Calling Malone's Bluff - Sycamore Portfolio Update [May 2024]

THX NVDA, Academy updates, and a NEW deep dive

Monthly Returns

Sycamore Capital Portfolio // +9.12%

S&P 500 // +4.80%

Differential // +4.32%

Year-to-date Returns

Sycamore Capital Portfolio // +32.62%

S&P 500 // +10.64%

Differential // +21.98%

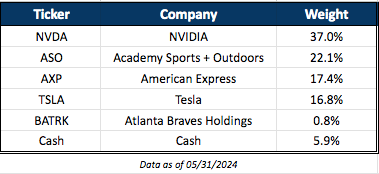

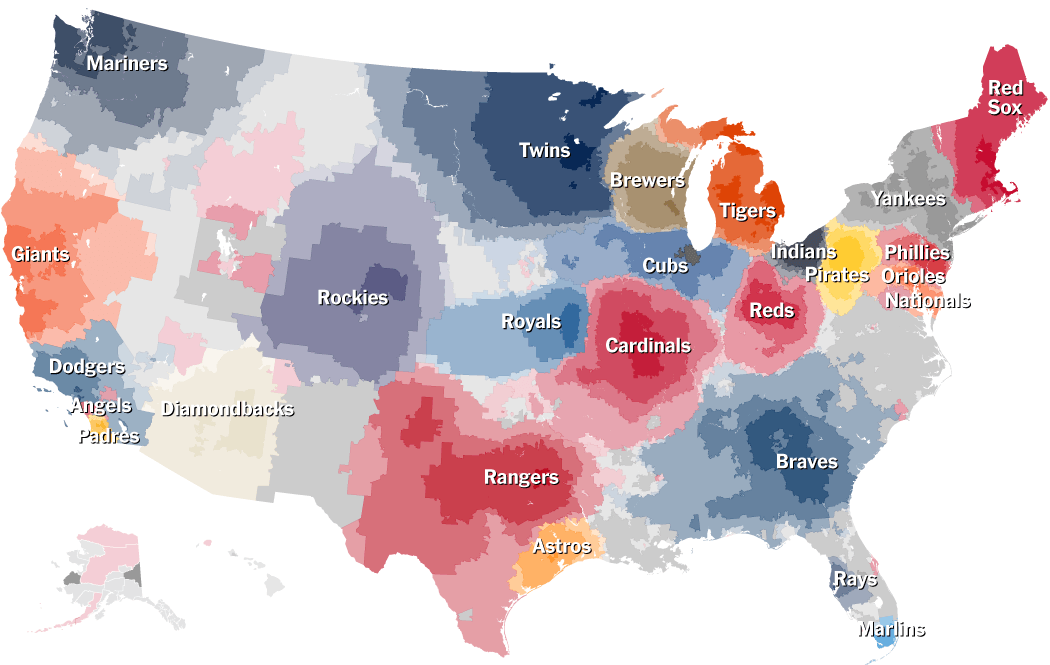

Current Holdings

Transactions in May

Sold out of PYPL

Decreased NVDA by 5.9%

Increased AXP by 13.2%

Increased TSLA by 38.3%

Initiated 0.8% position in BATRK

THX NVDA

Jensen and team blew another quarter out of the water. His commentary on the call about the transition to the Blackwell platform was a boom for the stock. Many analysts feared a slowdown in Hopper shipments as the company gets Blackwell launched. Jensen confirmed that demand continues to meaningfully outstrip supply and that demand for Hopper actually increased as the quarter went on and as they began production of Blackwell.

The best part of the call was when Stacy Rasgon from Bernstein tried to clarify with Jensen if Nvidia would see Blackwell revenue this year. Here is the clip:

“We will see A LOT of Blackwell revenue this year!” Jensen is a legend.

The stock is up 147% year-to-date as of this writing on June 5. This is following 2023 where the stock was up 239%. I commented here and here and here on how the stock was still somehow out of favor with Wall Street at the beginning of the year but we were sticking with it.

