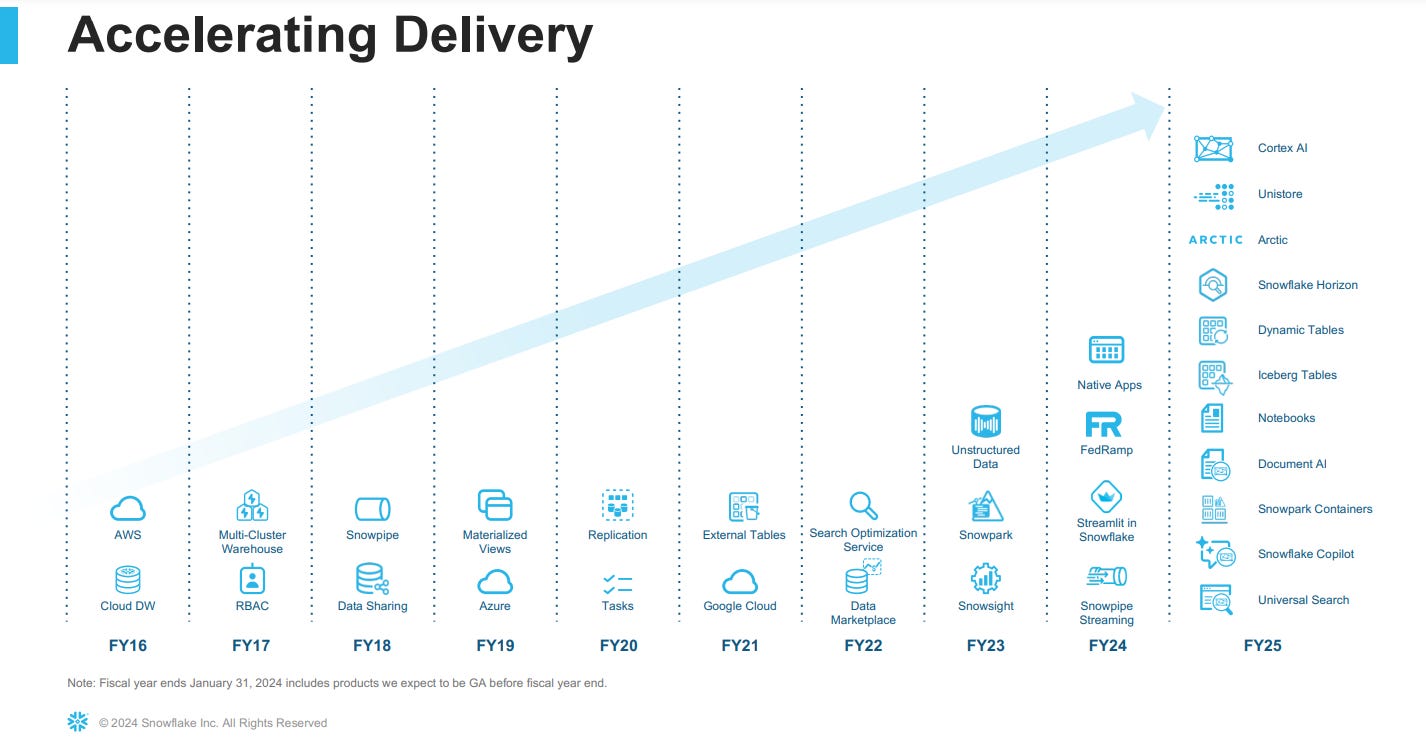

New Product Velocity

Snowflake is innovating and shipping new products and applications to customers at 2x the speed of the previous decade.

This has been driven by Snowflake’s new, product/engineer first CEO, Sridhar Ramaswamy, according to Mike Scarpelli, CFO:

“Sridhar is hyper focused on getting engineering to deliver product faster, but product that customers want. And so he's really driving more alignment between engineering product management and the go to market functions and making sure that engineering really owns a revenue number for what they're building.”

Sridhar Ramaswamy

At the end of the day, I thrive as a qualitative analyst. It appears to me that Sridhar is a super high quality engineer and manager. Here’s a few reasons why…

Sridhar has an extremely diverse work history: he was an SVP at Google, a venture capitalist, a founder (with successful exit), and now a CEO.

Prior to Snowflake, Sridhar was Senior Vice President at Google where he oversaw Google’s $115 billion advertising and commerce division. He was instrumental in scaling Google's advertising business growing it from $1.5 billion to over $100 billion.

When he took the job at Snowflake his first act was to travel the world visiting with over 100 of Snowflake’s largest global clients.

Sridhar is an engineer first, not a manager first.

Despite not being a manager first, his approval rating as CEO on Glassdoor is 90%.

According to Mike Scarpelli, Snowflake CFO, he is the hardest working person he has ever encountered.

“[Sridhar is] a really impressive individual and a workaholic. I can attest to that. It's funny, I was joking…I haven't worked this hard in 10 years.”

