The Final Stretch | Sycamore Portfolio Update [November 2024]

Portfolio update, monthly returns and transactions, my horse for 2025, trimming positions, and the Snowflake mistake

“Concentration. Not to be afraid of concentration. That’s a big reason for my success. … When you have conviction, you should bet really big.”

Stanley Druckenmiller, Duquesne Family Office

Monthly Returns

Sycamore Capital Portfolio // +6.09%

S&P 500 // +5.73%

Differential // +0.36%

Year-to-date Returns

Sycamore Capital Portfolio // +68.65%

S&P 500 // +26.47%

Differential // +42.18%

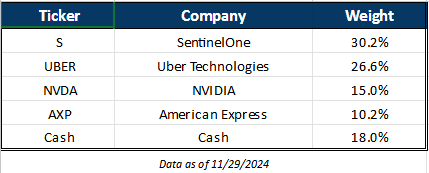

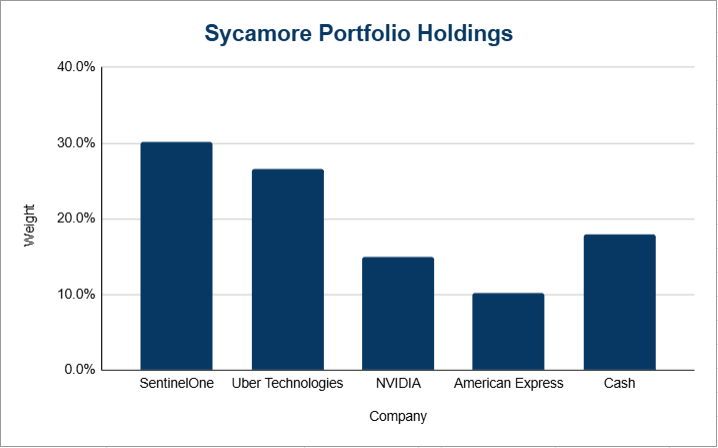

Current Holdings

Transactions in November

Increased UBER 0.85%↑ by 33.2% @ ~$69 /sh

Decreased AXP 0.21%↑ by 37.0% @ ~$290 /sh

Decreased S 0.00%↑ by 6.1% @ $28 /sh

Sold Out of SNOW 0.37%↑ @ ~$126 /sh

First Thoughts

This is not a typical monthly update. This one is short and sweet. I have been working on several other posts, one which has been published and one which has not yet been published. The Sycamore portfolio is also getting decimated in December, which has absorbed all the time that I would normally allocate to working on this post.

Also, my typical time spent on this has been much shorter as my wife and I are in the Advent season and preparing for Christmas with lots of small kiddos.

But just for fun, here is a picture from the traditional Thanksgiving football game (in the $SNOW!).