I think someone from the “Half-In Pod” needs a “THX SYCA” plate for Sycamore consistently being correct on the trade of the decade.

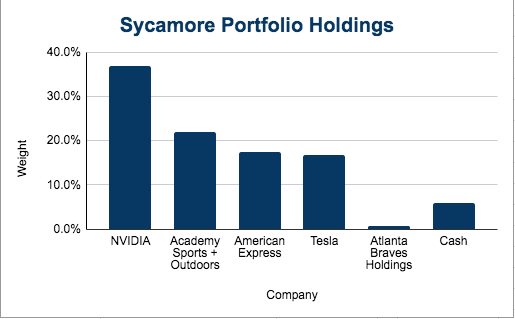

With all that said, the contrarian in me is getting a bit anxious. Expectations are sky high and being revised higher by the day as the forward P/E continues to surge to its highest levels of the past 12 months. Not my favorite set up. So, I’m starting to trim my position down. It’s still my highest conviction pick but I'm taking some profits after nearly a ninefold return in less than two years. I am targeting a 30% weight going forward as opposed to 35%. This represents a meaningful trim as the position continues to run hot and is now right at 40% overall.

My plan is to continue to sell shares and write calls into strength to generate income and possibly trim the position at even more advantageous prices.

Academy Upcoming Earnings & Google Review Tracker Update

Academy will post earnings results on Tuesday morning, June 11. We’ll take a long look at that in next months post. In the meantime, the read through from Dicks looks optimistic for a beat.

The stock has been moving higher from $52 /share on the back of DKS into the print. Stay tuned.

May update on the ASO & DKS Google Review Tracker:

Academy Sports + Outdoors

Total number of reviews // 115

Average rating // 4.25

Sequential improvement // -0.1%

Hard data // Academy Google Review Tracker

Dick’s Sporting Goods

Total number of reviews // 22

Average rating // 4.28

Sequential improvement // +34.1%

Hard data // Dick’s Google Review Tracker

Commentary

Apparently DKS got serious about customer service in the month of May and outperformed ASO by 3 bps. The first time it has outperformed since we began tracking five months ago.

Deep Dive

Calling Malone’s Bluff - Atlanta Braves Holdings (BATRK)

Irreplaceable Asset

The Atlanta Braves are an irreplaceable asset due to their rich history, loyal fan base, and strategic market position. As one of MLB's oldest teams and the longest continually operating franchise in MLB, the Braves boast a storied legacy. They command a fiercely loyal following throughout the southeastern U.S., a region with few competing major league teams. Their modern stadium, Truist Park, and the adjacent mixed-use development, The Battery Atlanta, enhance the fan experience with entertainment, dining, and retail options. This blend of historical prestige, regional dominance, and innovative facilities makes the Atlanta Braves a unique and unparalleled sports franchise.

Financials and Growth

Full-year 2023:

Total revenue grew 9% to $641 million in 2023

Baseball revenue up 9% to $582 million

Mixed-use development revenue up 10% to $59 million

Mixed-use development generated $39 million of Adjusted OIBDA in 2023

Q1 2024:

