May Momentum | Sycamore Portfolio Update [May 2025]

Quote, performance update, holdings, May transactions, first thoughts, new logo, Uber Go-Get, Trade Desk big earnings beat, and SentinelOne pain

“All of us, in the course of our lives, can find ourselves healthy or sick, employed or unemployed, living in our native land or in a foreign country, yet our dignity always remains unchanged: it is the dignity of a creature willed and loved by God.”

Pope Leo XIV

Monthly Returns

Sycamore // +12.66%

S&P 500 // +6.15%

Differential // +6.51%

Year-to-date Returns

Sycamore // +18.72%

S&P 500 // +0.51%

Differential // +18.21%

Historical Performance

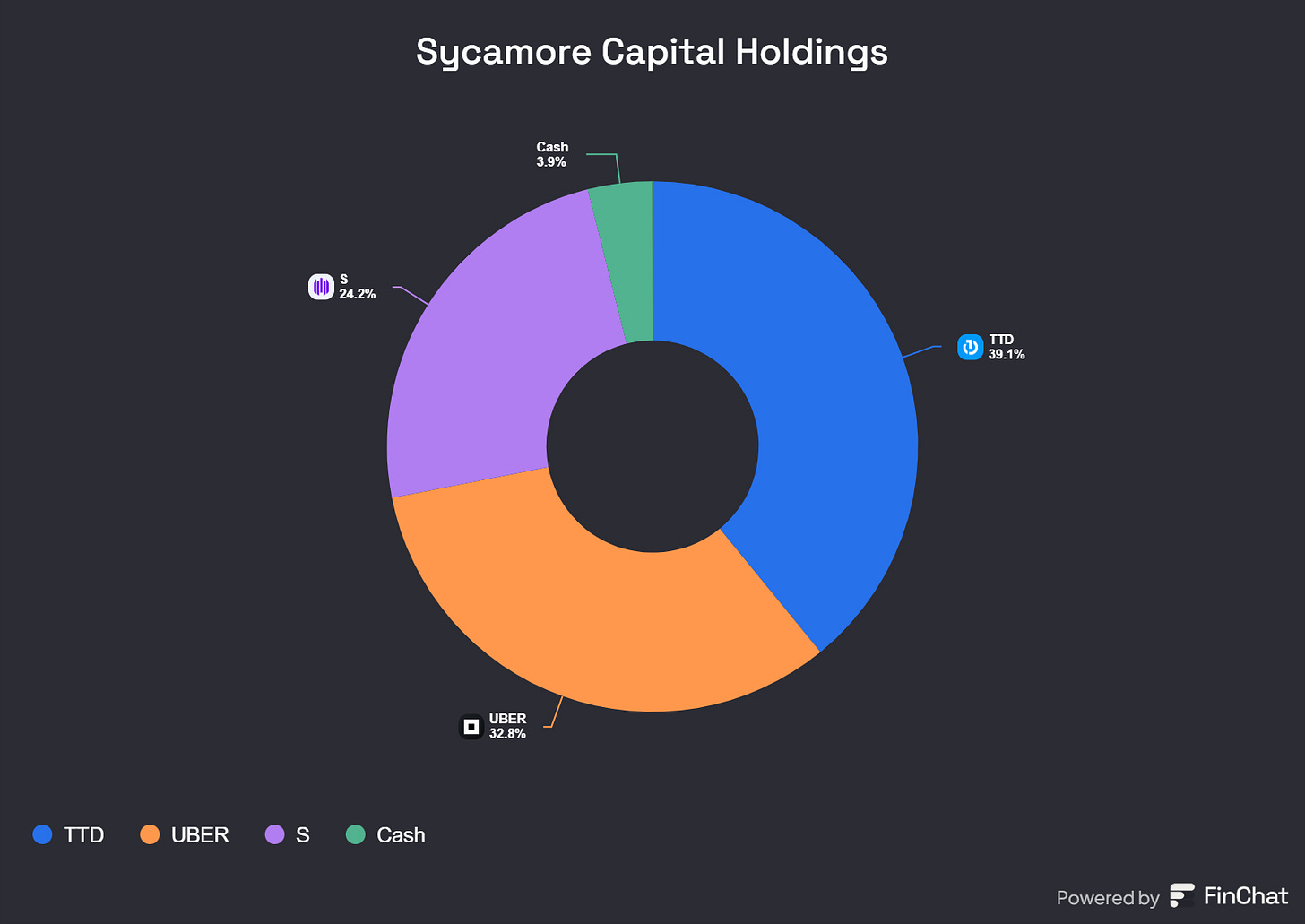

Current Holdings (as of May 30)

Transactions in May

No transactions in May

First Thoughts

Monthly Outperformance

May’s significant outperformance was driven by The Trade Desk’s massive earnings beat. It was shaping up to be the best month in Sycamore history until SentinelOne’s 11% decline following their earnings on the second to last day of the month.