Making Uber My Horse for 2025

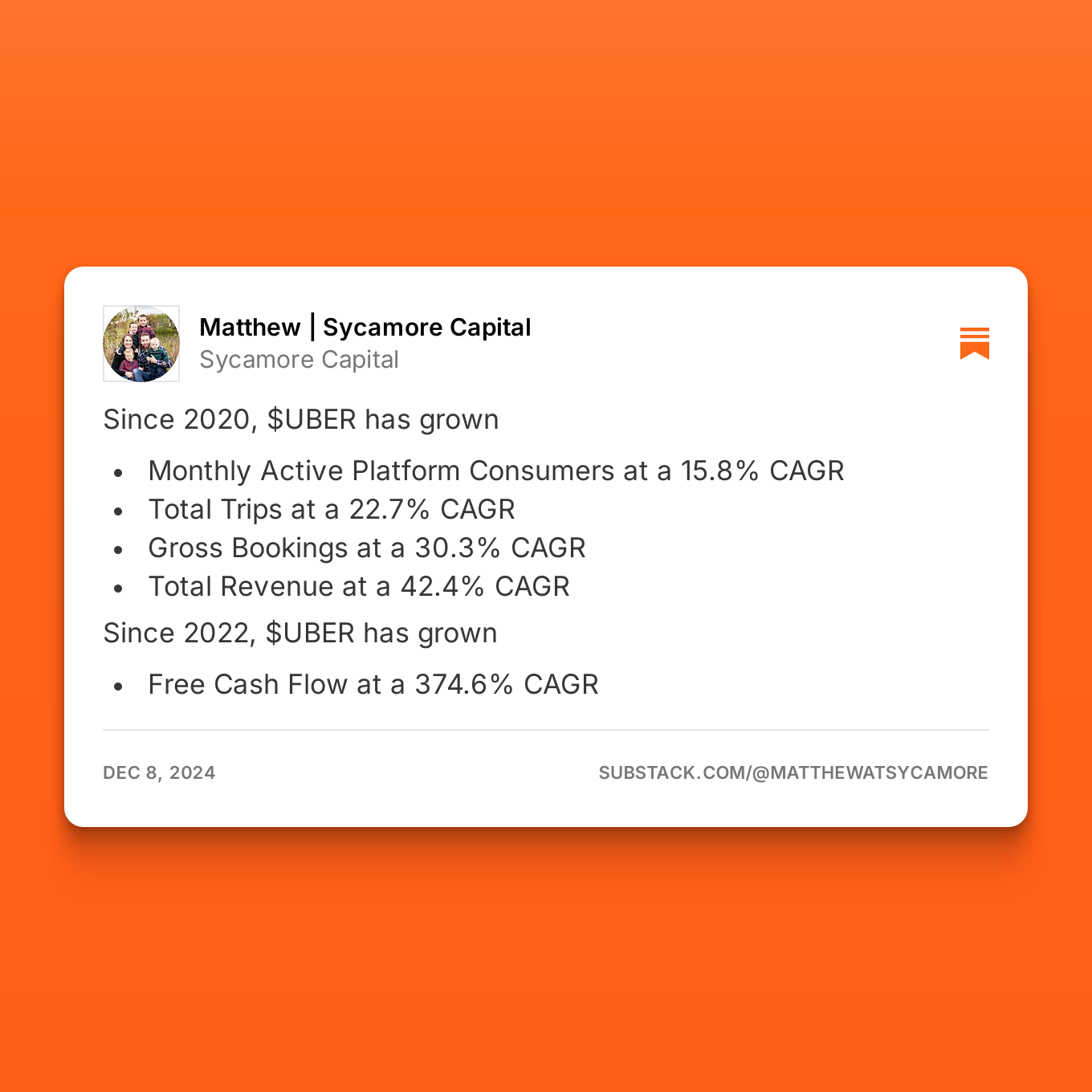

I have continued to build a sizable position in Uber, putting Sycamore in a position to significantly benefit from what I believe will be a very strong 2025 for the company and the stock.

While headlines are putting pressure on the stock right now, the underlying business is very strong and getting stronger as highlighted in my previous posts.

Bottom line on Uber, this is typically a 25-30x free cash flow business currently trading at approx. 15x 2025 FCF because of an overhang from potential autonomous vehicle disruption. I think that the majority of AV competition ultimately partners with Uber’s expansive network when all is said and done.

If AV companies are serious about positive unit economics on their fleets they will need the highest utilization possible. And for that they will need the most distribution possible.

Consider Waymo expanding into Phoenix only through their own app, Waymo One, in 2020. However, when they expanded their range in and around Phoenix (from 50 to 180 miles) they partnered with Uber for that scale/reach. In fact, Waymo cited Uber’s “massive scale” for partnering. With larger geographies like Austin and Atlanta, Waymo is partnering with Uber from the start. I’ll have more to say on this in next month’s update.

The bottom line here that I keep repeating is the following: very strong and growing business fundamentals, significant operating leverage and margin expansion being realized, global scale, strongest possible brand recognition, 35%+ y/y FCF growth in 2025, significant share repurchases incoming, and more positive headlines in 2025 on AV with the Q1 Austin Waymo launch and Q2 Atlanta Waymo launch. In my humble and often wrong opinion, this will drive the stock back to more normalized FCF multiples, which will mean significant upside from where I’m buying it today.

“When you have conviction, you should bet really big.” - Druckenmiller

Trimming American Express at All-Time Highs and Rebalancing SentinelOne

Simple thought here is American Express has never consistently traded above a 20x P/E multiple and I felt like trimming this down to a 10% weighting at these prices made sense. Could be wrong, but we’ll see. The stock has continued to move higher (3-4%) since I decreased the position.

I trimmed SentinelOne at $28 /share as the weighting had drifted above my 30% target. It represented slightly more than 32% of the overall portfolio when decreased. Conviction remains, just rebalancing.

Snowflake Mistake

Unfortunately, while I outperformed the market in November, it could have been much more rosy. I sold my Snowflake shares a few days prior to their earnings print. Following the report, the stock ripped 30% higher. Ouch. Here was my thought process in making the sale:

I bought it in classic Druckenmiller style: invest and then investigate.

I was having a hard time understanding the business - apparently data science is beyond my purview.

I had no way of developing conviction in a business where I couldn’t understand the drivers for success. I had an initial thesis but developing it further came to a halt.

The stock was up 10-12% from my cost basis, but I had no idea where it would/could go. I knew that if it ripped higher I would sell it and if it sold off, I would be stuck with it and without conviction to add to the position.

I didn’t want to be in that possible downside scenario, so I took my profit and ran.

In the end, I think I made the right decision by selling Snowflake, despite its significant run up afterward. I have a process, albeit a non-traditional one, but it’s a process that I have developed over 15+ years of investing and it has worked well for me. I stuck with that process.

![A Superlative Example | Sycamore Portfolio Update [October 2024]](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Ff027464b-4d0c-4f6d-8fb6-31d49651f813_800x600.jpeg)

I admire your concentration in Uber, it will certainly increases your focus of research. At its current valuation it has to keep growing the top line at which point the scale will improve the margins. Where do you see the growth drivers for its mobility sector for the next 12mths+? And are there any 'scale economy shared' attributes to Uber that you've identified?

Saw your brag on the returns for the year. Wanted to see if you were really posting the portfolio. I see the concentration. That's great fun. You bet big on a few positions. I appreciate that you had the courage to post those clear weights. Hope your cash either has a good money market fund or you're using Treasury bill ETFs.