Total revenue grew 20% to $37 million in first quarter

Baseball revenue up 25% to $22 million

Mixed-use development revenue up 13% to $15 million

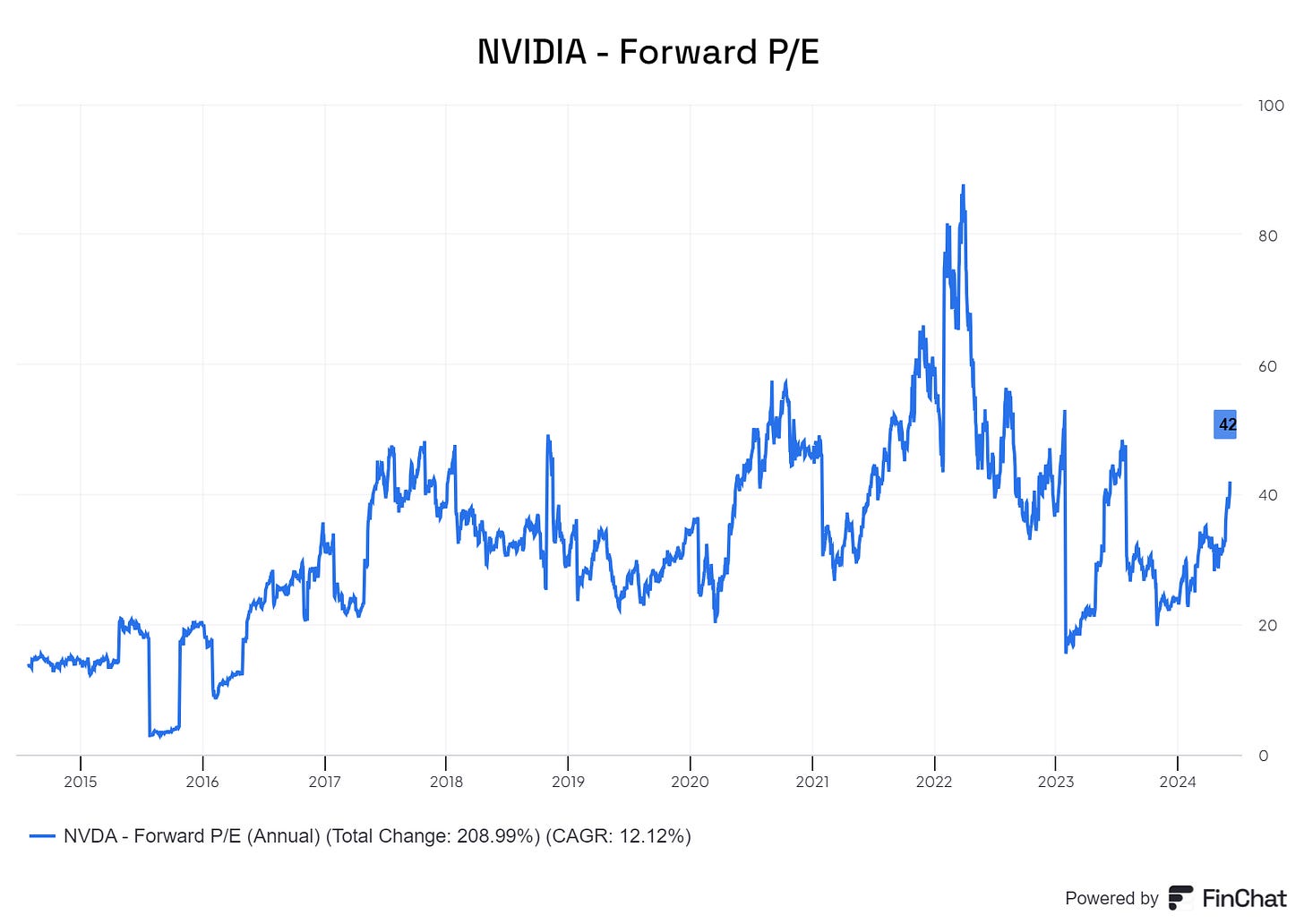

Market Breadth and Reach

The greater Atlanta area is home to more than 6 million people.

Braves broadcasts reach approximately 35 million across states including Georgia, Alabama, Mississippi, South Carolina, Tennessee, and parts of North Carolina and Florida. In the southeast US, the Braves are the only game in town.

