SentinelOne Q3 FY2025 Earnings Recap

Accelerating business, larger customers, robust pipeline, stable pricing, top-tier technology, and a hammered stock price

SentinelOne is Sycamore’s largest position at ~30% and has been a nice winner up 40% since we took a position this past summer.

They reported earnings today after the market close and investors have sold the shares down by 15% in the after hours.

Some quick rough math suggests that the stock down 15% tomorrow would give us an approximate $6.8 billion enterprise value. The company is guiding for an exit of fiscal 2025 with a 32% growth rate. Consensus is suggesting a 26% revenue growth rate for fiscal 2026. The company has not guided to this yet.

Assuming a slightly more conservative 25% growth rate for next year, that puts S 0.00%↑ at approximately $1.02 billion of revenue. Given tomorrow’s implied (assuming 15% drawdown) EV of $6.8 billion, that gives us an approximate forward EV/Sales multiple of 6.6x. On a growth adjusted basis, that means SentinelOne will be trading at 0.26x.

The median software business is currently trading at ~0.6x growth adjusted EV/Sales, which means SentinelOne will be trading at a 55% discount (ballpark) to the average software business.

Is SentinelOne a significantly below average software business?

Let’s consider this question in the context of the print and the call with management and analysts.

Highlights from the Print

Total revenue increased 28% to $210.6 million

Annualized recurring revenue (ARR) increased 29% to $859.7 million as of October 31, 2024

Net new ARR of $54M exceeded expectations, growing 20% sequentially over Q2, re-accelerating and significantly outpacing historical Q3 seasonality (analysts were very high on this strength in the call)

Customers with ARR of $100K+ grew 24% to 1,310 as of October 31, 2024 and customer with ARR of $1M+ grew at an even faster rate (driven by success with large enterprises and net expansion)

ARR per customer reached new record high in the quarter

GAAP gross margin was 75%, compared to 73%. Non-GAAP gross margin was 80%, compared to 79% (signifying pricing strength and stability)

Cash, cash equivalents, and investments were $1.1 billion as of October 31, 2024

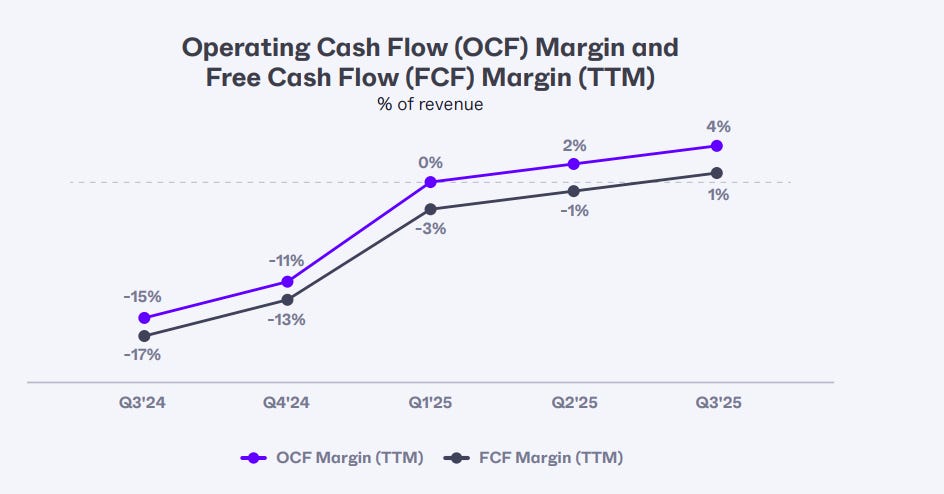

Continued improvement and expansion in operating and free cash flow margin

Full fiscal year revenue guidance raised from 31% to 32% y/y

Management Commentary

“Overall, there is more awareness, consideration and interest in SentinelOne than ever before. We're now engaging in opportunities that weren't available to us in the past. This includes some of the largest financial institutions in the world and other strategic opportunities as well as more channel engagements. This will play out in quarters and years to come as enterprise evaluate, test and come to renew their incumbent solutions over time. The road is open.”