Future Health is Positive

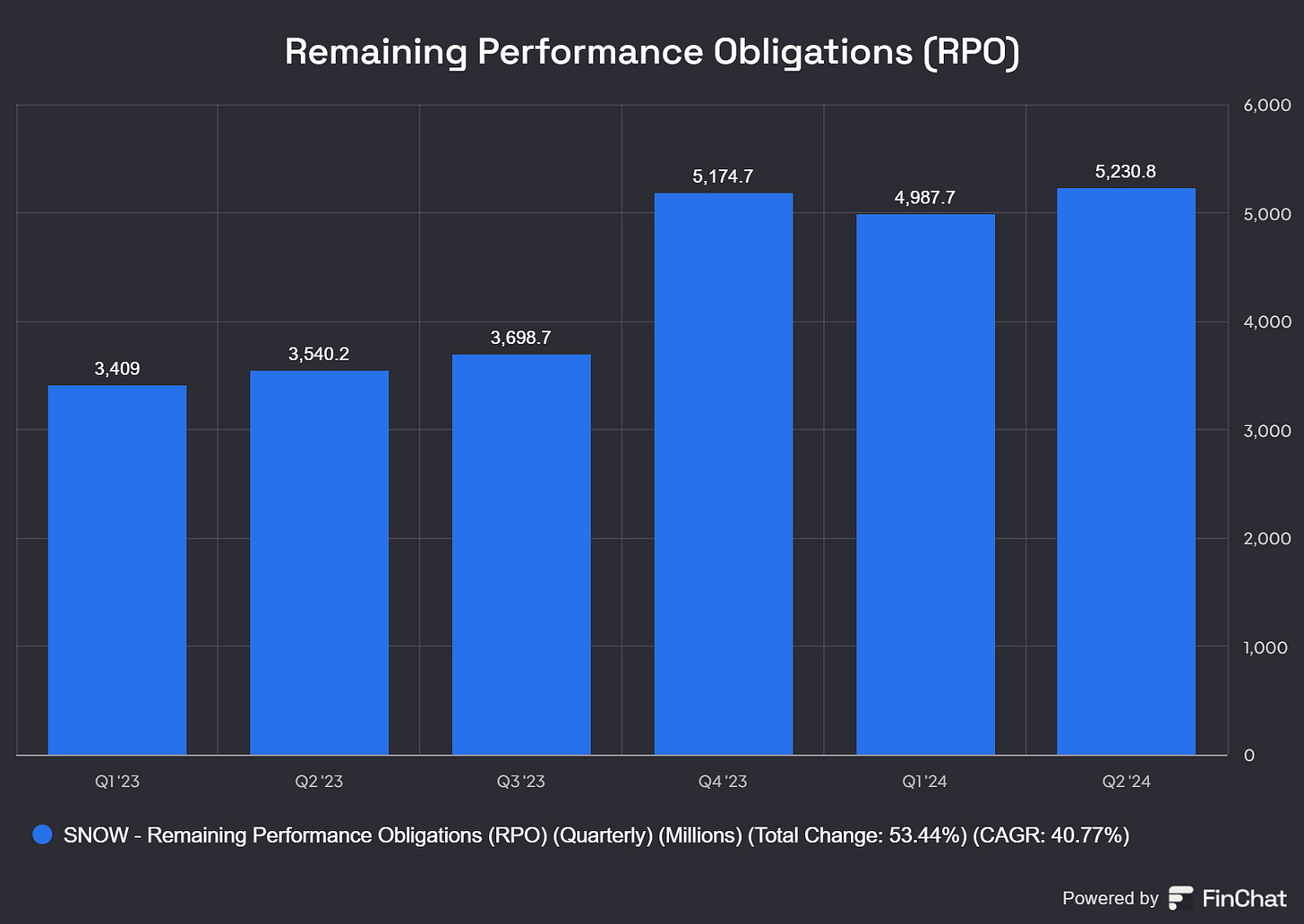

RPOs (Remaining Performance Obligations): For Snowflake, RPOs represent the company's contracted future revenue that has not yet been recognized. These obligations include deferred revenue and contracted revenue not yet billed. Snowflake uses this metric to indicate the long-term commitments its customers have made for future usage.

In simple terms, it indicates the future health of the business. RPOs reached an all-time high in the company’s latest earnings report at $5.2B, +48% y/y growth. That is very healthy.

Re-Accelerating Business and Margins:

Mike Scarpelli noted recently that the company is done buying GPUs from Nvidia. This heavy expense has been a drag on margins in recent quarters.

Given this information on CAPEX, the company’s return to product innovation, and healthy all-time high RPOs, could we see a re-acceleration of revenue and margin into and through calendar year 2025?

If so, with the stock trading down to ~8.5x times revenue, an all-time low, I think we could see multiples expand here once again and the stock take off.

Last thing: If you missed my notes from Snowflake’s presentation at Citi’s Global TMT Conference, you can find it here:

Also, your ability to trade TSLA with 10% of your portfolio is phenomenal.

Your research is pretty great, but honestly I’m coming back for what I can learn from your nimbleness & actions!

Excellent work, Matt.