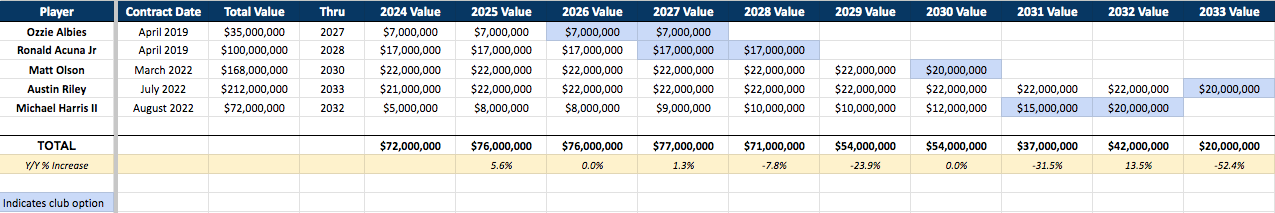

Young Talent on the Field

The team itself is really exciting with really high quality young talent on the field. The Braves core five non-pitching talent are all locked in long-term contracts with basically zero cost inflation built in through the next four seasons.

In other words, without significant cost increases, the organization will continue to put an exciting and winning product on the field for many more years. With significant flexibility in the future to exercise options on their best talent.

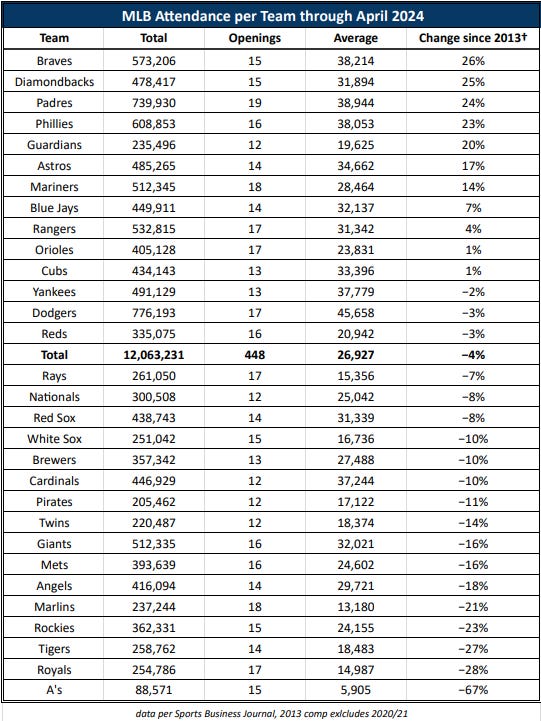

Best-in-Class Fan Attendance

Through the first two weeks of the 2024 season, Truist Park was the most utilized stadium in MLB with the average game at 92% of capacity. That includes two day games, a rain out, and a rain-delayed start. (source).

In addition, the Braves have experienced the highest average attendance increase during the month of April dating back to 2013 at 26%.

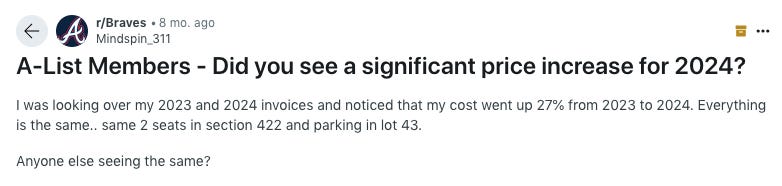

Season Tickets

Braves fans are showing up for games. They’re also paying up for season ticket packages. According to the /Braves subreddit page, season ticket holders saw prices increase anywhere from 10% to almost 30% going into the 2024 season.

Reading through the comments, no one seems to mind. And in fact many are saying this is the first increase they have seen in at least 3-4 years.

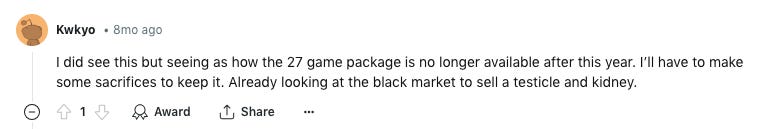

Regardless, if people don’t like the price increases, someone will gladly take their spot. The waitlist is long and growing…

Some are willing to wait years. And those who are already “A-list Members” are doing whatever it takes to pay up to keep their packages…

Get the tomahawk chop ready!

The Battery Atlanta

The Battery is a 2.25M sq. ft. mixed-use real estate development that is owned by Atlanta Braves Holdings. The development includes dining, retail, live music venue, entertainment, hotels, luxury apartments and condos, and commercial office space.