“Purple AI is proving to be truly transformative and we’re seeing great customer traction. Purple AI is now our fastest growing solution and the attach rate of Purple AI across all eligible endpoints doubled compared to Q2.” - Tomer, CEO

“While early, the investments we're making and expanding our market presence in mindshare are fueling one of the highest growth rates in all of software. In this quarter alone, we achieved record contributions across platform solutions, returned to positive new business growth and continued expanding margins. We are positioning the company for long term share gains across diverse growth opportunities”

“We continue to expect stronger net new ARR growth in the second half of fiscal twenty twenty five compared to the first half. This outlook is supported by positive trends in new customer acquisition, a healthy pipeline, a solid competitive position and increasing momentum with our data, cloud and AI solutions.”

“In Q3 alone, we've had a record number of wins against our closest competitor. We've added a record number of $100,000 plus customers. Our endpoint growth actually accelerated in Q3. So it really indicates the opportunity is improving not only across our growth lever with emerging products but really within our core market of endpoint. I mean the momentum on all these fronts drove some incremental upside to the ARR in the quarter, and we believe that's going to continue. Broadly, enterprise is paying more attention to security performance and operational resilience, so I think SentinelOne is proving to be the superior platform offering. It is resulting in more consideration for SentinelOne. It is resulting in bigger deals in the pipeline. It is resulting in just more engagements, and it's on us to translate these engagements. It's very encouraging. The type of customers that we're seeing, the industries that we're serving, the ability to have these conversations, as we mentioned in the prepared remarks, these are conversations we have not had before. So this will be positive for us. It continues to be something we unlock and it's going to translate in the quarters and years to come.”

“In terms of Lenovo, it is a multiyear agreement. We're in the early innings. We're really excited about its long-term potential. This is a strategic partnership. It's designed to evolve over time. We're working closely with Lenovo to activate multiple routes to market. That includes pre-installations as well as managed security offerings. It also builds on the fact that we have an existing reseller agreement today. So we're really extending, deepening our collaboration, and we expect the contribution to pick up in the latter part of next year in terms of revenue as Lenovo starts to ship pre-installed units and as we ramp up co-sell through all of our regions.”

“We fully believe that the pipeline supports the continued upwards trends into enterprise market. There is no question that some of the dialogues that we're having are of a different magnitude of the dialogues we've been having in the past. I think that pricing for us has always been our strong suit. I think we were always able to play almost at any price point. And specifically around endpoint protection, it's not an issue for us to match anybody in the market. It never has been. And you still see us operate throughout the years at around the 79% to 80% gross margin, which is obviously best of breed. So as we look into next year, we're going to continue to be aggressive. We're going to continue to sustain our gross margin, and we're going to continue having our average contract size be on the rise. … And we believe next year could be quite transformative in that regard.”

Bottom Line

So to answer our question: no, SentinelOne is not a below average software business. In fact, business is accelerating, the pipeline is full and growing with larger and larger customers, pricing is stable, and the technology is top-tier.

My best guess as to why the market is dumping on the stock is because it wants to see share gains against Crowdstrike to be large and to be immediate. But as management has said from the very beginning, these are large customers in a long sales cycle. This will be playing out for multiple years.

As for the market, I have a hard time believing this stock trades down 15% tomorrow and remains there for long. Depending on the market action, I may be adding to my position as I believe this business is humming right along and that the market will begin to appreciate what is going on here more so in CY 2025.

Hi conviction can sometimes require looking wrong for a period of time. I wish you strength and patience because your analysis looks strong, and at some point the “I want it now” crew will realise they want it “now”, and hopefully at much higher prices!

I like SentinelOne, for all the reasons mentioned. However, a drag on their stock price is the continued dilution of their shares. Consistently 6-8% dilution annually.

SentinelOne is now a mature enough business to no longer need to fund itself with further dilution. If management believes the story they are telling, especially now that they are free cash flow positive, they can stop the dilution. That management didn't mention this at all in their Q3 results was not quite a red flag but definitely a raised eyebrow. Perhaps they are waiting for more of a sustained signal about positive free cash flow in Q4 before they commit to starting to live at the stage of growth they have now achieved?

My assumption is that the market price has already baked in the 20% plus revenue growth each quarter. What is needed for the next move up in price is continued improvement in free cash flow and operating margins, continued wins of major corporate/government customers and a clear signal that company insiders are confident enough in their growth story that they no longer need to routinely dilute their stock.