UBER was +5.97% during the month

TTD was +37.59% during the month

S was -6.23% during the month

Despite SentinelOne’s continued underperformance (-21% this year) the portfolio has held up extremely well and is still outperforming the S&P by 37x.

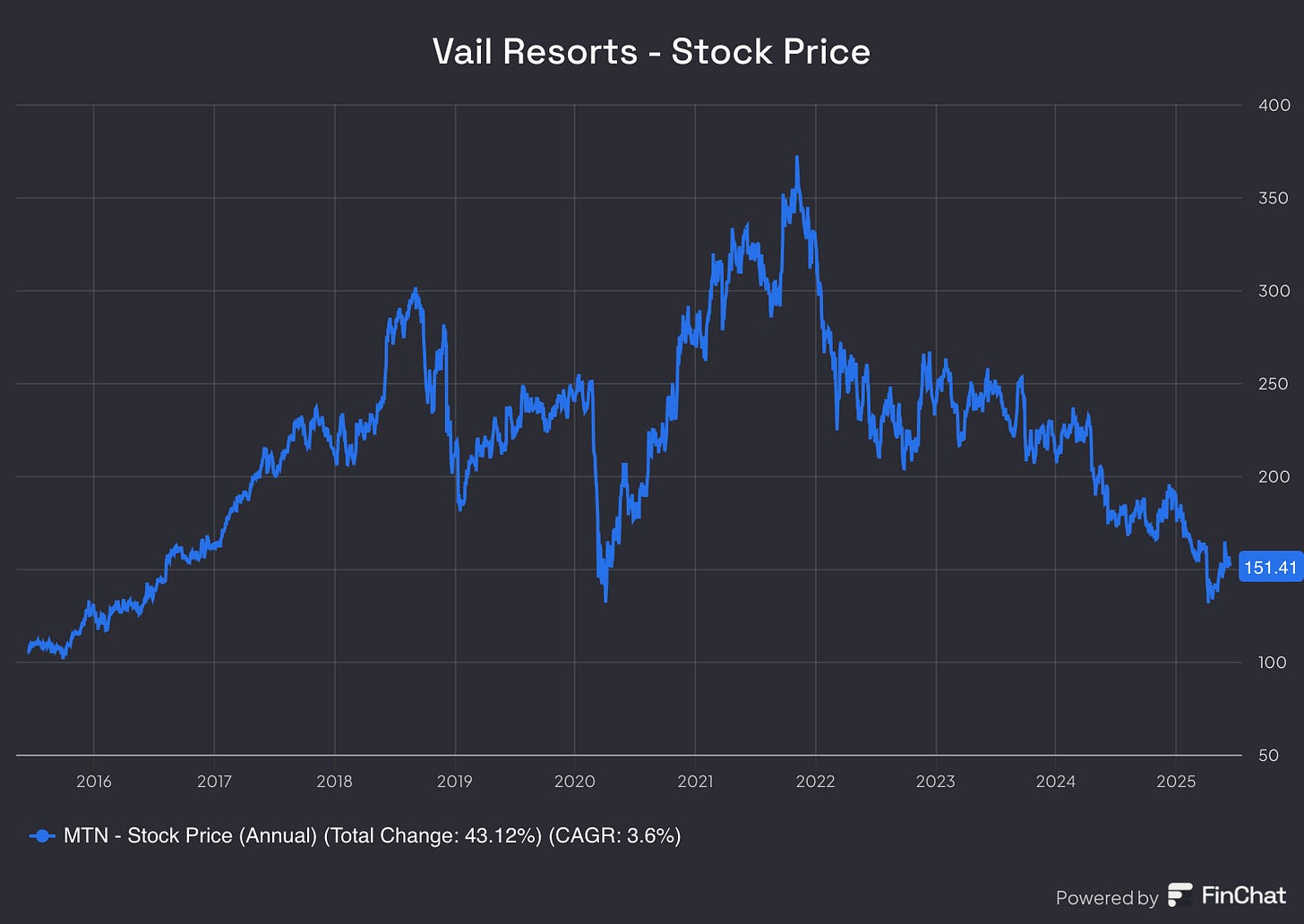

Vail Resorts Management Change

I’ve commented on Vail Resorts in previous monthly updates, suggesting that while it is a very unique asset, and one that I would be interested in owning, the company has mismanaged its balance sheet and capital allocation. The company is trying to do everything all at once: acquire new mountains, invest in the existing portfolio properties, paydown debt, buyback shares, and pay an outsized dividend. The result is a business stretched thin, in my opinion, which keeps me on the sidelines.