The Battery is a year-round entertainment destination, driving revenue for the business even when baseball is not in season. Click here for the full directory.

In 2023 The Battery generated $59M of revenue and $39M of adjusted OIBDA (operating income before depreciation and amortization).

While developing the real-estate around your stadium to drive incremental and year-round revenue is increasing in popularity, The Battery stands out as the gold standard across MLB. The Braves are far ahead other franchises in this regard. I believe driving incremental value to the franchise as a whole.

Diamond Sports Group Bankruptcy

In March 2023, Diamond Sports Group filed for Chapter 11 bankruptcy. The Atlanta Braves have a broadcasting agreement with Diamond’s subsidiary, Sportsouth Network II, LLC, allowing them to air most Braves games locally.

Key Developments:

February 12, 2024: A Bankruptcy Court order ensures that Diamond won't reject the Braves' broadcasting agreement before the end of the 2024 MLB season. This order provides assurance that required fees will be paid until a reorganization plan is confirmed or the final 2024 season payment is made.

April 17, 2024: Diamond filed a revised Disclosure Statement and Joint Plan of Reorganization, with a confirmation hearing scheduled for June 18, 2024. If confirmed, Diamond will assume the Braves' broadcasting agreement, maintaining obligations for both parties.

Potential Outcomes: If reorganization fails, the case could convert to Chapter 7, leading to asset liquidation. This might require the Braves to repay $34.2 million and write down $12.7 million in receivables if the agreement is rejected.

Current Status: The Braves have received all scheduled payments under the agreement during the bankruptcy proceedings.

Management is optimistic as the Braves are telecast through one of Diamond Sports’ profitable regional sports networks (RSN). The 20-year contract expires in 2027 if maintained.

The team is in a very good spot to negotiate a new contract, whether after the 2024 season or the 2027 season.

On the company’s most recent earnings call, this issue was directly addressed. Here is the exchange:

Barton Crockett, Analyst - Rosenblatt Securities

Okay. Great. I guess I wanted to switch gears a little bit and just get Greg, your thoughts on baseball on the Braves and TV and Diamond Sports, now some question about the viability of the emergence with block out of Comcast. What can you tell us about what the Braves could do if Diamond isn't viable? And what are your thoughts longer term about what should happen there with the TV rights situation there for the Braves?

Gregory Maffei, President & CEO - Liberty Media

Well, I'll give one cursory comment and then let Derek perhaps if you want to contribute, happy have you take over. I think we have some visibility into the Diamond Holdings, not only from our experience with the Braves, but our experience with Charter. And we watch the situation, obviously, very carefully. We have that benefit, as we've mentioned before, of an enormously attractive territory, and think we have options in the event that they are unable to complete their successful emergence from Chapter 11.

But I'll let Derek touch on that a little more if he would like.

Derek Schiller, President & CEO - Atlanta Braves

Thanks, Greg. Yes, to the first point, obviously, carriage disputes are sort of commonplace, unfortunately, and we don't like the fact that this carriage dispute is going on, we're not a party to it, and we're hoping that Comcast and Bally get together. To Greg's point, we're obviously monitoring the whole bankruptcy proceedings and doing our part to protect our rights. At this point in time, Diamond Bally is fulfilling their terms with us, including full payment.

But if the rights come back to us, we are very optimistic. Because, as Greg noted, we have a very large territory, one of the largest in sports. There's huge demand on the team, and we believe there's more optimism than pessimism with the future of Braves' television rights in that marketplace.

Barton Crockett

That's great. If I could just follow up. I mean, the precedent at some of the other baseball teams has been if they lose their RSN carriage that they're having to move to a lower revenue model where perhaps they get broader exposure on broadcast, but less revenue. It sounds like you don't think that, that's what the Braves would face if they came to it. Am I hearing you correctly?

Derek Schiller

Yes, I think you are hearing me correctly, partly because the other situations that we've seen around in particular, baseball, the marketplaces are just vastly different. And their situations, I don't think are necessarily analogous to us. We have about 6 states that are in our territory and about 35 million people in that territory. So one way to look at this is, to the extent that we can unlock the opportunity to offer the Braves content to a wider stretch of that territory to more of those 35 million people, we think that the revenue should follow.

And we've been modeling that and feel like we're in a good position should those rights come back to us.

Sports Franchise Valuations

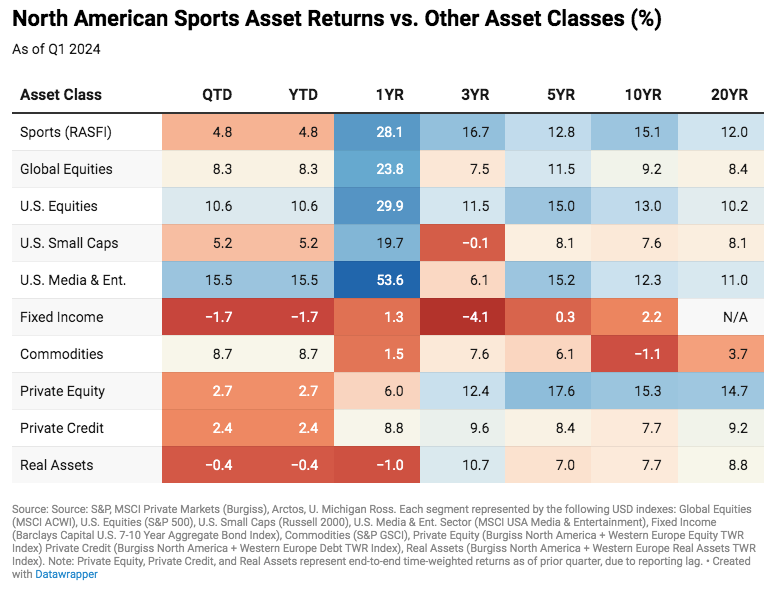

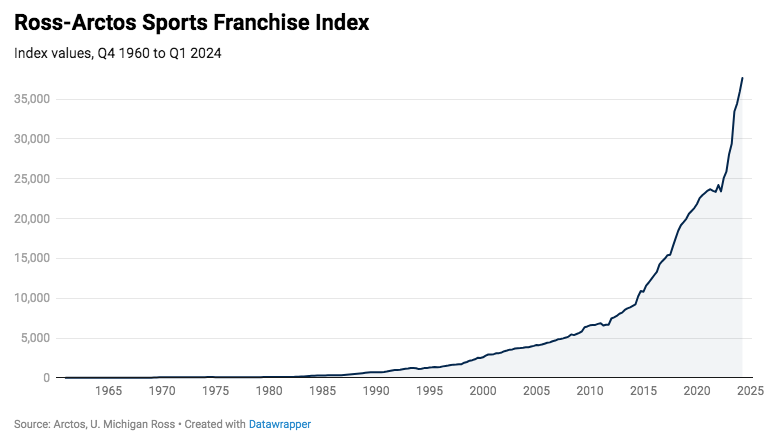

According to the brand new Ross-Arctos Sports Franchise Valuations Index, produced by the University of Michigan-Ross School of Business and Arctos Partners (PE Group), sports franchise valuations have outperformed the S&P 500 by 20% annually for the past 20 years. The index is based on 60 years of sports franchise transactions data.

With a 60-year historical index like that, you want to be the price maker, not the price taker. In other words, you want to own the franchise.

Who is John Malone

John Malone is an influential figure in the media and telecommunications industry, widely recognized for his entrepreneurial acumen and strategic vision. He is the chairman of Liberty Media, a company he has transformed into a media powerhouse through a series of strategic acquisitions and investments.

Malone is known for his aggressive acquisition strategy, using leverage and complex financial structures to maximize returns. His approach often involves acquiring undervalued assets, restructuring them, and then selling them for a profit.

Malone personally owns ~5% of the public float of the Braves but represents 47.5% of the aggregate voting power.

Spin-off to Unlock Value

Liberty Media announced its decision to spin off the Atlanta Braves Holdings into a separate, publicly traded company on November 17, 2022. The separation was completed on July 18, 2023. This strategic move aimed to create more focused business entities and unlock value for shareholders. Liberty Media owns nearly 14% of the public float.

By separating the Atlanta Braves, Liberty Media allows investors to directly invest in the baseball team and its associated real estate development, The Battery Atlanta. This split helps both Liberty Media and the new Atlanta Braves Holdings company to pursue tailored growth strategies and operational efficiencies, enhancing overall shareholder value.

Spin-off to Complete a Transaction

Spinning off the Atlanta Braves Holdings into a separate company can provide Liberty Media with cleaner tax implications if they decide to sell the team. By structuring the team and its associated assets as a standalone entity, Liberty Media can facilitate a more straightforward transaction. This setup can potentially reduce the tax liabilities and complexities associated with selling a portion of a diversified media company.

Moreover, it can make the Atlanta Braves Holdings more attractive to potential buyers, as they can acquire a clearly defined business without entanglements with Liberty Media's other operations.

Sending Mixed Signals

Was the spin-off to unlock value for shareholders or set the team up for a clean transaction? Management is sending mixed signals on this. Many have questioned management of the Braves and they typically respond with a “we’ll see” type of comment. To me, “we’ll see” means there are conversations going on behind closed doors.

However, from my understanding of the tax implications, Malone and Liberty Media cannot spin off the Braves just to sell the business. Therefore, they need to play their cards close and make it appear they are simply trying to unlock shareholder value, rather than setting the business up for a transaction.

Malone has even gone so far to interview with Sportico to ensure he has no intentions of selling the team. But the truth is, he has to say this. He says so himself in the interview:

“When we spun the Braves off, I personally had to sign a representation to the lawyers that I had no plan or intent to sell my interest in the Braves.” - John Malone (source)

Therefore, he is calling Sportico to make a public statement that the team isn’t for sale. So that when an offer comes in, which it will, he can point to his public record that it was never his intention to sell the team and a transaction can successfully go through.

Malone is a capitalist with no sentimental ties to the Atlanta Braves and the franchise is at the top of its game in every way.

So, I’m calling Malone’s bluff. He’s going to sell high. It’s when, not if.

What is the Franchise Worth

Professional sports franchises trade hands on a revenue multiple. Here are some recent MLB comps:

Baltimore Orioles: sold in January 2024 to David Rubenstein for $1.725B. The Orioles generated $328M in total revenue in 2023, per Statista, which gives it a 5.3x revenue multiple.

This sale came as a surprise to many in the industry and even the state of Maryland, which had committed $600M to funding upgrades at Camden Yards just six weeks before the sale. Many analysts called the valuation low because of Baltimore’s surging young talent, loyal fanbase, and despite it being a smaller media market (source).

Philadelphia Phillies: a minority stake (16.25%) sold in 2022 at a $2.8B valuation. The Phillies generated $398M in total revenue in 2022 per Statista and Bloomberg, which gives it a 7x revenue multiple (source).

Implications for The Braves

Put it all together, how do you value this irreplaceable asset? The market says it’s worth about $2.5B today, about a 4x revenue multiple to its market cap.

At a 5.3x multiple comping with the recent Orioles sale, the asset is worth $3.4B today or $55 per share.

At a 7x multiple comping with the 2022 Phillies transaction, the asset is worth $4.5B today or $72 per share.

Bottom Line

The Atlanta Braves and The Battery Atlanta is an irreplaceable asset with a tremendous amount of demand for its product on the field and off the field. It is set up for many years of sustained growth and at a very reasonable price (implying downside protection).

I’m calling Malone’s bluff that he does in fact intend to sell the team. And that when a transaction clears, it will be at a premium multiple for an MLB franchise.

Why did you sell out of PYPL ?