I will be watching to see what the returning CEO does with the business in the first few months. Rob Katz was CEO from 2006-2021 and led the company through significant expansion and the launch of the Epic Pass. The stock was a near 10-bagger during his time as CEO, compounding at about 20% annually for 15 years.

I would like to see him kill the dividend (113% payout ratio currently), pause on M&A, and get really focused on cleaning up the balance sheet, reinvesting in already existing properties, and buyback shares if there is capital available. The business is overleveraged with a 235% net debt to equity ratio and a 3x interest cover, which is especially concerning given how cyclical and economically sensitive the industry is.

Nonetheless, in his first earnings call as CEO, he made it clear to analysts that he sees no reason to lower or eliminate the dividend: “We are comfortable with the current dividend.”

New Sycamore Capital Logo

When I launched this publication in August 2023, I didn’t expect much from it. I even used a free logo generator just to get the launch across the finish line. It was brought to my attention after the fact that it is so small you can hardly even read it.

Now, as I approach 1,500 subscribers, it’s clear this has grown into something more meaningful for me. To mark the moment, I’m introducing a new Sycamore Capital logo.

Yes, this is also a generated image, but with a bit more meaning behind it. As you’ve probably noticed over the life of this publication, my family is extremely important to me. This new logo reflects that. It’s designed as a family seal and centered on a sycamore tree. Here’s what it represents:

Family Seal Aesthetic: The design has the feel of a family seal, which is meant to convey permanence and legacy.

Rootedness and Growth: The tree symbolizes deep roots in faith and a long-term vision for growth in things that actually matter (hint: it’s not ROI).

The Sycamore Tree: Luke 19 tells of Zacchaeus, a wealthy man who “was seeking to see who Jesus was... so he ran ahead and climbed a sycamore tree in order to see Jesus, who was about to pass that way.” It’s the sycamore tree that is the catalyst in Zacchaeus’ conversion of heart. This image has always stayed with me.

Now, back to it…

Uber’s New Products Focus on Affordability

At its 2025 Go/Get event, Uber announced a suite of new features aimed at helping users save money and simplify daily life:

Commute Alerts – Notifications tell you the best time to book based on traffic and pricing trends.

Price Lock – Lock in a flat fare for your daily commute; pay the lower price if fares drop.

Prepaid Passes – Buy ride bundles (5, 10, 15, 20 rides) and save up to 15%.

Route Share – Walk to a shared route and save up to 50% off UberX; launching in NYC.

Commute Hub – New in-app dashboard (coming this summer) to manage all commute tools.

Savings Slider – Grocery price comparisons that auto-swap items based on your savings preferences.

Dine Out – Discover restaurant deals, make reservations, and book rides in one flow.

OpenTable Integration – Book tables and rides together; OpenTable VIPs get 6 months of Uber One.

Uber One Upgrades – 10% back on rentals, Turo, and scooters; expanded perks and brand discounts.

Shared Autonomous Rides – Coming in 2026 via partnership with Volkswagen; starts in Los Angeles.

Everything’s built around one goal: helping users save, whether they’re commuting, shopping, dining out, or trying autonomous rides for the first time.

The company also reported very strong earnings in the quarter, which I was very pleased with. The delivery business was a standout in the quarter, which management called “under-appreciated.”

If you missed it, you can read my full earnings recap here:

The Trade Desk Beats Big

The Trade Desk reported strong first-quarter results, marking a solid rebound after a softer Q4. Revenue grew 25% Y/Y to $616 million, exceeding both company guidance and analyst expectations by a long shot. Net income also rose sharply, up 59% to $51 million, as the company expanded margins and drove higher profitability.

According to CEO Jeff Green, the outperformance was driven in part by strategic platform upgrades launched in late 2024, most notably continued adoption of Kokai. Despite a cautious advertising environment earlier in the year, management noted that major marketers are increasingly shifting budgets to the open internet, a trend that plays directly to The Trade Desk’s strength in objective, data-driven media buying.

It was an extremely important earnings release, coming on the heels of the company’s first quarterly miss in 33 quarters as a public company. I sleep well knowing Jeff Green is in charge of this company.

If you missed it, you can read my full earnings recap here:

The Pain Continues with SentinelOne

SentinelOne kicked off FY2026 with solid results and continued operational momentum. However, the company beat their revenue guidance by the skin of their teeth, fell short on net new ARR, and lowered guidance again for the next quarter and full year. This is the second time in a row the company has posted what are basically in-line results and then lowered next quarter guidance.

It has been quite frustrating to see the company continue to win every accolade there is for their technological capabilities, hear the CEO talk about the overwhelming momentum in the business, and then proceed to lower guidance again and again.

I’ve started re-underwriting my thesis on this pick, with a renewed focus on the management team’s ability to execute. Frankly, they haven’t delivered for as long as I’ve been following them. More on this in next month’s update.

If you missed it, you can read my full earnings recap here: